Notes

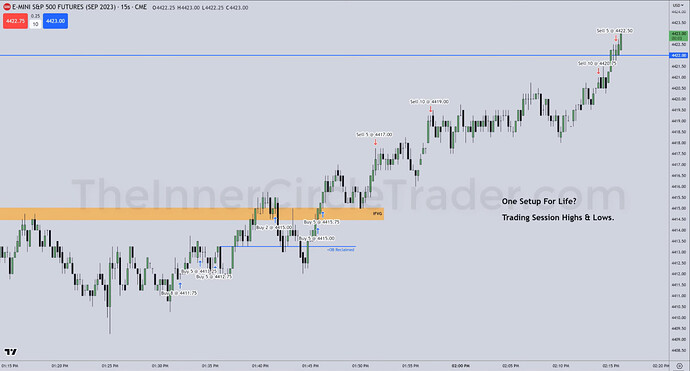

- In this lecture, Michael teaches traders to find their own setups by understanding when and where setups form. It aims to equip traders with a repeatable and reliable setup for life.

- Michael’s method of identifying liquidity pools is applicable across asset classes, such as currencies, indices, or bonds.

- The algorithm uses liquidity pools created in the previous RTH session regardless of whether they have already been taken out outside regular trading hours. It considers them untouched after the market opens at 9:30.

- The sole purpose of price delivery is to seek liquidity.

- Liquidity is either in the form of stop-loss orders or imbalances.

- Markets operate on time-based liquidity hunts. Time and price are the core principles of market movement.

- Opening Range Gap (ORG) serves as a potential target for liquidity run.

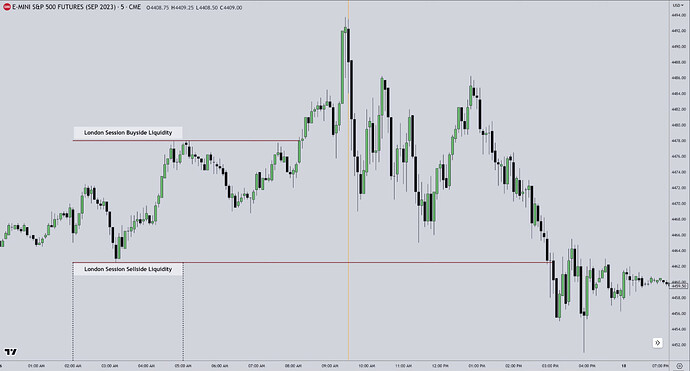

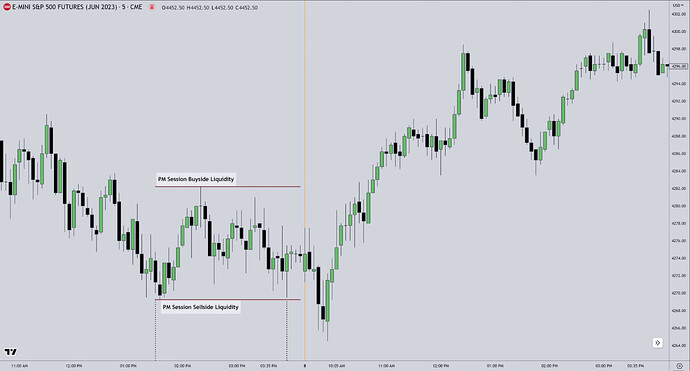

- Liquidity Pools:

- Above session highs - Buy-side liquidity.

- Below session lows - Sell-side liquidity.

- Key ranges to monitor:

- New York AM Session: 9:30 a.m. to 12:00 p.m.

- New York Lunch: 12:00 p.m. to 1:30 p.m.

- New York PM Session: 1:30 p.m. to 4:00 p.m.

- London Session: 2:00 a.m. to 5:00 a.m.

- Opening Range Gap 4:15 p.m. to 9:30 a.m.

Liquidity Pools - London Session

Liquidity Pools - New York AM Session

Liquidity Pools - New York Lunch

Liquidity Pools - New York PM Session

Liquidity Pools - Opening Range Gap

ES Trade Example - 1-Minute Chart

ES Trade Example - 15-Second Chart

Next lesson: 2023 ICT Mentorship - Market Review: June 24

Previous lesson: 2023 ICT Mentorship - T.G.I.F. Setup