Notes

- In this lesson, Michael introduces the process for selecting a high-probability swing trade.

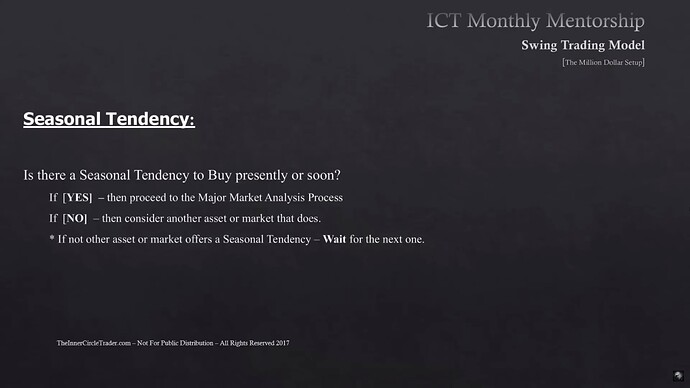

- We do not look for a swing trade without a seasonal tendency.

- When the price heads from the discount to the premium (or from the premium to the discount), we can expect a stop run after the equilibrium is overcome. The next stop run may then occur in the last quarter or third.

- Michael prefers short-term trading and day trading as it offers a higher trading frequency than swing trading.

The Million Dollar Swing Setup

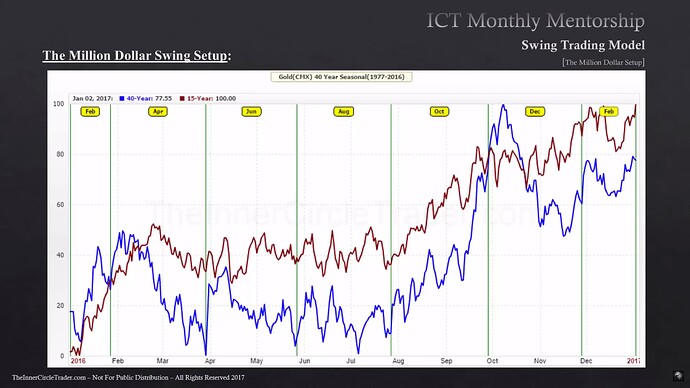

The Million Dollar Swing Setup - Seasonal Tendency

The Million Dollar Swing Setup - Major Market Analysis

The Million Dollar Swing Setup - Intermarket Analysis For Foreign Currency Or Metal Bullish Swing Trade Setups

The Million Dollar Swing Setup - Intermarket Analysis For Foreign Currency Or Metal Bearish Swing Trade Setups

