Notes

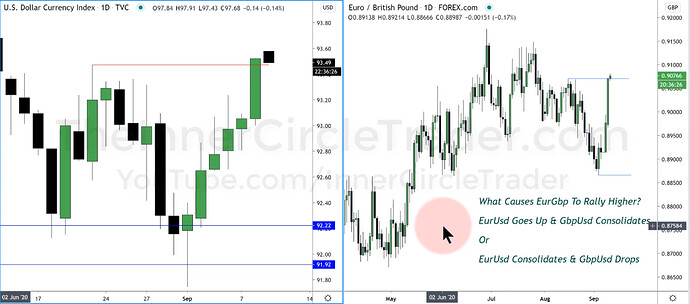

- Cross-currency relationships refer to the connections between currency pairs that do not involve the U.S. Dollar directly (e.g., EUR/GBP).

- If we are bearish, the best selling opportunities occur in the lower half of the previous day’s range.

- If we are bullish, the best buying opportunities occur in the upper half of the previous day’s range.

- When high-impact news is expected, the currency is more likely to consolidate until the news is announced.

- If a currency has no economic drivers for the week, it allows it to move much more freely than a currency that is held in consolidation due to high-impact news.

- While EUR/USD and GBP/USD are generally correlated, they can behave differently at times due to factors such as economic events.

- The EUR/GBP pair is used as a tool to determine which currency will lead and which will lag, offering insight into which currency pair to trade.

- The economic calendar helps identify which currency is likely to experience major moves, while price action analysis shows which pair is more likely to show strength or weakness.

Economic Calendar - No High-Impact News For GBP

US Dollar Index And EURGBP Daily Charts

GBPUSD - Optimal Trade Entry On 15-Minute Chart

Next lesson: ICT Forex Price Action Lesson - EURUSD Market Maker Sell Model In Action

Previous lesson: ICT Forex Price Action Lesson - GBPUSD London Close Short Trade