Notes

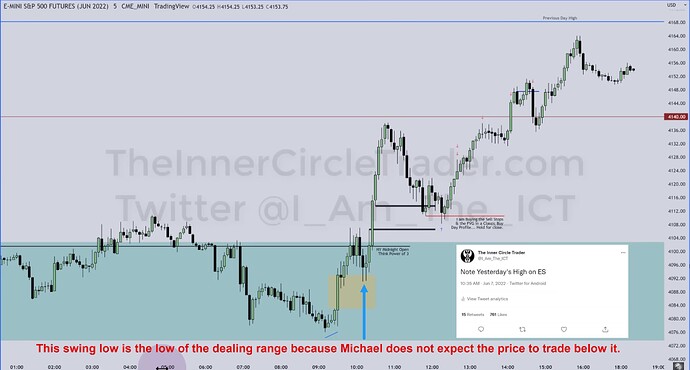

- If we are bullish, we need to identify a swing low below which price will not want to trade. This swing low forms the low of our dealing range.

- If we are bearish, we need to identify a swing high above which price will not want to trade. This swing high forms the high of our dealing range.

- The ICT 2022 YouTube entry model can also be used for day trading. Instead of looking for setups on small time frames, we will look for setups on the 15-minute or 5-minute chart and ensure they align with the power of three concept, i.e., we want to buy below or near the New York Midnight Open and sell above or near the New York Midnight Open.

- On bullish days, we expect an upward move during the New York AM session, a lunchtime consolidation followed by a sweep of sell-side liquidity, and a continuation of the morning trend in the New York PM session.

- On bearish days, we expect a downward move during the New York AM session, a lunchtime consolidation followed by a sweep of buy-side liquidity, and a continuation of the morning trend in the New York PM session.

- If we do not see the market entering a consolidation phase after the morning move and instead make a retracement, it is likely to continue moving in the established direction without any break during lunch.

ICT 2022 YouTube Model - ES Daily Chart

ICT 2022 YouTube Model - ES Hourly Chart

ICT 2022 YouTube Model - ES 15-Minute Chart

ICT 2022 YouTube Model - Determining Of Dealing Range Low

ICT 2022 YouTube Model - OTE And Turtle Soup Setup

Next lesson: 2022 ICT Mentorship - Episode 39 - Narrative Formation, Algorithmic Theory and ICT’s Son Model

Previous lesson: 2022 ICT Mentorship - Episode 37 - Journaling