Notes

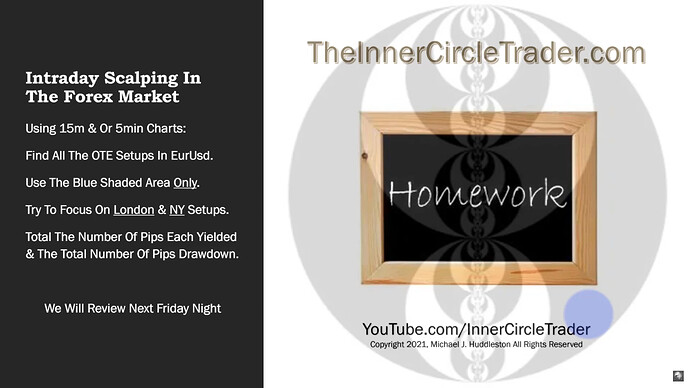

- In this lecture, Michael introduces a hindsight teaching exercise that allows us to backtest the OTE strategy on a small data set.

- It is recommended to use the 62% retracement level for entries and place a stop-loss five pips above the old high.

- We should note the entry price and how much of a drawdown occurs before the trade moves in our favor.

- All trades should take place during the London and New York Kill Zones.

- We should use 15-minute and 5-minute charts to look for price swings and identify pullbacks that offer optimal trade entries.

- Every trader who has ever succeeded has done some form of backtesting.

EURUSD - Optimal Trade Entry And Dealing Range

EURUSD - Area To Study

EURUSD - Homework

Next lesson: ICT Forex Price Action Lesson - Intraday Scalping In The Forex Market [Part 2]

Previous lesson: ICT Forex Price Action Lesson - Why ICT Doesn’t Trade Non-Farm Payroll