Notes

- Michael uses these three types of real gaps:

- We should use futures charts to trade CFD contracts, as they provide accurate (centralized) data.

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

- The algorithm treats the wicks as gaps. The most sensitive part is the wick’s Consequent Encroachment (midpoint), which should be monitored.

- Michael doesn’t trade the dollar index directly but uses it to gauge bias in other markets like the S&P, Euro, and Pound. It serves as a “barometer” that indicates whether to enter or exit short or long positions in other assets.

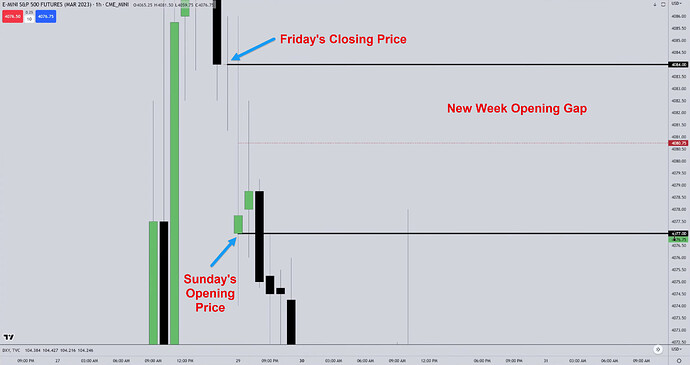

New Week Opening Gap

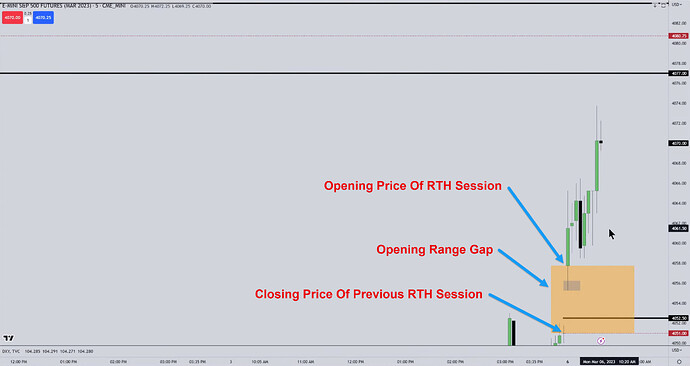

Opening Range Gap

ES And DXY Negative Correlation

Next lesson: 2023 ICT Mentorship - Live Tape Reading And Fed Chair Testimony: March 7

Previous lesson: 2023 ICT Mentorship - Market Commentary: February 25