Notes

- Michael does not analyze every high and low in correlated or inversely correlated markets just to look for divergences. He looks for SMTs (divergences) in markets where he already has a predetermined bias.

- We should look for SMT divergence in locations where the price is testing some PD arrays, such as Order Block or Fair Value Gap.

- The meaning of SMT:

- Smart Money Technique.

- Smart Money Tool.

- Smart Money Time.

- The highs and lows of the previous three days are important levels to watch.

- Not every imbalance is FVG. The narrative determines what FVG is.

- Risk-off scenario: If the US dollar’s value rises, foreign currencies will fall, and all other asset classes are likely to fall as well.

- Risk-on scenario: If the US dollar’s value falls, foreign currencies will rise, and all other asset classes are likely to rise as well.

- Gaps are the real supports and resistance.

- Price movements are not caused by buying and selling pressures. They are algorithmically delivered.

- We should avoid trading during high-volatility events like Non-Farm Payroll.

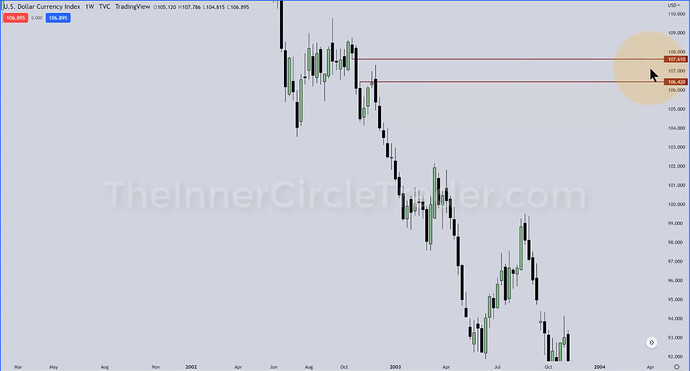

Dollar Index - Weekly Chart

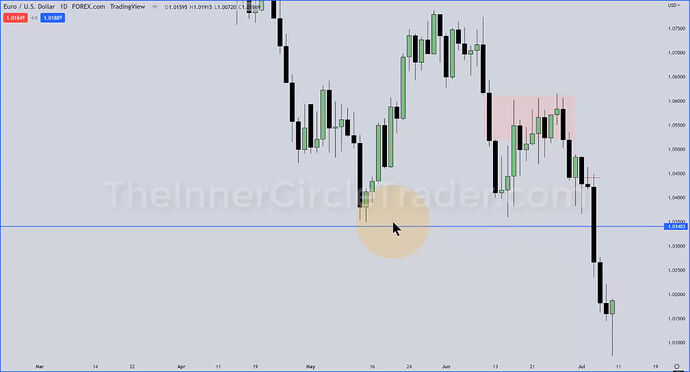

Dollar Index - SMT With EURUSD On Daily Chart

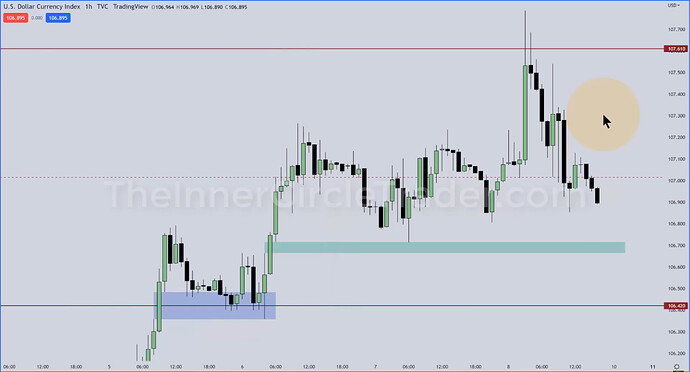

Dollar Index - Hourly Chart

EURUSD - Daily Chart

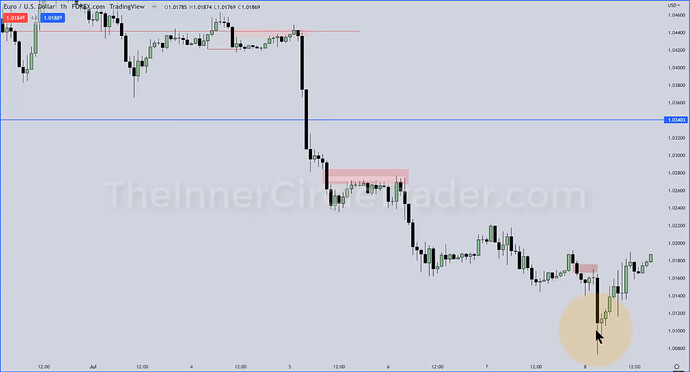

EURUSD - Hourly Chart

EURUSD - 15-Minute Chart

ES - Highs And Lows Of Previous Three Days

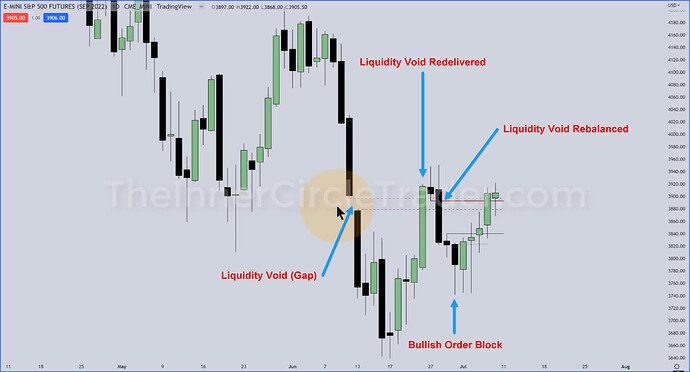

ES - Rebalancing Of Liquidity Void

ES - Real Support And Resistance

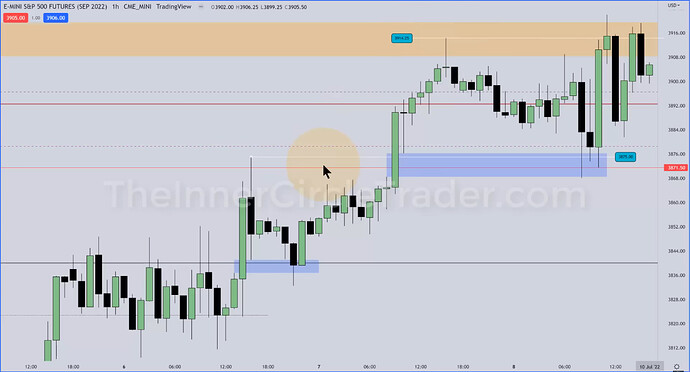

ES - Hourly Chart

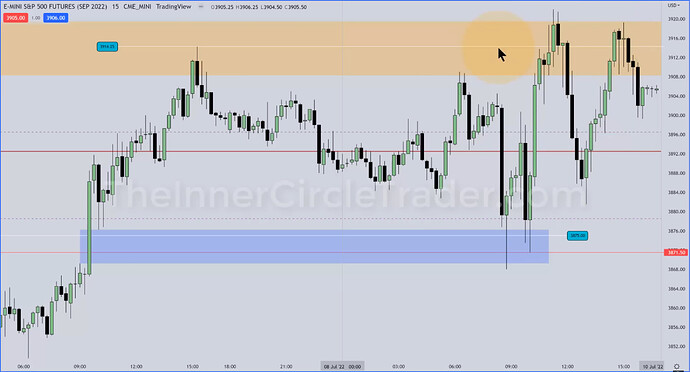

ES - 15-Minute Chart

ES - SMT On 5-Minute Chart

ES - Long Trade Opportunites On 1-Minute Chart

ES - Trade Entry And Exits

Next lesson: 2022 ICT Mentorship - Market Review: July 18

Previous lesson: 2022 ICT Mentorship - Market Review: July 6