Notes

- When smart money participates in a move, it’ll be seen in price action.

- Order blocks are formed at support and resistance levels.

- When the bullish order block is validated and the price trades back immediately, we can enter on the same candle that broke the high of the down candle.

- When the bearish order block is validated and the price trades back immediately, we can enter on the same candle that broke the low of the up candle.

- If we have not entered immediately, we will wait for the retracement following the displacement.

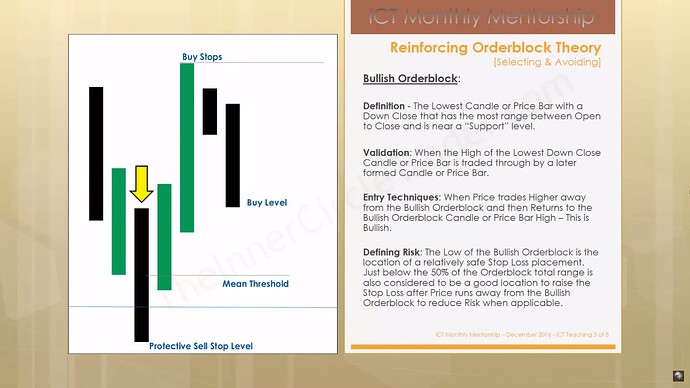

- Three possible levels of entry on order blocks:

- Open price.

- High - Bullish order block.

- Low - Bearish order block.

- Michael uses high/low candles (wicks) for entries when the order block overlaps with the fair value gap.

- The best bullish order blocks will not trade below 50% of their body range, i.e., the mean threshold. The opposite is true for bearish order blocks.

- The stop loss for bullish order block trade could be below the low of the wick, but we will primarily place it below the candle’s body. The opposite is true for bearish order block trade.

- If the HTF indicates that we are going higher, we ignore bearish order blocks on the way up.

- If the HTF indicates that we are going lower, we ignore bullish order blocks on the way down.

- Two or more up candles can also form a bearish order block.

- Two or more down candles can also form a bullish order block.

- Michael wants to see a displacement corresponding to at least two to three times the range of the order block.

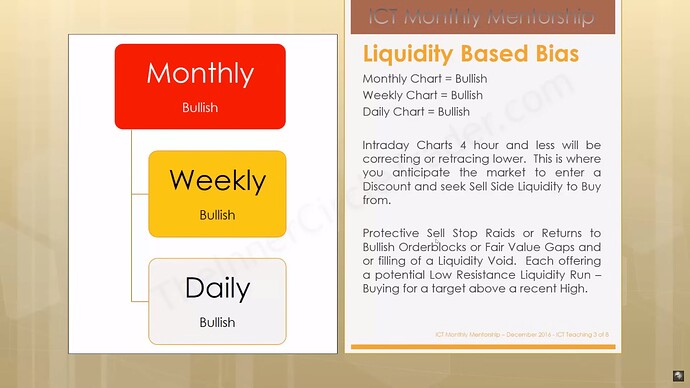

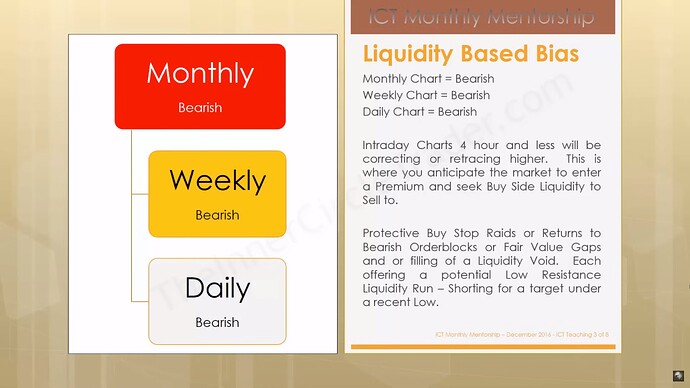

- You can refine order blocks to even the 5-minute time frame if you want. However, only focus on the direction of the monthly, weekly, and daily charts.

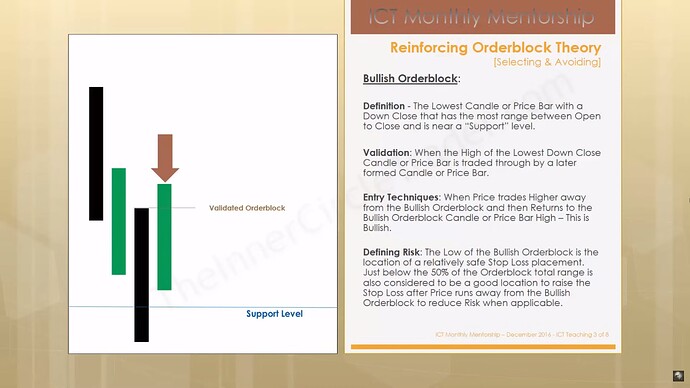

ICT Order Blocks - Validated Bullish Order Block

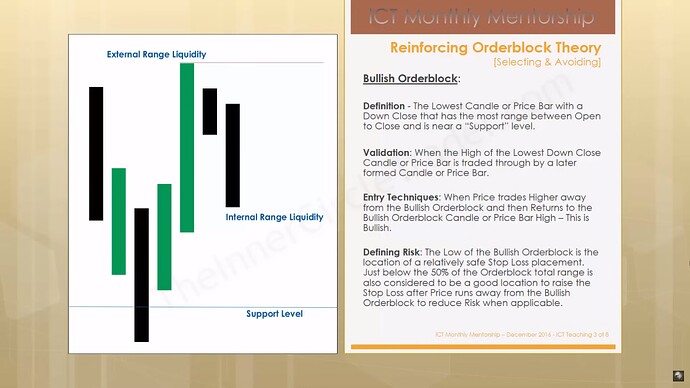

ICT Order Blocks - External And Internal Liquidity

ICT Order Blocks - Bullish Order Block Entry

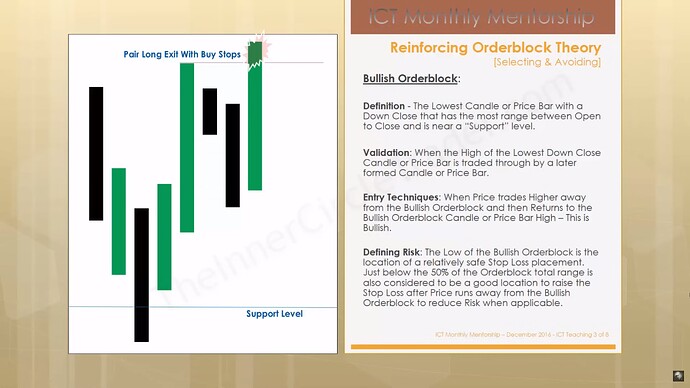

ICT Order Blocks - Bullish Order Block Exit

ICT Order Blocks - Liquidity Based Bias - Bullish

ICT Order Blocks - Liquidity Based Bias - Bearish

ICT Order Blocks - Liquidity-Based Bias - Bearish - Monthly Bullish Order Block Examples

ICT Order Blocks - Liquidity Weekly Chart

ICT Order Blocks - Newly Formed Bullish Order Block

ICT Order Blocks - Displacement

Next lesson: ICT Mentorship Core Content - Month 4 - Mitigation Blocks

Previous lesson: ICT Mentorship Core Content - Month 4 - Reinforcing Liquidity Concepts & Price Delivery