Notes

- Smart money sells in upmoves and buys in downmoves.

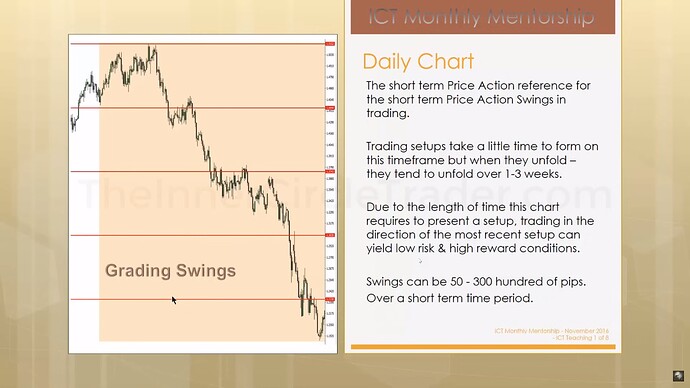

- Grading price swings help determine where entry setups will form. They should occur around 25%, 50%, and 75% levels of a specified range.

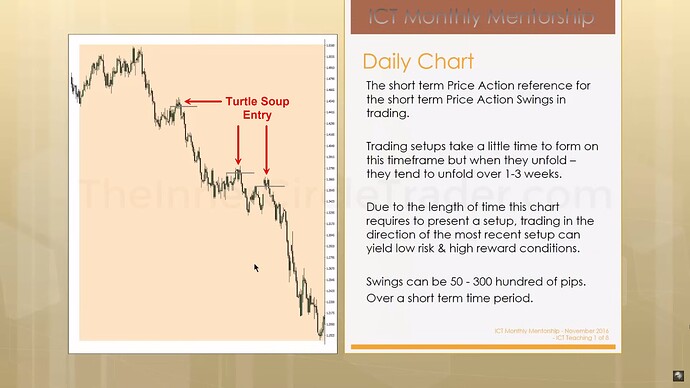

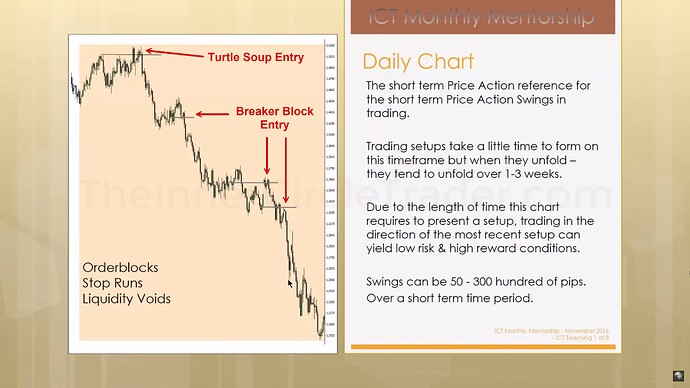

- A daily chart will give you your daily bias.

- Always hold on to the bias until you’ve clearly shown that you’re wrong.

- Michael trades only these three setups:

- Order blocks.

- Liquidity voids.

- Stop runs (turtle soup).

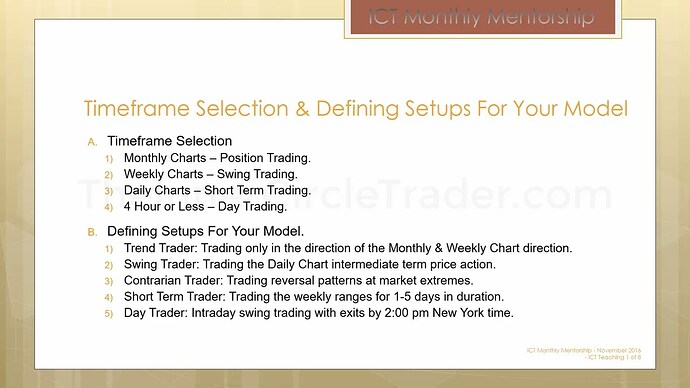

Timeframe Selection & Defining Setups For Your Model

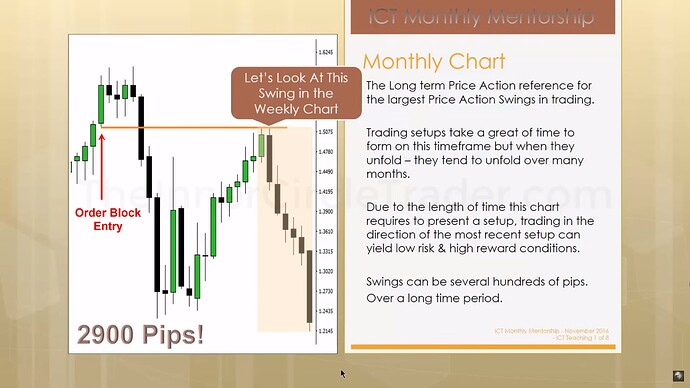

Timeframe Selection & Defining Setups - Monthly Chart Example

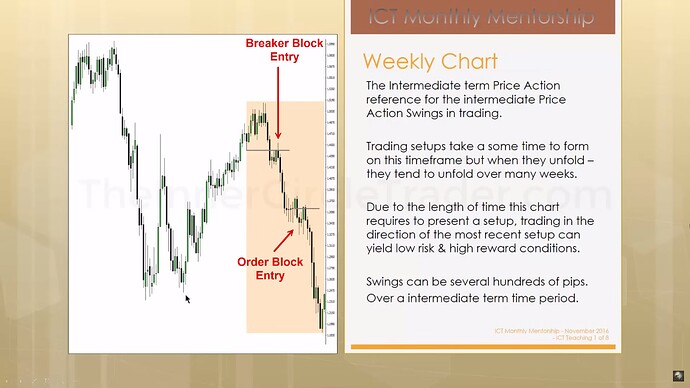

Timeframe Selection & Defining Setups - Weekly Chart Example

Timeframe Selection & Defining Setups - Grading Price Swings

Timeframe Selection & Defining Setups - Daily Chart

Timeframe Selection & Defining Setups - Daily Chart

Next lesson: ICT Mentorship Core Content - Month 3 - Institutional Order Flow

Previous lesson: ICT Mentorship Core Content - Month 2 - Market Maker Trap - False Breakouts