Notes

- Each new day, we shift the IPDA data range forward.

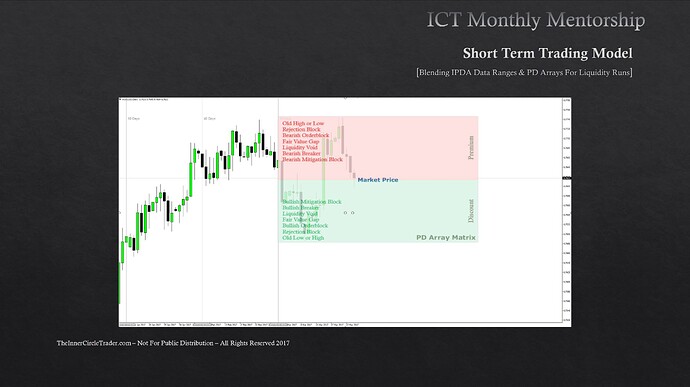

- The Interbank Price Delivery Algorithm (IPDA) uses data for the last 20, 40, and 60 days. The PD array in reference to price determines which data array is used.

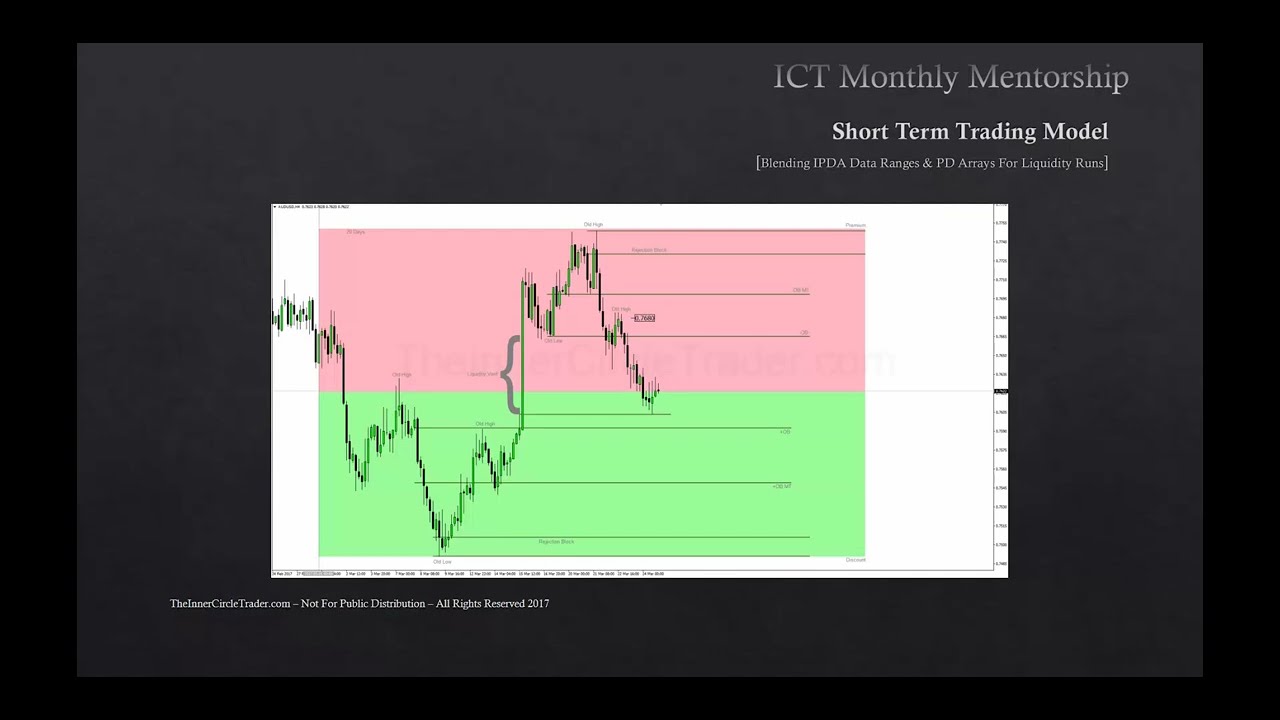

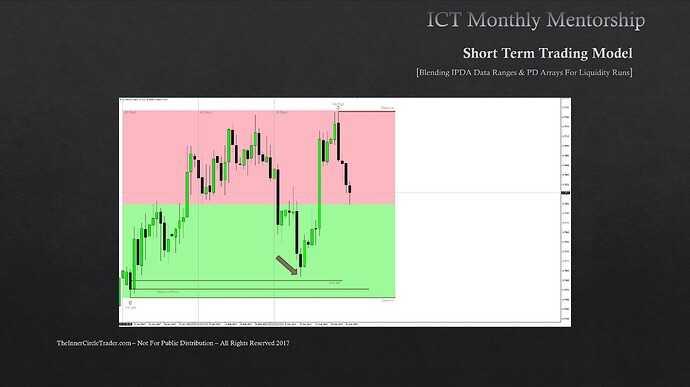

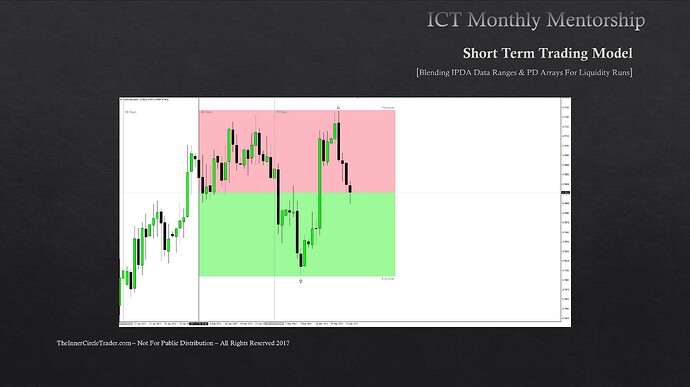

- Blending time and price, in this case, means combining IPDA data ranges with the PD array matrix.

- We break down the price range over the last 60, 40, and 20 days to see where their highs and lows are.

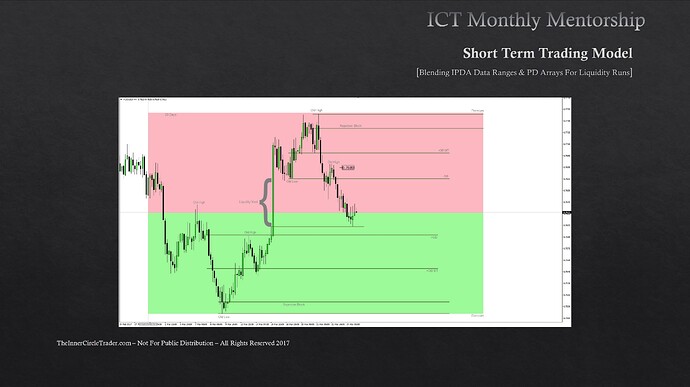

- When we look at the 20-day range, we look at which premium arrays are above the current price and which discount arrays are below it.

