Foundation Presentation

Amplified Teaching

Trade Plan & Algorithmic Theory

Notes

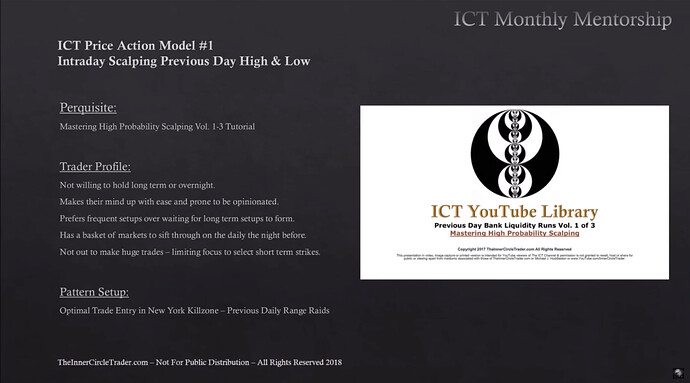

- This price action model builds on Mastering High Probability Scalping series.

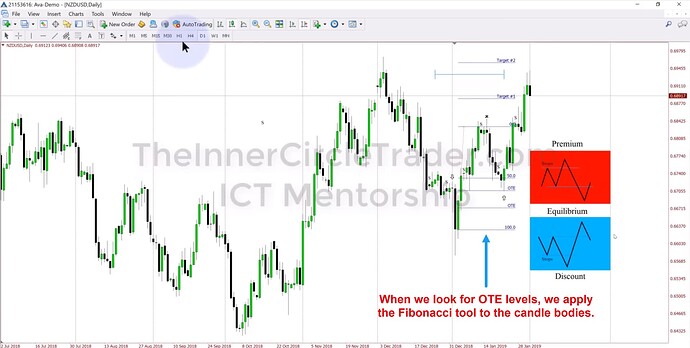

- When we mark a dealing range using the Fibonacci tool, we always use candle wicks.

- When we look for OTE levels, we apply the Fibonacci tool to the candle bodies.

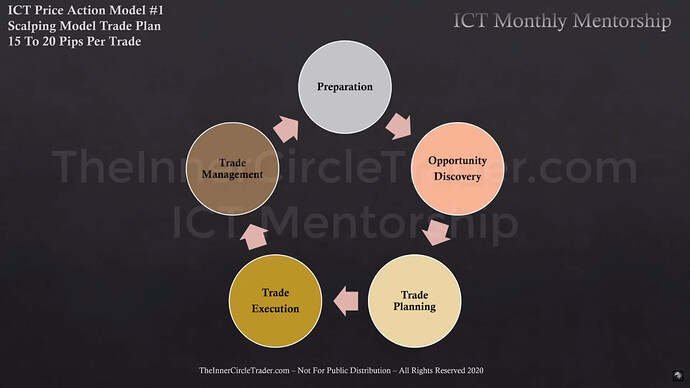

- Trading plans should be concise and fit on the back of a business card. They should also be tailored to individual experiences and comfort levels with various ICT tools.

- Understanding institutional order flow is crucial for developing a trading model. It helps identify where to enter and exit trades.

- ICT tools (concepts) should be used when applicable. Not all tools are necessary for every model.

- The ICT Mentorship Core Content lays the groundwork for understanding price action and these trading models.

- In the Mastering High Probability Scalping series, swing points were used to determine entry and exit points. The strategy includes buying when a swing high is broken and a swing low is formed, or selling short when a swing low is broken and a swing high is formed.

- The Amplified Teaching lecture discusses refining this model to anticipate market movements before swing points form. Michael claims that it should enhance precision and entry points.

