Notes

- The COT chart is used to identify support and resistance on higher time frames using commercial extremes.

- The zero line in the COT chart helps delineate traders’ positions. Above it indicates buying, and below it indicates selling.

- Commercials often take positions opposite to large speculators.

- A long period of buying by commercials followed by a rally can suggest upcoming resistance. The opposite is true for support.

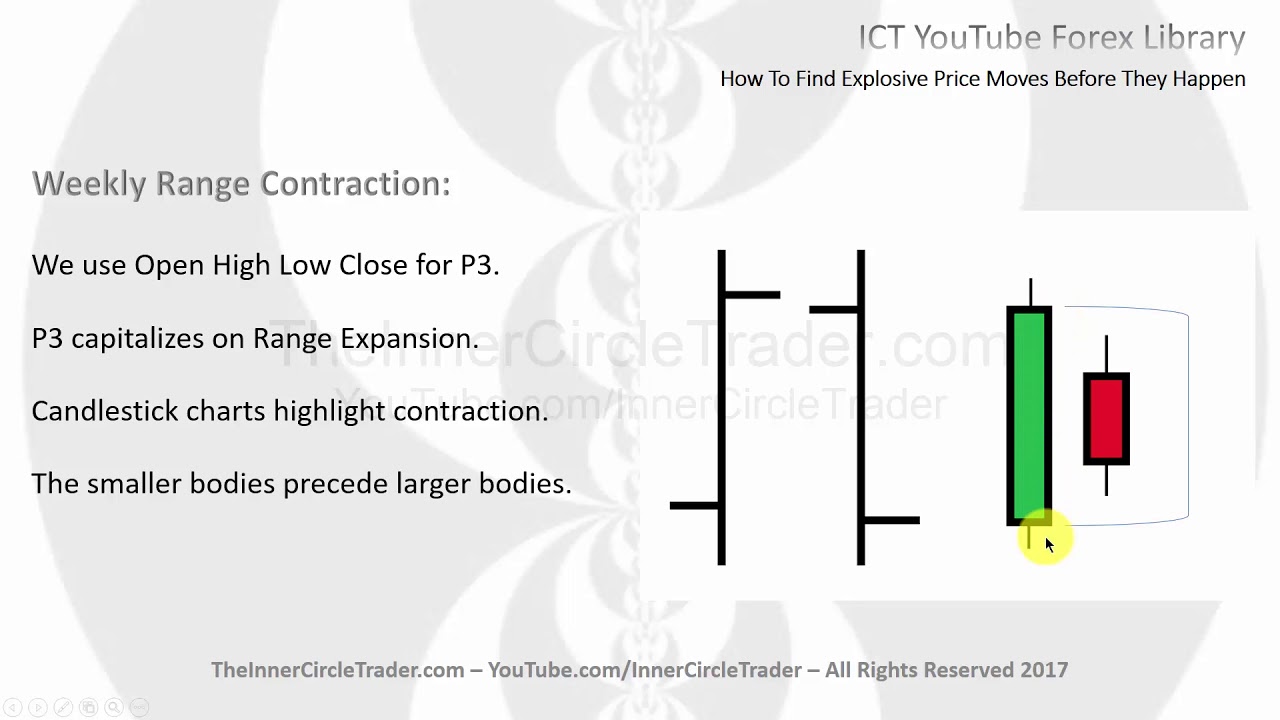

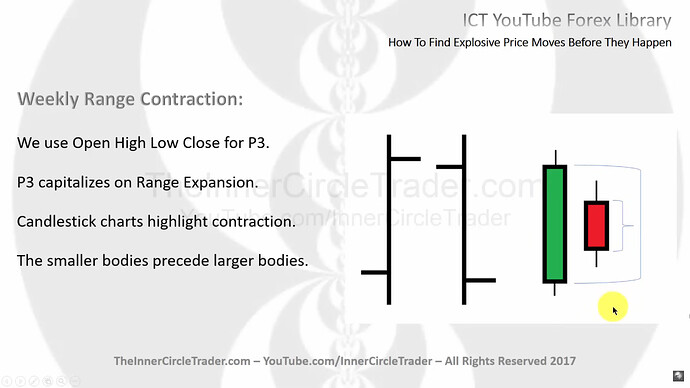

- Large range days often follow periods of range contraction (small candlestick bodies).

- We should focus on periods of market quietness, indicating potential large moves.

- Michael compares candle sizes based on their bodies, not by using wicks.

How To Find Explosive Price Moves Before They Happen - Commitment Of Traders

How To Find Explosive Price Moves Before They Happen - Commitment Of Traders Example

How To Find Explosive Price Moves Before They Happen - Weekly Range Contraction

How To Find Explosive Price Moves Before They Happen - Weekly Range Contraction 2

How To Find Explosive Price Moves Before They Happen - Weekly Range Contraction Examples

How To Find Explosive Price Moves Before They Happen - Daily Range Contraction Examples

Next lesson: ICT Forex - Market Maker Primer Course - Higher Time Frame Concepts

Previous lesson: ICT Forex - Market Maker Primer Course - COT Insights For Effective Price Action Analysis