Notes

- This model focuses on low-risk, rule-based trading with minimal frequency.

- The goal is to build a sustainable income, not to compete or maximize profits aggressively.

- We must be disciplined and selective about entries.

- It is essential to avoid revenge trading, over-leveraging, or increasing contract size to recover losses.

- If we are stopped out twice in one week, we have to stop trading for that week.

- The strategy (model) is simple but difficult due to the discipline required.

- Trading is a mental game. Those who follow the rules will thrive, while those who chase trades will struggle.

- Michael recommends testing the model via six months of demo trading before using real capital.

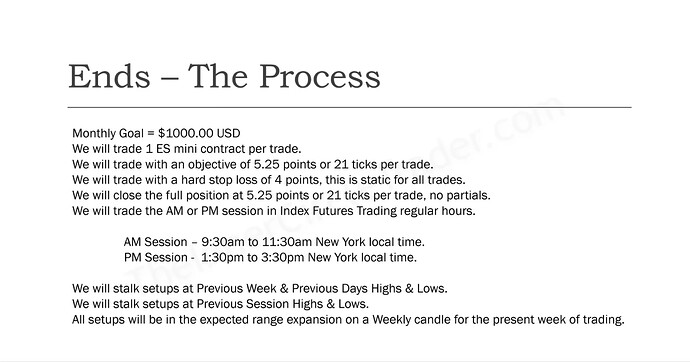

Process - Overview

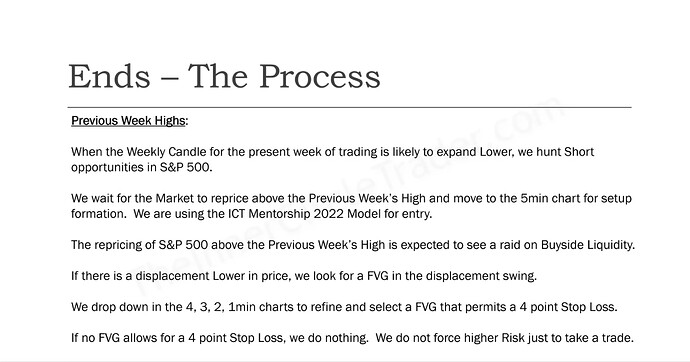

Process - Previous Week Highs

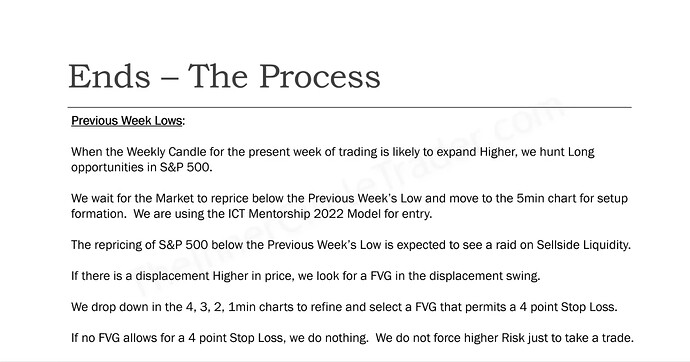

Process - Previous Week Lows

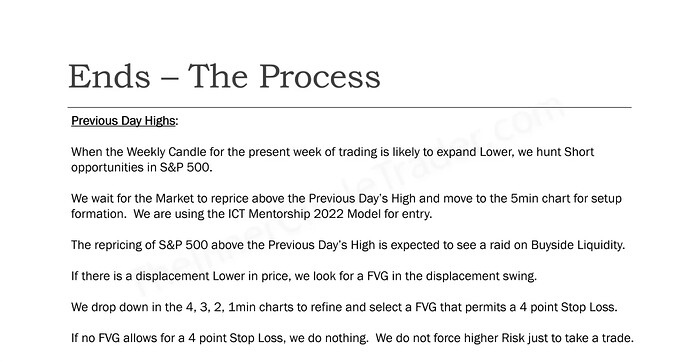

Process - Previous Day Highs

Process - Previous Day Lows

Process - Previous Session Highs

Process - Previous Session Lows

Process - Keeping Liquidity In Focus

Process - Prepare Yourself And Accept Many Missed Entries

Next lesson: 2022 ICT Mentorship - Why I Avoid AM Sessions After Large Range Days

Previous lesson: 2022 ICT Mentorship - Ends Series [Part 3]