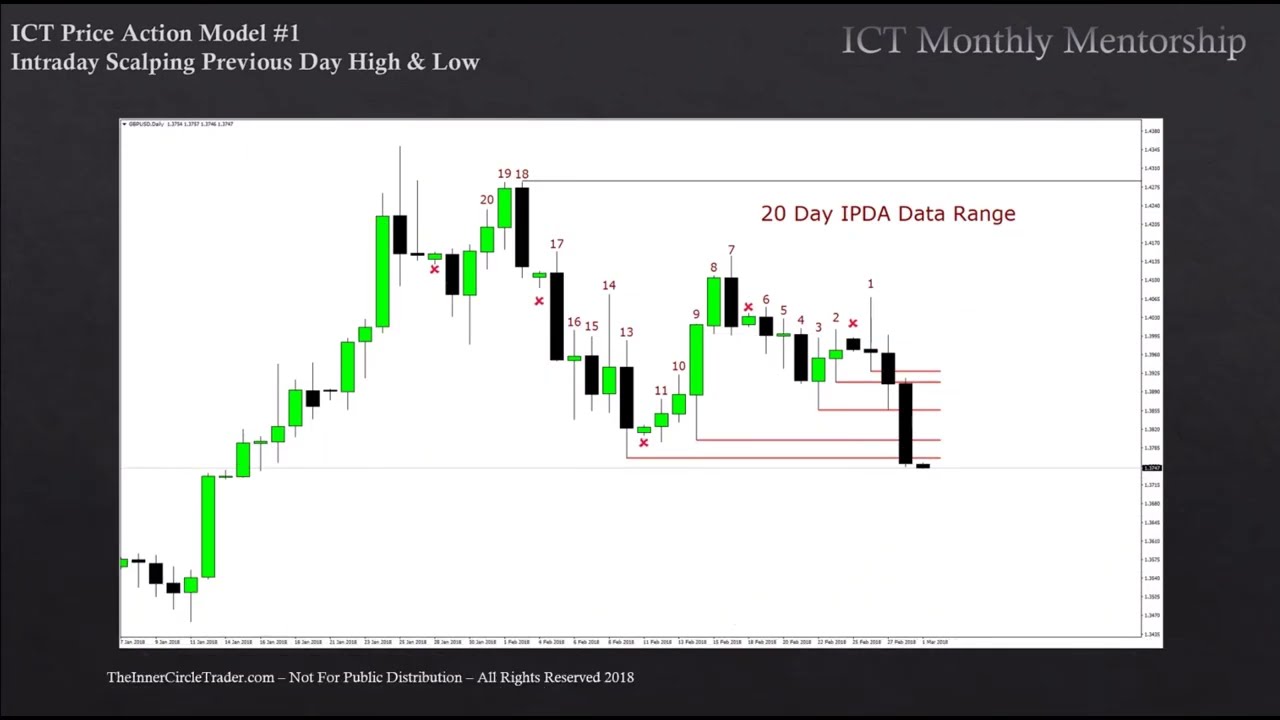

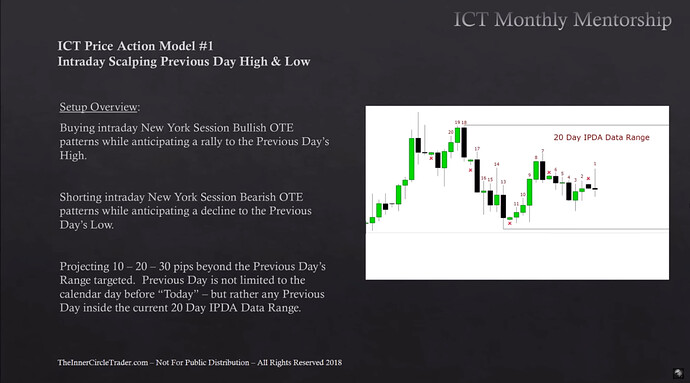

- The refined scalping model uses IPDA data ranges to identify key support and resistance.

- Our primary focus should be on mastering one setup per week, achieving consistent returns, and gradually increasing complexity as experience grows.

- A simple, well-understood model can be more effective than complex strategies.

- As traders, we do not need external validation of our trading models. Success is determined by consistent application and sample size data.

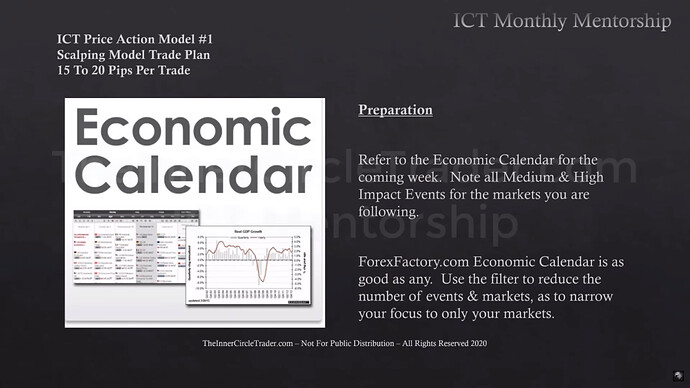

- When we expect the report (news) at 10:00 a.m. or 10:30 a.m., the New York Kill Zone can be extended until 11:00 a.m.

