Notes

- In this lecture, Michael discusses his OSOK trade from September 6, 2024.

- Lunch macro starts at 11:30 a.m. and ends at 1:30 p.m. (EST).

- During the lunch macro, the price makes some form of retracement against the prevailing movement of the AM session.

- Important PD arrays form during the first 30 minutes after the start of the AM session (9:30 a.m.) and PM session (1:30 p.m.).

- According to Michael, Candle Range Theory (CRT) is bullshit.

- The name for the Turlte Soup setup comes from the book Street Smarts: High Probability Short-Term Trading Strategies. It refers to Linda Raschke’s stop-hunt strategy, which targets so-called “turtle” traders.

- According to Michael’s observation, women outperform men in trading. They are more focused, effective, and avoid unnecessary distractions.

- We should not begin with ICT concepts if we are not ready to commit to the long learning process.

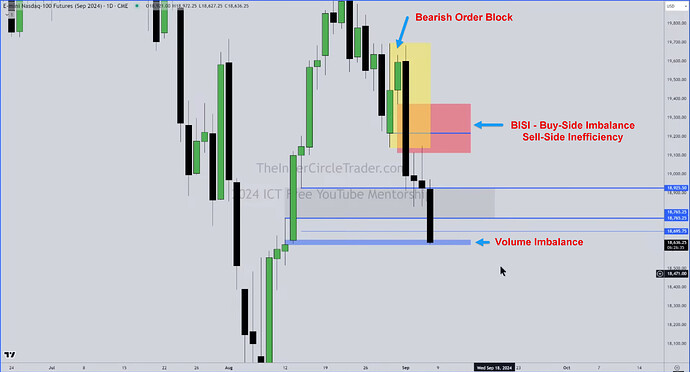

NQ OSOK Trade Example - Daily Chart

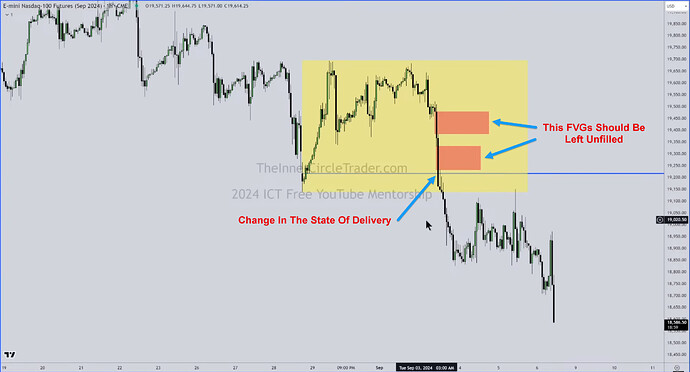

NQ OSOK Trade Example - Turtle Soup And Real FVG

NQ OSOK Trade Example - Hourly Chart

NQ OSOK Trade Example - Balanced Price Range

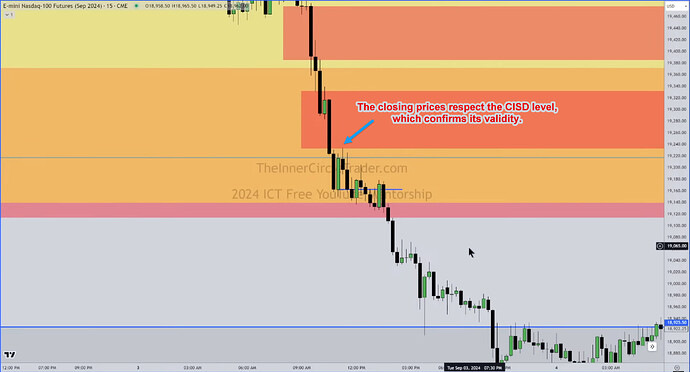

NQ OSOK Trade Example - 15-Minute Chart

NQ OSOK Trade Example - Closing Prices Respect Daily FVG On 15-Minute Chart

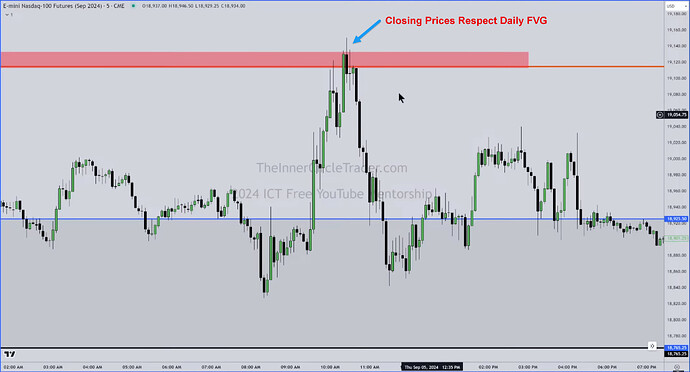

NQ OSOK Trade Example - Closing Prices Respect Daily FVG On 5-Minute Chart

NQ OSOK Trade Example - Market Maker Sell Model

NQ OSOK Trade Example - First And Second Stage Of Re-Distribution

NQ OSOK Trade Example - Trade Executions

Next lesson: 2024 ICT Mentorship - September 9

Previous lesson: 2024 ICT Mentorship - NQ Live OSOK Execution: September 6