Notes

- The only way to eliminate the fear of missing out (FOMO) is by backtesting because it lets us know how often our setup will occur in the market.

- Michael describes his son’s model in this lesson. He advises him to look for setups at these times:

- 8:30 a.m.

- 9:30 a.m.

- 1:30 p.m.

- Between 3:00 p.m. and 4:00 p.m.

- Before trading the New York PM session, ask yourself what the daily range wants to do.

- Forming a narrative requires experience.

- In forex, bond, and stock index markets, the price is delivered by an algorithm. Buying and selling pressure have no effect. However, there are times when manual intervention is necessary, and smart money will send the price to a specific price level.

- Price levels are useless until time is considered.

- Time is useless unless the price is at a key PD array.

- Blending time and price yields astonishing results and precision.

- ICT’s algorithmic theory is based on time and price.

- The algo doesn’t know how much volume is below or above an old high or low.

- Time elements to consider in trading:

- Time of the day.

- Day of the week.

- Week of the month.

- Month of the year.

- Seasonal Tendencies.

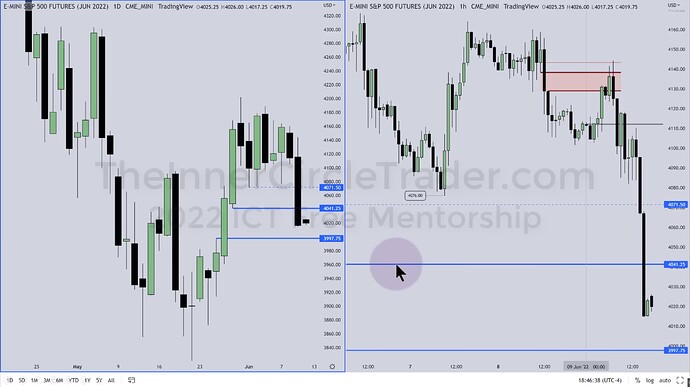

ICT 2022 YouTube Model - ES Daily And Hourly Chart

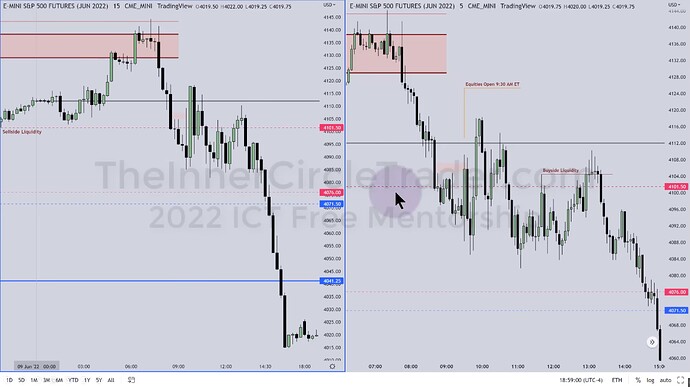

ICT 2022 YouTube Model - ES 15-Minute And 5-Minute Chart

ICT 2022 YouTube Model - ES 5-Minute Chart

ICT 2022 YouTube Model - Bearish Breaker

ICT 2022 YouTube Model - ES Trade Entries And Exits

ICT 2022 YouTube Model - ICT’s Son Model

Next lesson: 2022 ICT Mentorship - Episode 40 - Keys To Daily Bias

Previous lesson: 2022 ICT Mentorship - Episode 38 - Changing Bias, Late Morning Retracement And Day Trading Model