- Michael likes to reduce his risk per trade by half after five winning trades.

- Backtesting is vital to mastering and gaining confidence in any price action model.

- Algorithm is a set of instructions designed to perform a specific task and or solve a problem.

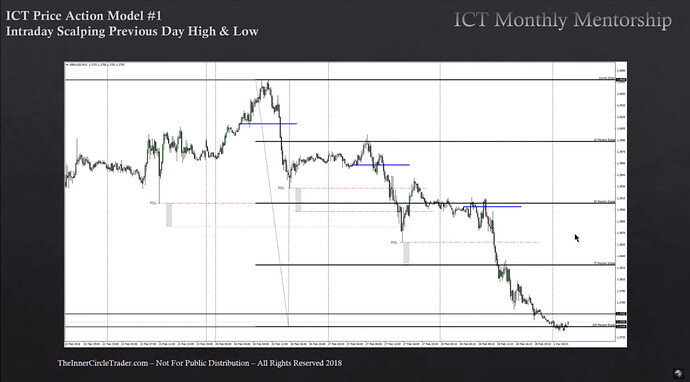

ICT Price Action Model 1 - Intraday Scalping Previous Day High And Low

Intraday Scalping Previous Day High And Low - Setup Overview

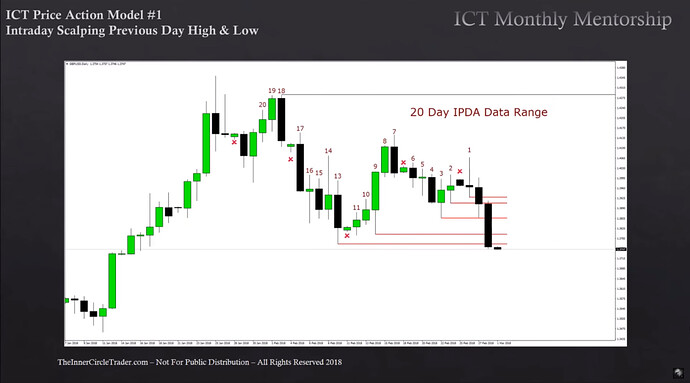

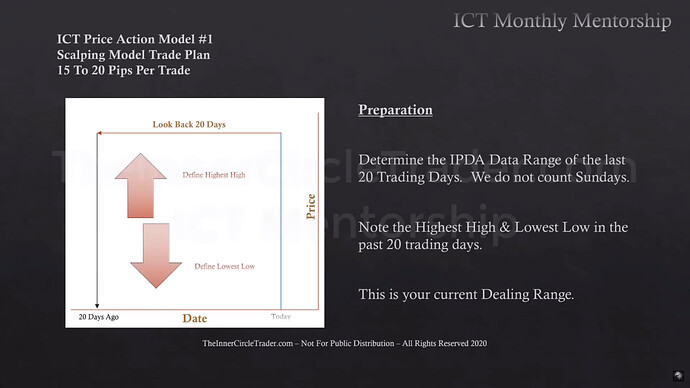

Intraday Scalping Previous Day High And Low - 20-Day IPDA Data Range

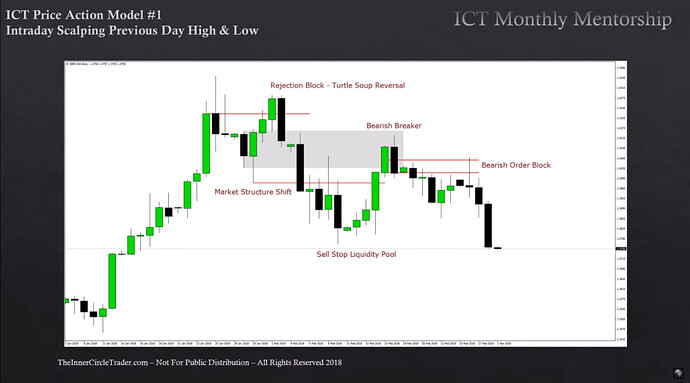

Intraday Scalping Previous Day High And Low - ICT Price Action Analysis

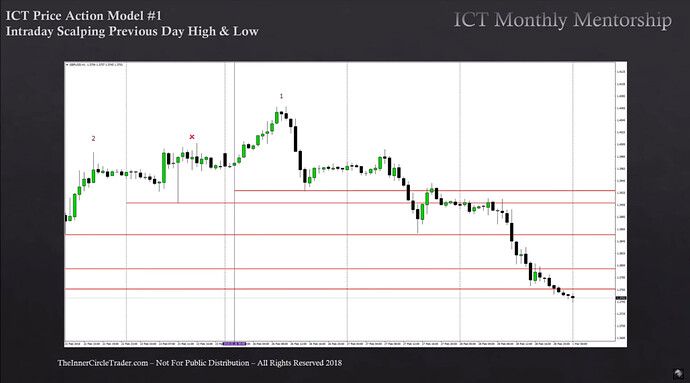

Intraday Scalping Previous Day High And Low - Previous Lows

Intraday Scalping Previous Day High And Low - Previous Daily Lows And NY Midnight Open

