Notes

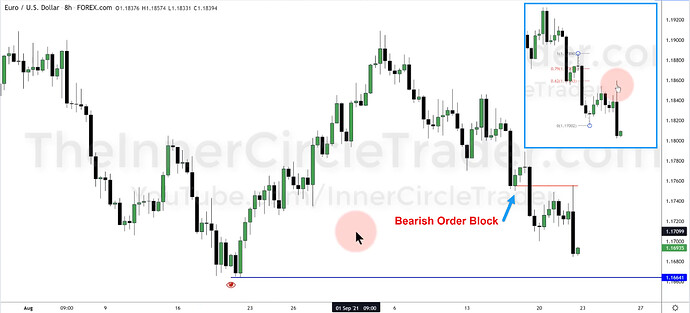

- The basis of Michael’s trade is a bearish order block and an OTE level of 62%.

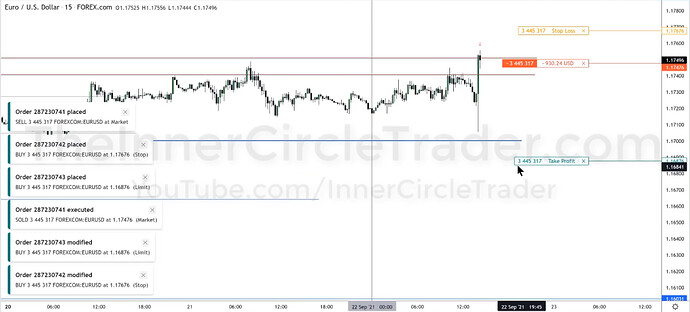

- He ties the trade execution to the high-impact news event of the FOMC (Federal Open Market Committee).

- The economic calendar is a useful tool for anticipating volatility and planning trades accordingly.

- Michael advises against being glued to the charts all day and encourages focusing on economic events that influence the markets, making the trading approach more systematic and less speculative.

- We should focus on finding one high-quality trade setup per week rather than over-trading.

- The live trade example starts at 23:12.

EURUSD Trade Example - Optimal Trade Entry And Bearish Order Block

EURUSD Trade Example - Trade Entry

EURUSD Trade Example - Partial Exits

Next lesson: ICT Forex Price Action Lesson - Institutional Concepts & Market Making Insights In Action

Previous lesson: ICT Forex Price Action Lesson - How To Find Trending Days For High-Probability Intraday Scalps & Day Trades