Notes

- Every day should start with a look at the economic calendar. We look for medium and high-impact events that take place during the London or New York session.

- As day traders, we will most often monitor PD arrays formed in the last 20 days. If all have already been used or overcome, we will extend our filter to 40 days.

- When down candles are respected, and highs are being broken, the institutional order flow is bullish.

- When up candles are respected, and lows are being broken, the institutional order flow is bearish.

- Michael sometimes uses the terms institutional order flow and institutional sponsorship as synonyms, even though each represents a different ICT concept.

- Although we have concluded a directional bias, we should always have a scenario in place for a contrary market development. In other words, we need to have both a bullish and a bearish scenario ready.

We look for the following PD arrays:- The LTF PD array overlaps with the HTF PD array. For example, an hourly bullish order block inside a daily bullish order block.

- LTF PD array overlapping with LTF PD array. For example, an hourly bullish order block and a fair value gap.

- If we come to a directional bias based on our analysis of the HTF charts, we look to the LTF charts for reasons to justify trading in that direction. We never go against that bias!

- Don’t view the loss as a bad thing. Smart money doesn’t view a loss as a defeat. It’s a premium paid for greater insight.

- The best trades will be in sync with institutional order flow.

- If Monday is a USD bank holiday, then Tuesday generally becomes what Monday tends to be, a range day.

- ICT Day Trading Daily Routine

- Determine The Economic Calendar Impact For Today

- Narrow Focus To Killzone News Releases High or Medium

- Determine The Daily Institutional Order Flow Of USDX

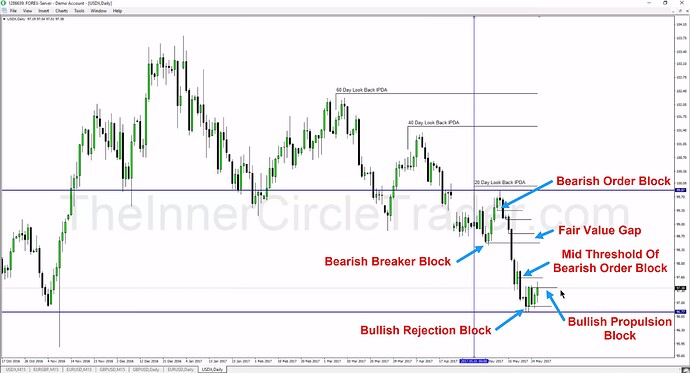

- Locate The USDX Daily PD Arrays In IPDA Data Ranges

- Consider If USDX Is Moving From Premium Or Discount

- Using The News Due Out - Focus On That Pair Intraday

- Determine The Daily Institutional Order Flow Of Pair

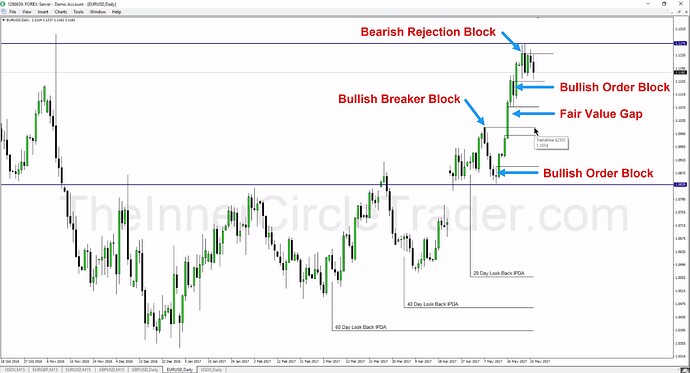

- Locate The Pair’s Daily PD Arrays In IPDA Ranges

- Confirm The Pair Is Moving From An Opposing PD Array

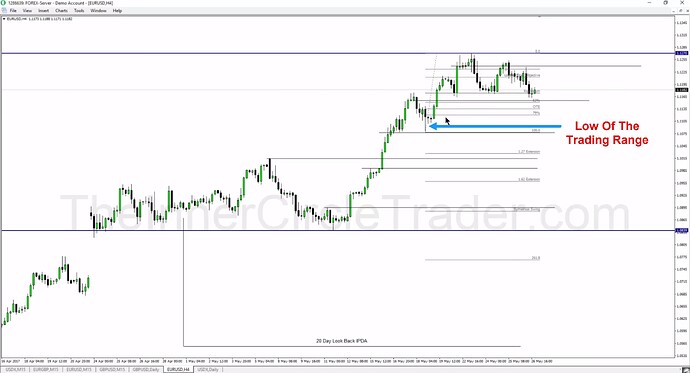

- Locate The Pair’s 4-hour PD Arrays

- Locate The Pair’s 60-minute PD Arrays

- Note The 0 GMT Opening Price & Consider The Daily Range

- At Midnight In New York - Calculate The STDV Levels

- CBDR Standard Deviations

- Asian Range Standard Deviations

- Flout Standard Deviations

- Note The Midnight New York Opening Price

- Look For 15/5 min PD Arrays To Converge With STDV

- Consider Intraday Scenarios That Would Unfold

- ADR High & Low Can Assist In Converging STDV Levels

ICT Day Trade Routine - USDX Daily Chart

ICT Day Trade Routine - EURUSD Daily Chart

ICT Day Trade Routine - EURUSD 4-Hour Chart

ICT Day Trade Routine - EURUSD Hourly Chart

Next lesson: ICT Mentorship Core Content - Month 10 - Commitment Of Traders

Previous lesson: ICT Mentorship Core Content - Month 9 - Bread & Butter Sell Setups