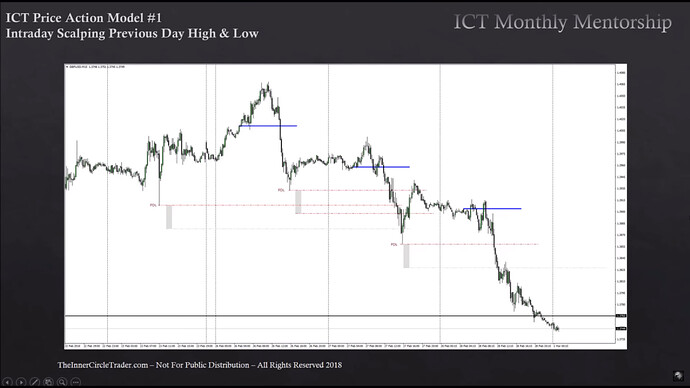

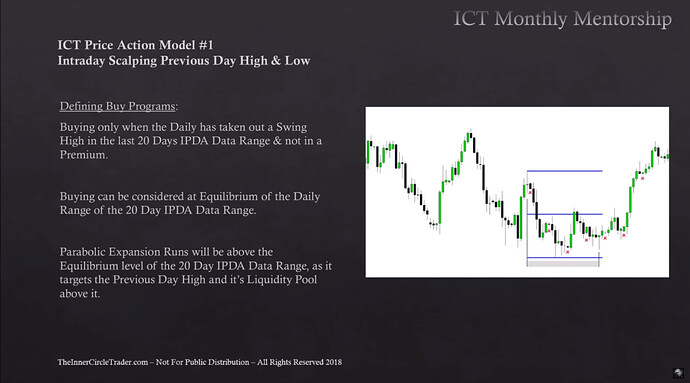

Intraday Scalping Previous Day High And Low - Defining Buy Programs

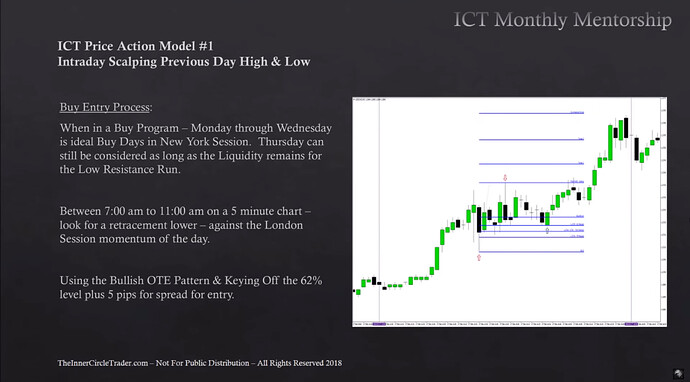

Intraday Scalping Previous Day High And Low - Buy Entry Process

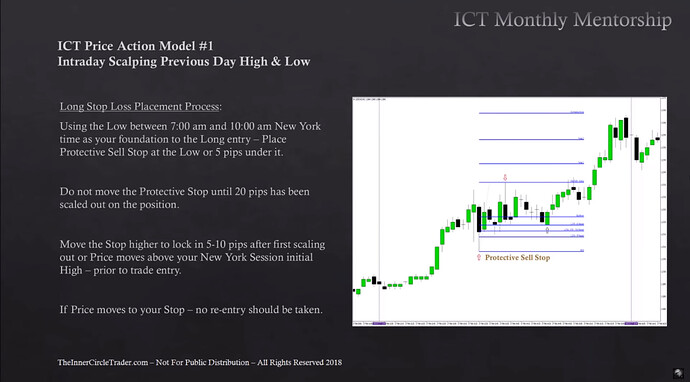

Intraday Scalping Previous Day High And Low - Long Stop Loss Placement

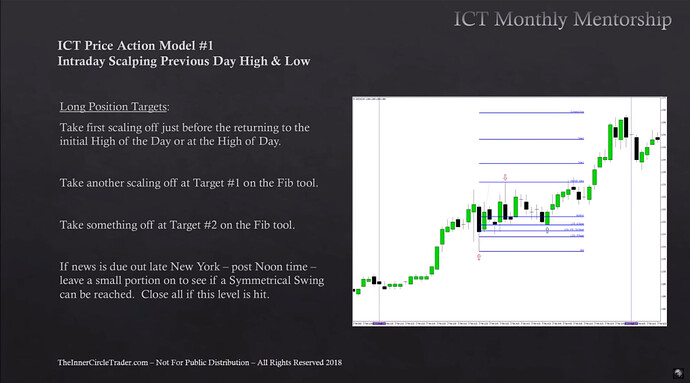

Intraday Scalping Previous Day High And Low - Long Position Targets

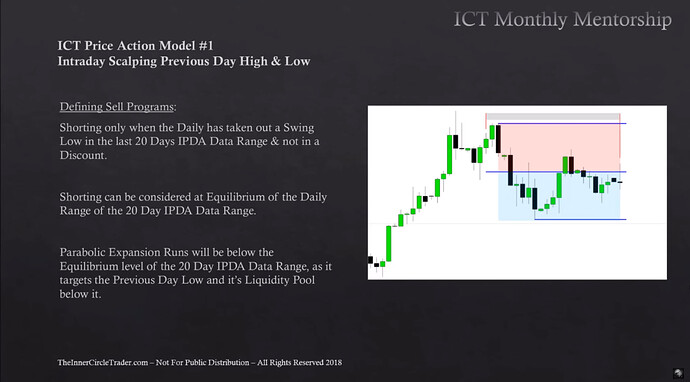

Intraday Scalping Previous Day High And Low - Defining Sell Programs

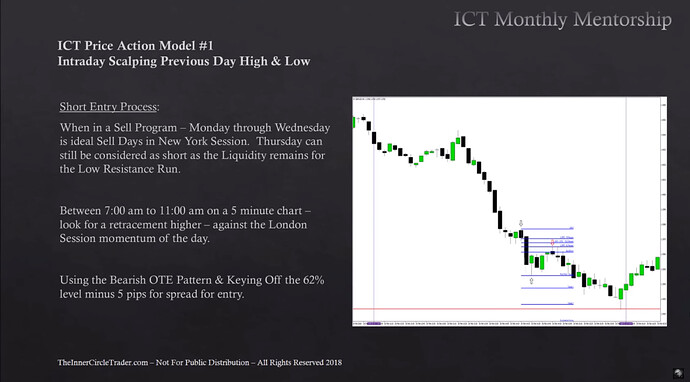

Intraday Scalping Previous Day High And Low - Short Entry Process

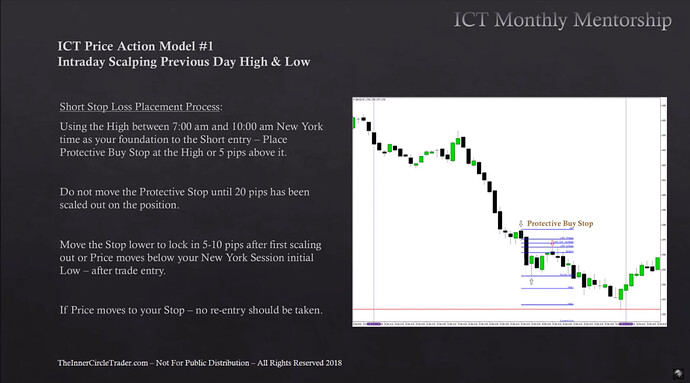

Intraday Scalping Previous Day High And Low - Short Stop Loss Placement Process

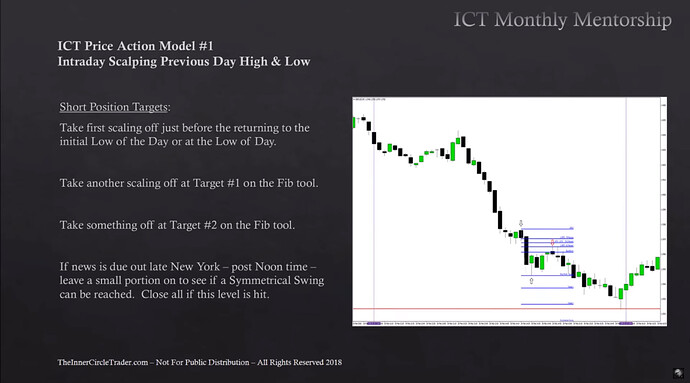