- All discount or premium arrays are rarely present at the same time. Far more often, we will see the presence of two to four elements of the PD array matrix.

Blending IPDA Data Ranges & PD Arrays

Blending IPDA Data Ranges & PD Arrays - 60-Day Look Back Period

Blending IPDA Data Ranges & PD Arrays - 40-Day Look Back Period

Blending IPDA Data Ranges & PD Arrays - 20-Day PD Array Matrix

Blending IPDA Data Ranges & PD Arrays - 20-Day Look Back Period

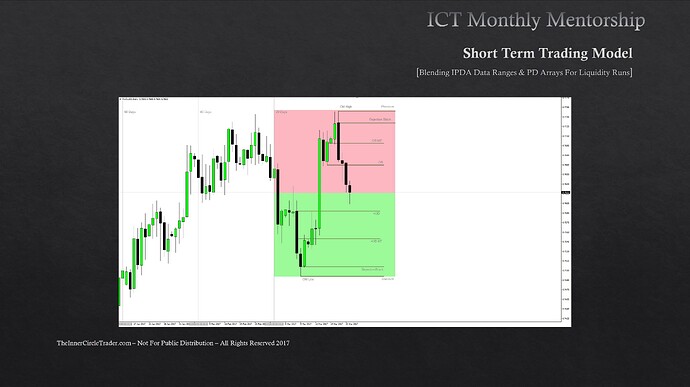

Blending IPDA Data Ranges & PD Arrays - AUDUSD 4-Hour Chart

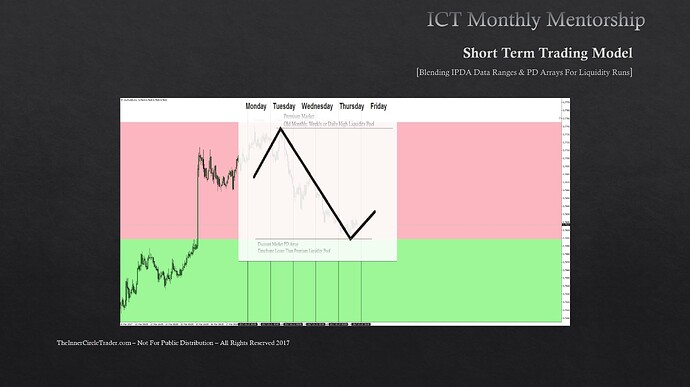

Blending IPDA Data Ranges & PD Arrays - Days Of The Week

Blending IPDA Data Ranges & PD Arrays - Classic Tuesday High Of Week

Next lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Low Resistance Liquidity Runs [Part 1]

Previous lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Market Maker Manipulation Templates