Notes

- Michael uses bond market (T-Bonds and T-Notes) analysis to obtain an intermediate to long-term bias, i.e., the outlook for the next three to six months.

- It builds an idea of where the market wants to go based on fundamentals without looking at the numbers.

- Basic characteristics between the analyzed markets:

- Interest rates higher

Dollar goes higher.

Dollar goes higher. - Interest rates higher

Bond market goes lower.

Bond market goes lower. - Interest rates lower

Dollar goes lower.

Dollar goes lower. - Interest rates lower

Bond market goes higher.

Bond market goes higher.

- Interest rates higher

- To determine future direction, we look for divergences between the following markets:

- USDX

T-Bonds.

T-Bonds. - T-Notes

T-Bonds.

T-Bonds.

- USDX

- Nothing moves in the financial sector without interest rates.

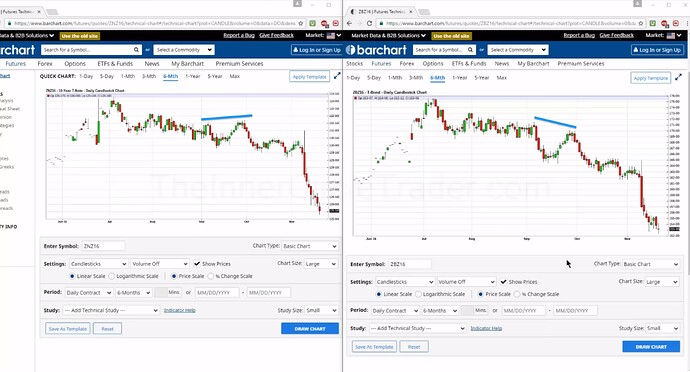

Macro Economic To Micro Technical - SMT Between USDX And T-Bonds

Macro Economic To Micro Technical - SMT Between T-Bonds And T-Notes

Next lesson: ICT Mentorship Core Content - Month 3 - Market Maker Trap - Trendline Phantoms

Previous lesson: ICT Mentorship Core Content - Month 3 - Institutional Market Structure