Notes

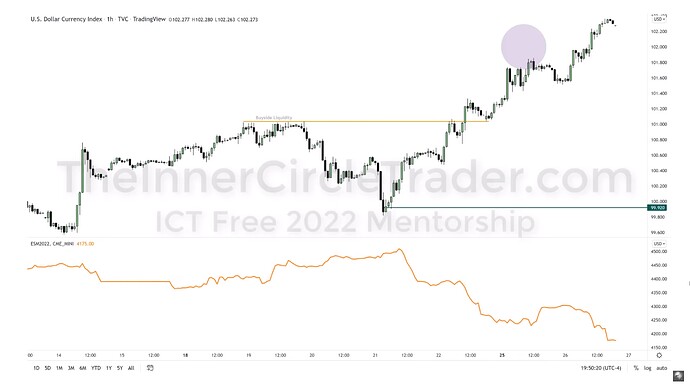

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

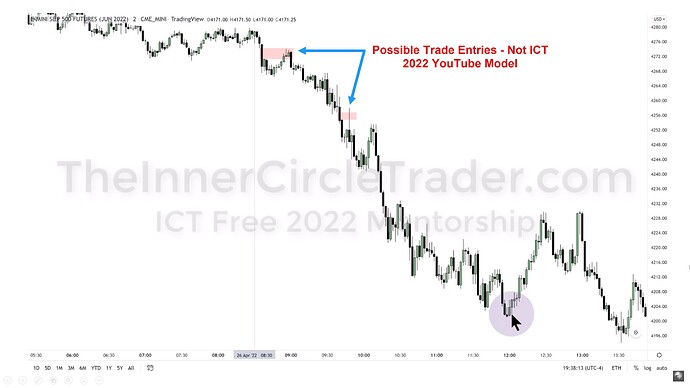

- When we are bearish, and the price is unable to create a power of three situations, i.e., not trading above the NY Midnight Open price or the 8:30 price, it indicates extreme bearishness.

- When we are bullish, and the price is unable to create a power of three situations, i.e., not trading below the NY Midnight Open price or the 8:30 price, it indicates extreme bullishness.

- Michael’s typical trade lasts a maximum of 2 hours.

- Michael no longer holds positions overnight. He only does day trades and scalps.

- There is no way to participate in every market movement. We will miss a lot of moves in the future, and that’s okay. It’s part of the game.

- When the market starts to trend strongly, it is possible to enter trades on FVGs in the direction of the prevailing intraday movement.

ICT 2022 YouTube Model - Correlation Between US Dollar And Standard And Poor’s 500

ICT 2022 YouTube Model - ES Price Move From Bearish Order Block

ICT 2022 YouTube Model - ES Hourly Chart

ICT 2022 YouTube Model - Possible 15-Minute Trade Entry

ICT 2022 YouTube Model - No 2022 YouTube Setup On 5-Minute Chart

ICT 2022 YouTube Model - Possible 2-Minute Entries

ICT 2022 YouTube Model - Possible 1-Minute Entries

Next lesson: 2022 ICT Mentorship - Episode 22 - Tape Reading Example

Previous lesson: 2022 ICT Mentorship - Episode 20 - London Open