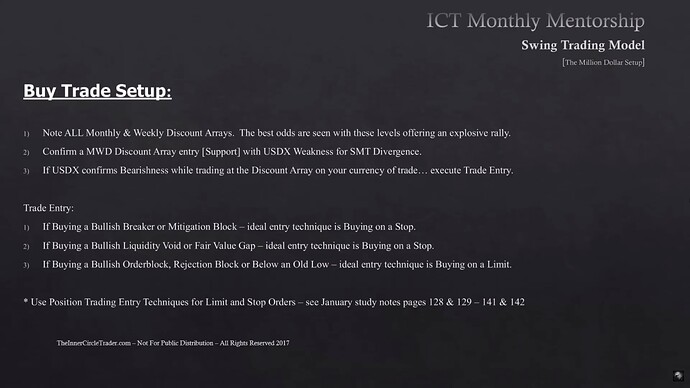

The Million Dollar Swing Setup - Buy Trade Setups

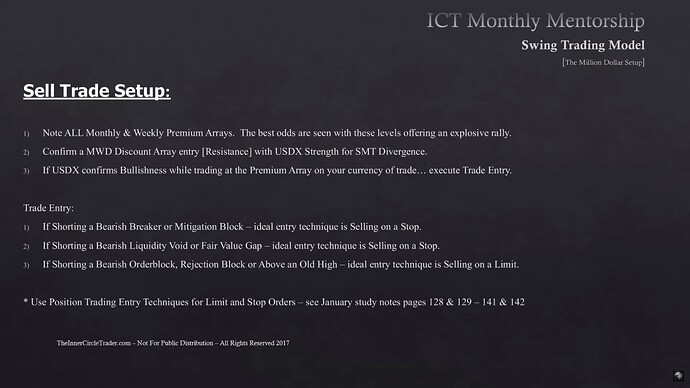

The Million Dollar Swing Setup - Sell Trade Setups

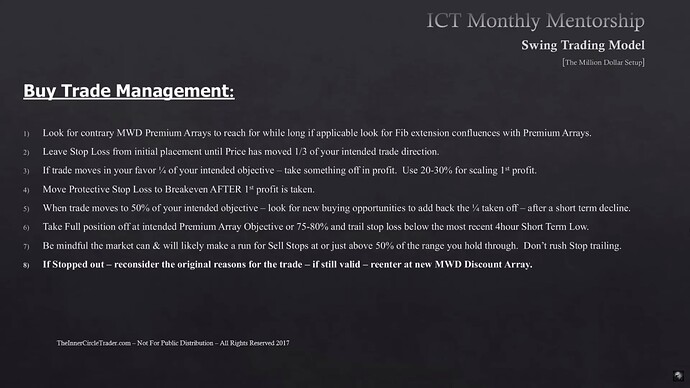

The Million Dollar Swing Setup - Buy Trade Management

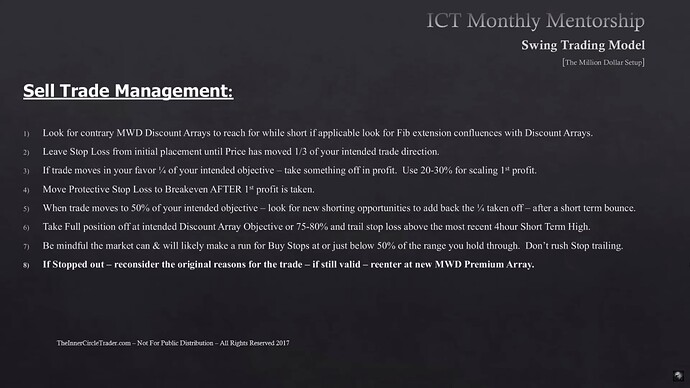

The Million Dollar Swing Setup - Sell Trade Management

Gold Example - Seasonal Tendencies

Gold Example - 30-Year T-Bond Daily Chart

Gold Example - US Dollar Index Daily Chart

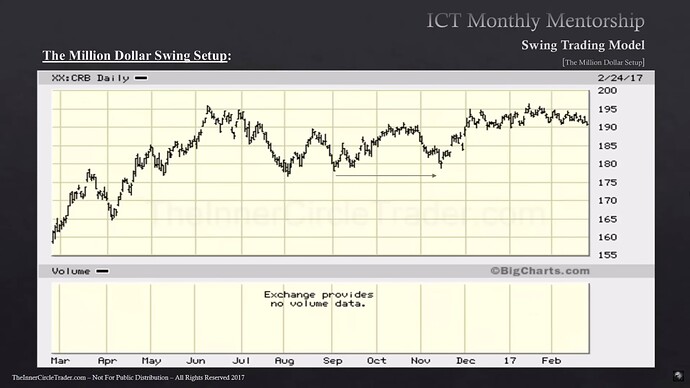

Gold Example - CRB Commodity Index Daily Chart

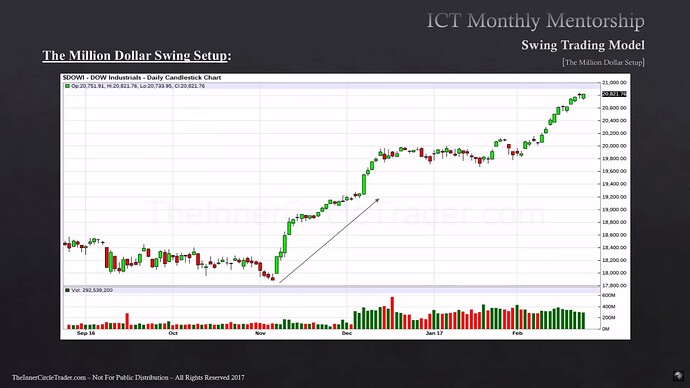

Gold Example - Dow Jones Industrial Index Daily Chart

Gold Example - Open Interest, COT, And Williams %R

Gold Example - Gold Daily Chart

Gold Example - US Dollar Index Daily Chart - Divergence With Gold

Gold Example - High Grade Copper Daily Chart

Gold Example - Live Cattle Daily Chart

Gold Example - Soybeans Daily Chart

Gold Example - Monthly Bullish Order Block

Gold Example - Target On Weekly Chart

Gold Example - Monthly Old Low

Gold Example - Trading Range

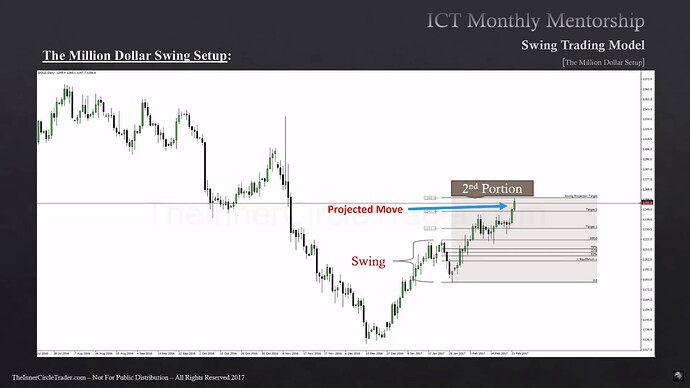

Gold Example - 2nd Portion

Next lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Using Monthly & Weekly Ranges

Previous lesson: ICT Mentorship Core Content - Month 6 - Keys To Selecting Markets That Will Move Explosively