Intraday Scalping Previous Day High And Low - Short Position Targets

Intraday Scalping Previous Day High And Low - Following The Elephant

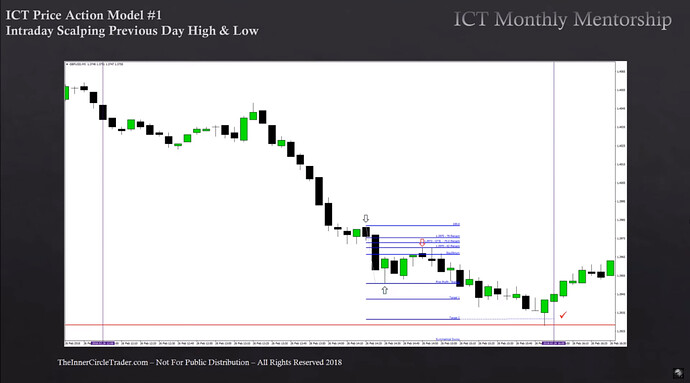

Intraday Scalping Previous Day High And Low - GBPUSD Short Trade Example

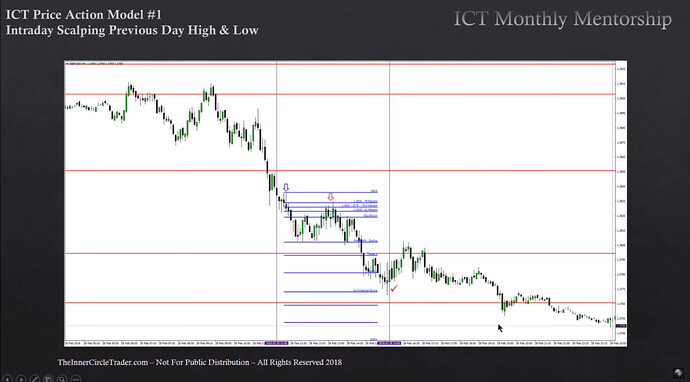

Intraday Scalping Previous Day High And Low - GBPUSD Short Trade Example 2

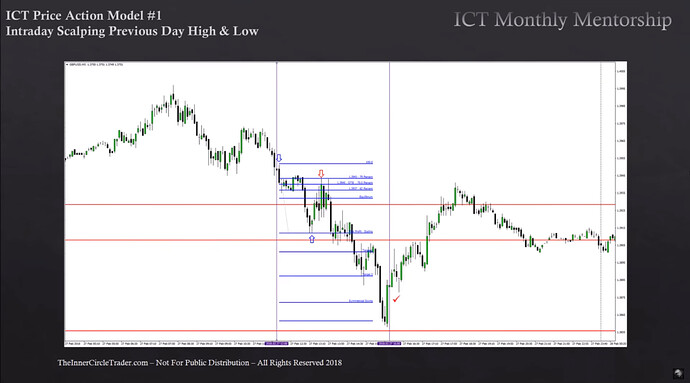

Intraday Scalping Previous Day High And Low - GBPUSD Short Trade Example 3

Intraday Scalping Previous Day High And Low - Grading Price Swings

Amplified Teaching - Dealing Range, Premium And Discount

Amplified Teaching - Refined Dealing Range

Amplified Teaching - Optimal Trade Entry

Trade Plan & Algorithmic Theory - Trade Stages

Trade Plan & Algorithmic Theory - Economic Calendar

