Notes

- When price sweeps buy-side liquidity and creates a swing high, we expect lower prices.

- When price sweeps sell-side liquidity and creates a swing low, we expect higher prices.

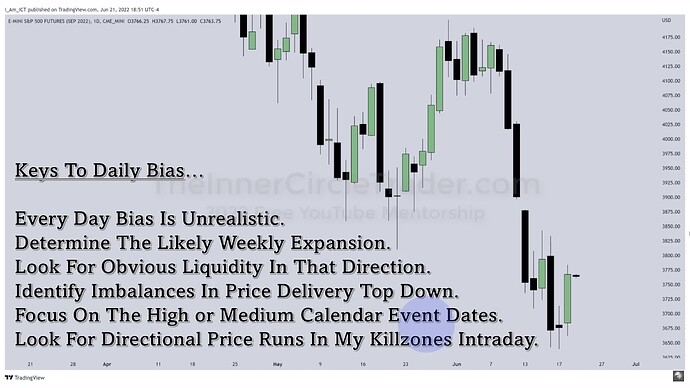

- Keys to daily bias:

- Everyday bias is unrealistic.

- Determine the likely weekly expansion.

- Look for obvious liquidity in that direction.

- Identify imbalances in price delivery top-down.

- Focus on the high or medium calendar event dates.

- Look for directional price runs in the ICT Kill Zones intraday.

- When a news event creates a candle with large wicks on both sides, Michael ignores them and only considers the body of the candle.

- Michael also monitors correlated markets for potential divergences during the news announcement period to determine which are strong and which are weak. For example, he looks for SMT divergence between EURUSD and GBPUSD.

- When we want to determine whether the swing high or low is likely to hold, we need to look more to the left and see if there was a stop hunt before it.

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

ICT 2022 YouTube Model - Buy-Side Liquidity Sweep And Swing High Formation

ICT 2022 YouTube Model - USDCAD 15-Minute And 5-Minute Chart

ICT 2022 YouTube Model - Michael’s Twitter Post

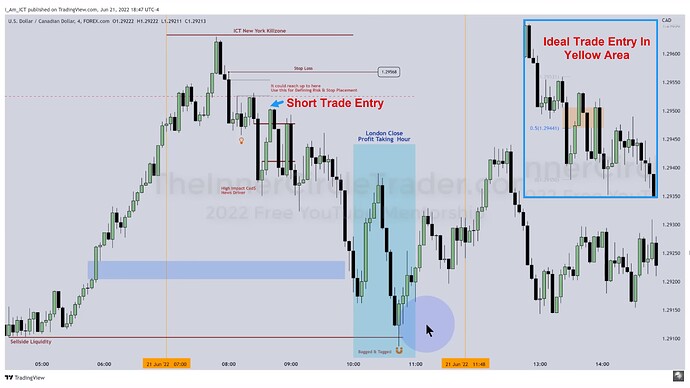

ICT 2022 YouTube Model - USDCAD Short Trade Entry On 4-Minute Chart

ICT 2022 YouTube Model - Keys To Daily Bias

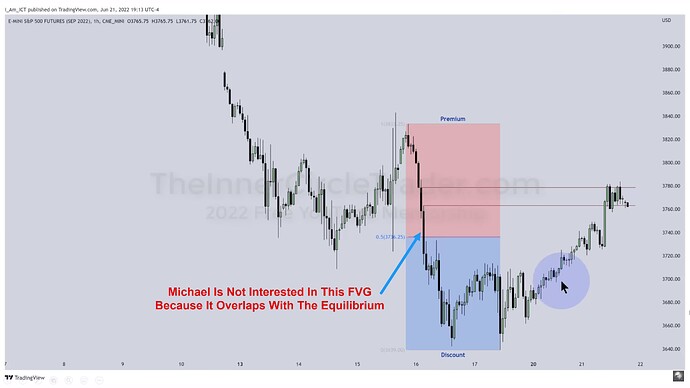

ICT 2022 YouTube Model - Choosing The Right FVG

ICT 2022 YouTube Model - ES 15-Minute Chart

ICT 2022 YouTube Model - ES 5-Minute Chart

ICT 2022 YouTube Model - ES Long Trade Entry On 3-Minute Chart

ICT 2022 YouTube Model - ES 3-Minute Chart

ICT 2022 YouTube Model - ES And USDCAD Negative Correlation

ICT 2022 YouTube Model - Michael’s Scalp Trade

Next lesson: 2022 ICT Mentorship - Episode 41 & Final

Previous lesson: 2022 ICT Mentorship - Episode 39 - Narrative Formation, Algorithmic Theory and ICT’s Son Model