Notes

- Recommended approach to trading for beginners or unsuccessful traders:

- Observe price action daily (without trading).

- Backtest setups to recognize patterns.

- Simulate trades without real money.

- Trade micros to build confidence.

- The most popular Micro E-mini futures:

- MES - Micro E-mini S&P 500 - Minimum tick = $1.25

- MNQ - Micro E-mini Nasdaq-100 - Minimum tick = $0.50

- MYM - Micro E-mini DOW - Minimum tick = $0.50

- M2K - Micro E-mini Russell 2000 - Minimum tick = $0.50

- MGC - Micro Gold - Minimum tick = $1.00

- SIL - Micro Silver - Minimum tick = $5.00

- MCL - Micro WTI Crude Oil - Minimum tick = $1.00

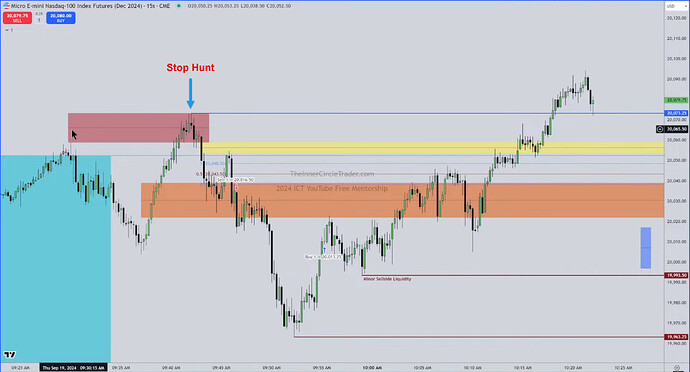

- Each time a stop hunt (Turtle Soup) occurs, this area changes to the Balanced Price Range.

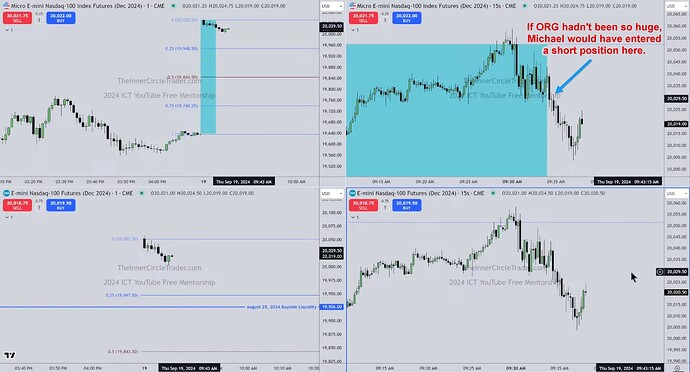

- When the ORG is huge (a few hundred points), we should first wait for a stop hunt against the move we intend to trade in.

- US citizens cannot legally trade CFDs.

NQ Short Trade Example - Huge Opening Range Gap

NQ Short Trade Example - Trade Entry And Exit

NQ - Stop Hunt

NQ - Stop Hunt Area Turns Into Balanced Price Range

Next lesson: 2024 ICT Mentorship - CFDs Vs. Futures: September 20

Previous lesson: 2024 ICT Mentorship - ICT Grey Pools Used In Action: September 18