Notes

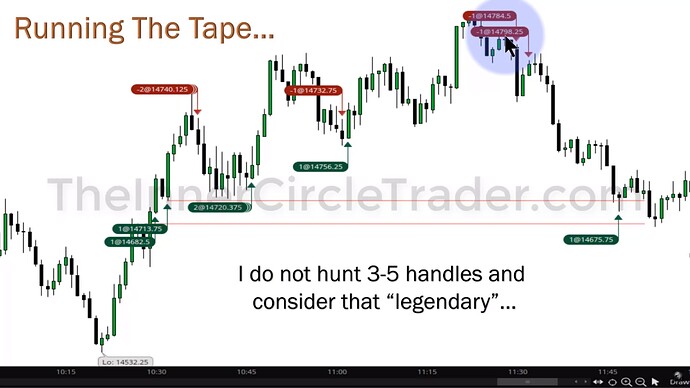

- 1 handle = 4 ticks (1 point).

- Price always goes after stop losses or wants to fill imbalances, such as liquidity voids and fair value gaps.

- A stop hunt precedes every significant movement.

- If we expect a significant move down, the price will likely make a run on buy stops first (buy-side liquidity).

- If we expect a significant move up, the price will likely make a run on sell stops first (sell-side liquidity).

- According to Michael, high-frequency algorithms do not operate on higher time frames than the 3-minute chart. However, they mostly use multi-second charts.

- To find imbalances in the indices, Michael recommends using 1-minute, 2-minute, 3-minute, and 5-minute charts. We should always view them simultaneously.

- If we want to open a short position, we enter at a premium and exit at a discount.

- If we want to open a long position, we enter at a discount and exit at a premium.

- Homework:

- Go through your Emini Futures Intraday charts. Look for Breaks in Market Structure and then look for an Imbalance in Price.

- Determine where an opposite High or Low resides then log & backtest the number of handles you see in hindsight examples.

[Elements To A Trade Setup - Trade Examples in Thinkorswim Platform

Elements To A Trade Setup - Buy Stops, Sell Stops, And Imbalance

Elements To A Trade Setup - Nasdaq 100 Hourly Chart

Elements To A Trade Setup - Nasdaq 100 15-Minute Chart

Elements To A Trade Setup - ICT YouTube 2022 Model Trade Entry Example

Elements To A Trade Setup - Premium And Discount

Next lesson: 2022 ICT Mentorship - Episode 3 - Internal Range Liquidity & Market Structure Shifts

Previous lesson: 2022 ICT Mentorship - Episode 1 - Introduction