Notes

- In August, the market tends to be very choppy, frustrating traders trying to capture sustained price movements.

- Times when the algorithm is most likely to perform normal market procedures (price runs, rebalances, re-pricing):

- 2 a.m. to 5 a.m. - London session (Forex).

- 7 a.m. to 10 a.m. - New York session (Forex).

- 8:30 a.m. to 11 a.m. - AM New York session (Futures).

- 1:30 a.m. to 4 a.m. - PM New York session (Futures).

- We should focus on specific time ranges (kill zones) because market movements are most predictable during these periods.

- Understanding of ICT concepts comes from exposure to these principles over time.

- August is not a good month to do funding challenges.

- Most trading failures stem from a trader’s character flaws like impatience or the inability to admit when one is wrong.

- ICT methods work because they are rooted in understanding the underlying mechanics of price action and institutional behavior.

- The market behavior is highly predictable when approached with the right framework.

- Michael recommends that traders become independent thinkers who do not rely on anyone else’s system or software.

- We should keep a trading journal to track trades, reasons for taking them, and lessons learned.

- Through regular journaling, we can gain insights into our own decision-making process and identify patterns in our failures or successes.

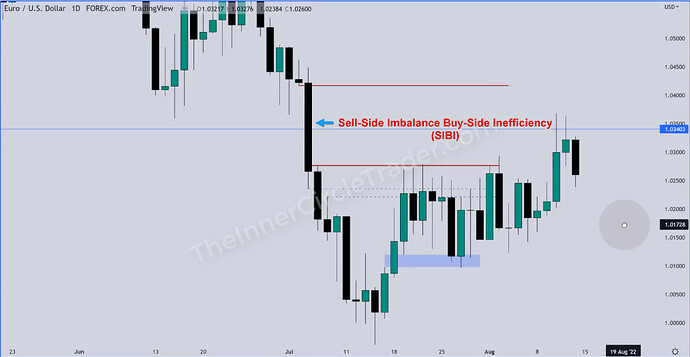

EURUSD - Sell-Side Imbalance Buy-Side Inefficiency (SIBI)

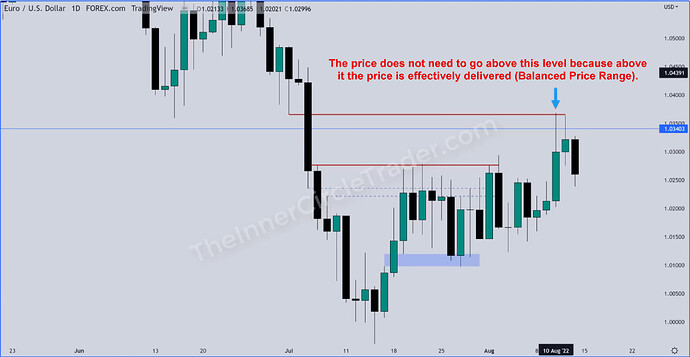

EURUSD - Price Reaction To Balanced Price Range

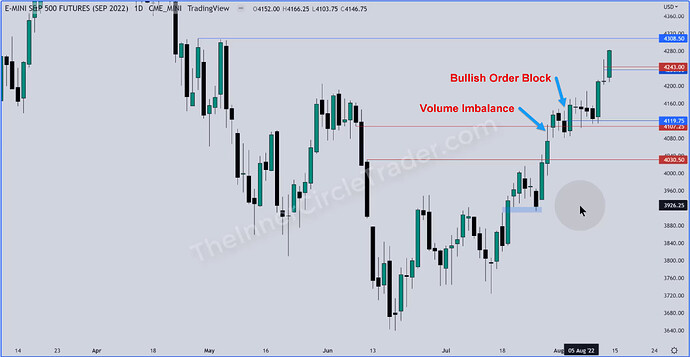

ES - Volume Imbalance And Bullish Order Block

Next lesson: 2022 ICT Mentorship - E-mini S&P 500 AM & PM Session Review: September 2

Previous lesson: 2022 ICT Mentorship - Market Review: August 2