Trade Plan & Algorithmic Theory - IPDA Data Range

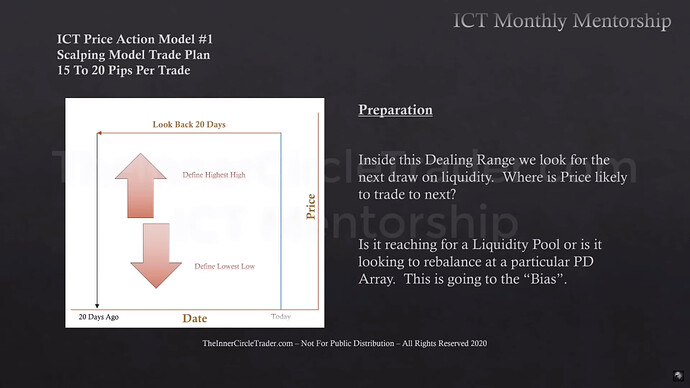

Trade Plan & Algorithmic Theory - Daily Bias

Trade Plan & Algorithmic Theory - Anticipation Of Price Movement

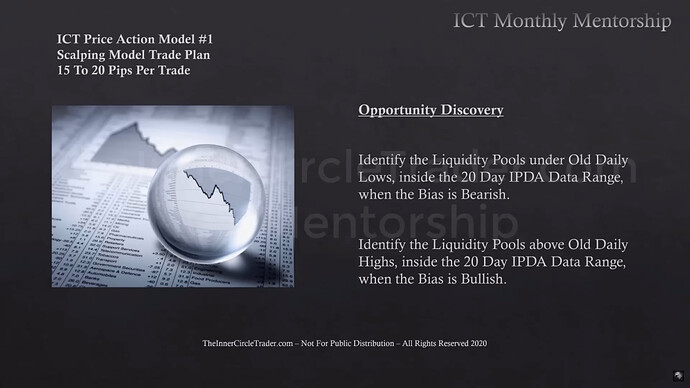

Trade Plan & Algorithmic Theory - Liqudity Pools

Trade Plan & Algorithmic Theory - PD Arrays

Trade Plan & Algorithmic Theory - Manipulation

Trade Plan & Algorithmic Theory - Short Trade Entry

Trade Plan & Algorithmic Theory - Long Trade Entry

Trade Plan & Algorithmic Theory - Short Trade Targets

Trade Plan & Algorithmic Theory - Long Trade Targets

Trade Plan & Algorithmic Theory - Long Trade Execution

Trade Plan & Algorithmic Theory - Short Trade Execution

Trade Plan & Algorithmic Theory - Short Trade Entry Price

Trade Plan & Algorithmic Theory - Short Trade Target Prices

Trade Plan & Algorithmic Theory - Short Trade Stop Loss

Trade Plan & Algorithmic Theory - Long Trade Entry Price

Trade Plan & Algorithmic Theory - Long Trade Target Prices

Trade Plan & Algorithmic Theory - Long Trade Stop Loss

Trade Plan & Algorithmic Theory - Stop Loss Management

Trade Plan & Algorithmic Theory - Position Size Calculation Formula

Trade Plan & Algorithmic Theory - Position Size Calculation Example

Trade Plan & Algorithmic Theory - Position Size Calculation Example 2

Trade Plan & Algorithmic Theory - Position Size Calculation Example 3

Trade Plan & Algorithmic Theory - Risk Reduction When Losing

Trade Plan & Algorithmic Theory - Risk Reduction When Winning

Trade Plan & Algorithmic Theory - Backtesting

Intraday Scalping Previous Day High And Low (PAM1) - Bullish And Bearish Algorithmic Theory

Next lesson: ICT Price Action Model 2 - Short Term Trading