Notes

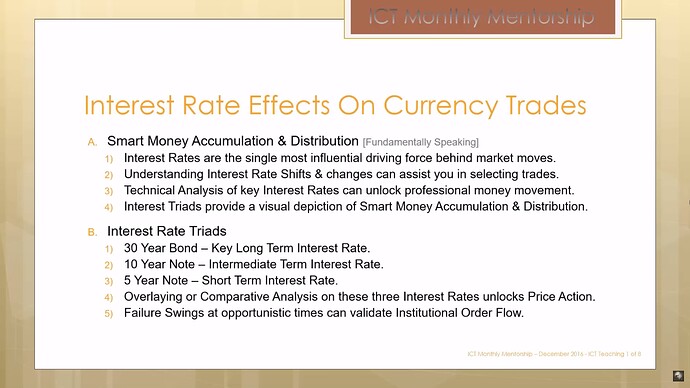

- Interest rates are the number one driver of the currency market.

- The divergence between T-bonds, 10-year T-Notes, and 5-year T-Notes markets confirms the validity of the PD array on the Dollar Index. It makes the trade highly probable.

- Benchmark examples:

- Dow Jones Index - Stocks.

- Dollar Index - Currencies.

- CRB Commodity Index - Commodities.

Interest Rate Effects On Currency Trades

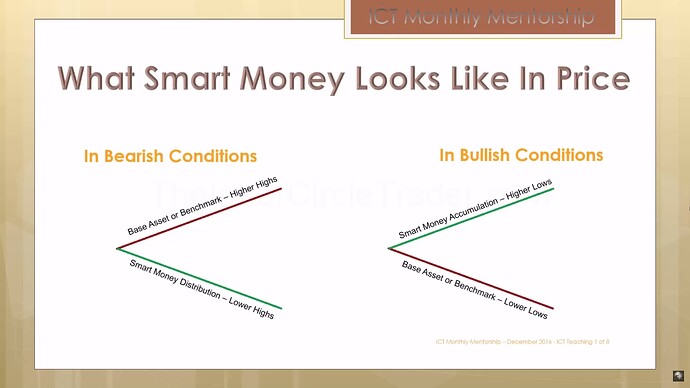

Interest Rate Effects On Currency Trades - What Smart Money Looks Like In Price

Interest Rate Effects On Currency Trades - Interest Rate Triad

Interest Rate Effects On Currency Trades - T-bonds Example

Interest Rate Effects On Currency Trades - 10-Year T-Notes Example

Interest Rate Effects On Currency Trades - 5-Year T-Notes Example

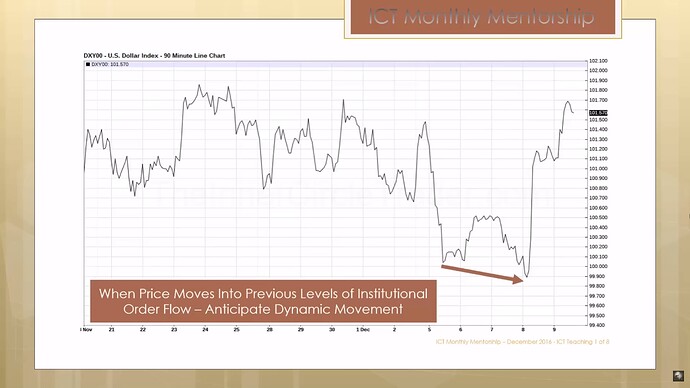

Interest Rate Effects On Currency Trades - Dollar Index Example

Interest Rate Effects On Currency Trades - Dollar Index Example - Hourly Chart

Interest Rate Effects On Currency Trades - 4-Hour Chart

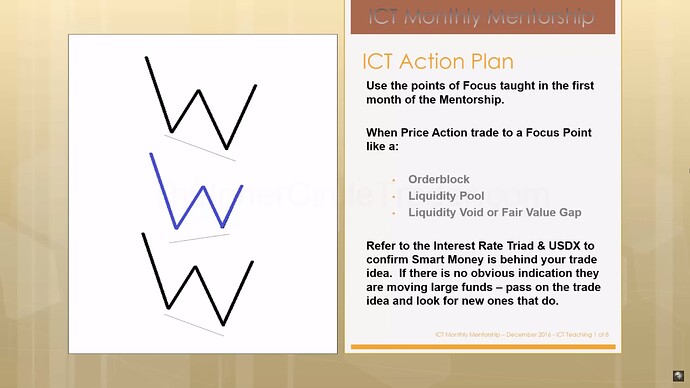

Interest Rate Effects On Currency Trades - ICT Action Plan

Next lesson: ICT Mentorship Core Content - Month 4 - Reinforcing Liquidity Concepts & Price Delivery

Previous lesson: ICT Mentorship Core Content - Month 3 - Market Maker Trap - Head & Shoulders Pattern