Notes

- Ask yourself what characteristics you are trading in, and then you can build a framework.

- In consolidation, you can say I will not do anything, and I’ll be waiting.

- Michael refers to the consolidation phase as a holding pattern.

- All the moves start from consolidation. That’s where the market makers build orders.

- You need to know where the price is, where it is likely to go, and where it came from.

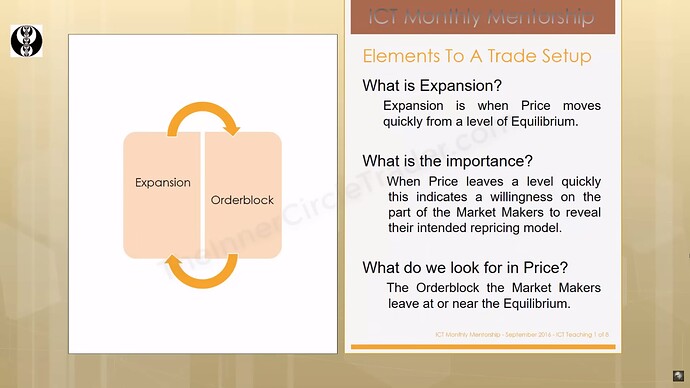

- Expansion is also known as impulsive price swing.

- We always wait for the first expansion.

Elements To A Trade Setup

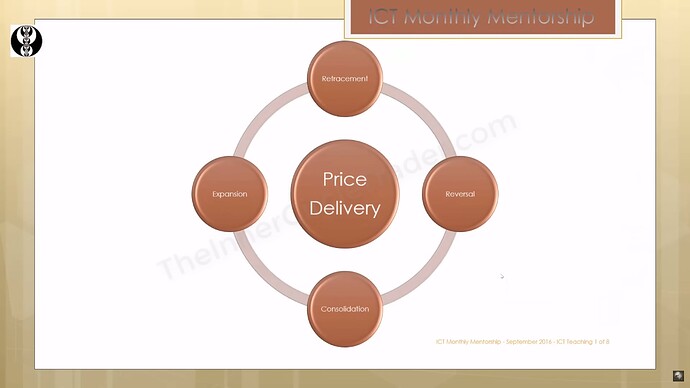

A. Context or framework surrounding the idea

- Expansion.

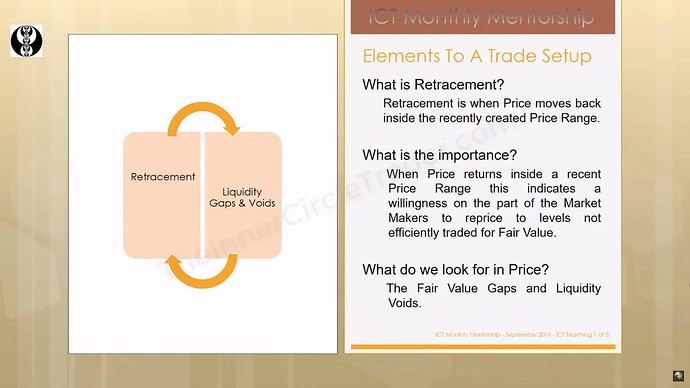

- Retracement.

- Reversal.

- Consolidation.

B. Reference points in institutional order flow

- Orderblocks.

- Fair value gaps and liquidity voids.

- Liquidity pools and stop runs.

- Equilibrium.

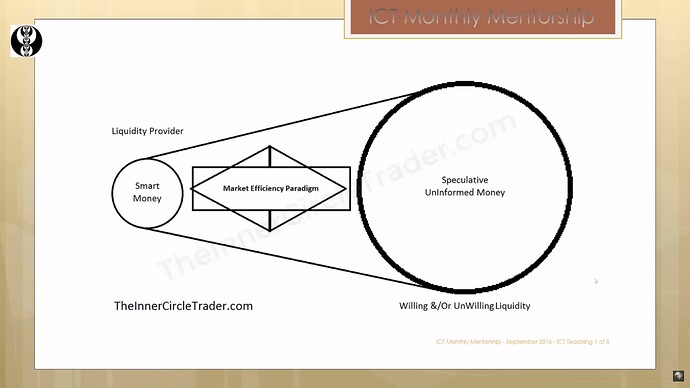

Elements To A Trade Setup - Market Efficiency Paradigm

Elements To A Trade Setup - Price Delivery Stages

Elements To A Trade Setup - Price Delivery Stages - Expansion

Elements To A Trade Setup - Price Delivery Stages - Expansion Example

Elements To A Trade Setup - Price Delivery Stages - Retracement

Elements To A Trade Setup - Price Delivery Stages - Retracement Example

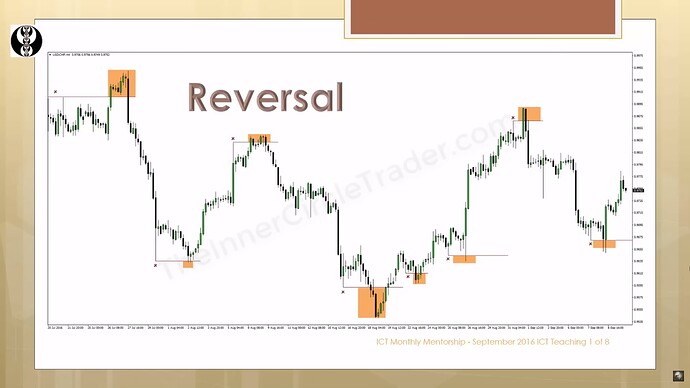

Elements To A Trade Setup - Price Delivery Stages - Reversal

Elements To A Trade Setup - Price Delivery Stages - Reversal Example

Elements To A Trade Setup - Price Delivery Stages - Consolidation

Elements To A Trade Setup - Price Delivery Stages - Consolidation Example

Next lesson: ICT Mentorship Core Content - Month 1 - How Market Makers Condition The Market