Notes

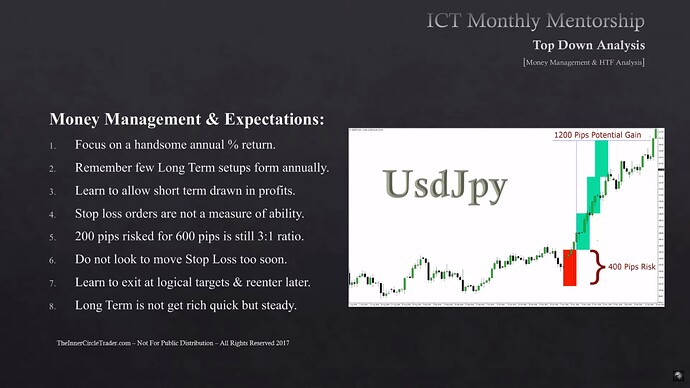

- If you can show a consistent equity curve with very little drawdown, you’ll attract investors. It doesn’t matter if it’s a lot of percentage gain, as long as it’s consistent.

- Michael has a limit allocation of only 30% of equity for long-term trading. If he has a 100k account, he will use only 30k. So when he risks 2%, he risks 2% of 30k, not 100k.

- With only 30% of capital at risk, you never have to worry about overleveraging, margin calls, or significant dips in your equity.

- According to Michael, an annual return of 18% to 25% is good and an industry standard for managed funds. If you can do that every single year, you’ll never have a shortage of investors.

- Since you only use 30% of your capital for long-term trades, you can use the rest for short-term and swing trading.

- If you don’t have the option to open hedge trades, you can trade correlated assets instead. For example, if you are long USDJPY and expecting a retracement, you can open a short-term EURUSD short position.

- Long-term trades require patience. Resist the urge and avoid moving the stop loss too soon.

- Focus on two really good setups a year.

- A long-term trade will last a minimum of three months.

- You don’t want to work hard when managing money. You want to work smart. It takes little to do very well on higher time frames.

Money Management And Higher Time Frame Analysis

Money Management And Expectations

Next lesson: ICT Mentorship Core Content - Month 5 - Defining HTF PD Arrays

Previous lesson: ICT Mentorship Core Content - Month 5 - Ideal Seasonal Tendencies