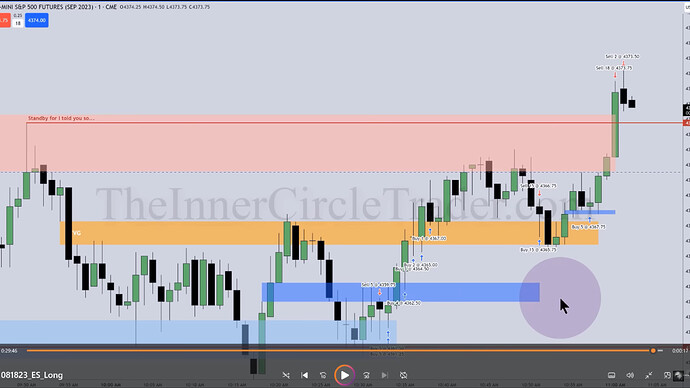

- In this video, Michael explains the thought process that led to the ES trades on August 18.

- Once the price closes above a bearish IFVG, it should support the price to rise.

- Once the price closes below a bullish IFVG, it should support the price to fall.

- If the price forms an FVG after breaking a swing high or low (Market Structure Shift), we should never place our stop loss into the FVG area because the price will probably want to revisit it.

- Without a narrative, we only analyze random up-closed and down-closed candles. The narrative is what validates PD arrays.

- ICT stresses the importance of seeing the bigger picture by considering the broader market structure, not just individual candles. Zooming out to identify inefficiencies and areas of support/resistance provides better insights for positioning a trade.

- Markets (ES, NQ, YM,…) follow an almost deterministic “script,” and once we understand it, we can confidently predict price movements.

ES - Trade Executions

Next lesson: 2023 ICT Mentorship - Index Futures Review: August 21

Previous lesson: 2023 ICT Mentorship - Weekend Commentary: August 19