Foundation Presentation & Amplified Lecture

Trade Plan & Algorithmic Theory

- Foundation Presentation & Amplified Lecture

Trade Plan & Algorithmic Theory

Notes

- The Price Action Model 2 (PAM2) focuses on short-term trading using weekly range expansions, key price levels, and institutional order flow concepts to identify high-probability trading setups.

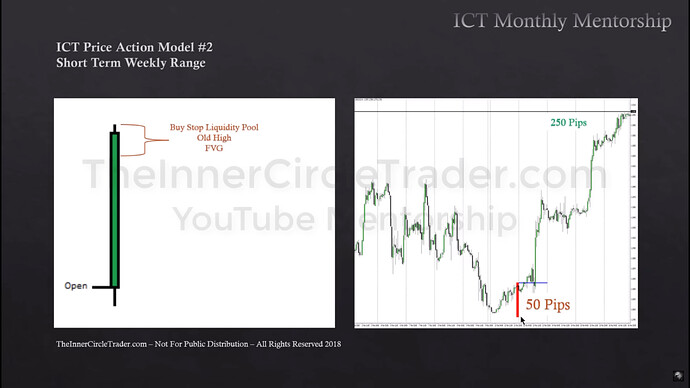

- The goal is to capture 50 to 100 pips per trade.

- Markets ignore the time shift, i.e., the transitions between winter and summer time.

- Institutional levels:

- Big-figure levels - 00 levels, such as 1800, 1.200, 96.00.

- Mid-figure levels - 50 levels, such as 1850, 1.250, 96.50.

- 80-20 levels - For example, 1820, 1880, 1.220, 1280, 96.20, 96.80.

- Small-rounded levels - Levels like 1810, 1830, 1,2230, 96.70, 96.90.

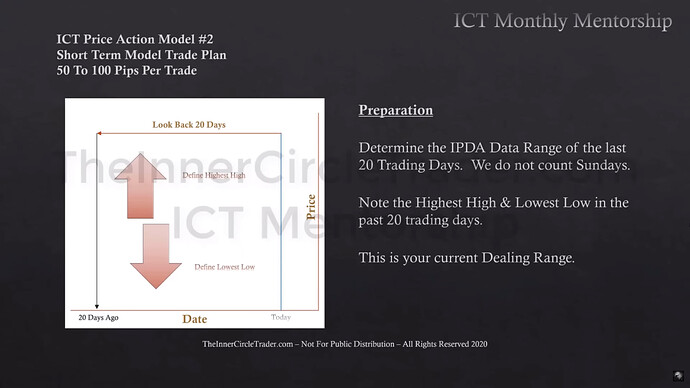

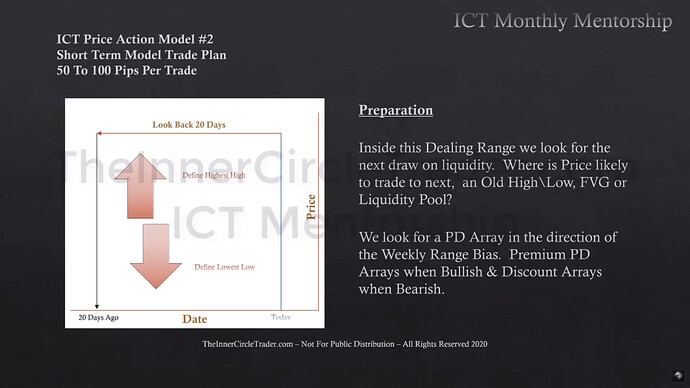

- This model uses IPDA data ranges to find PD arrays.

- If we have no PD arrays to choose from in the last 20 days, we will extend our period to 40 or 60 days.

- This model works with standard deviations derived from the Asian range, CBDR, or Flout.

- We can look for reversal trading opportunities after meeting our weekly objectives.

- We can also use OTE levels as a basis for our trade entry.

- We don’t trade on Mondays.

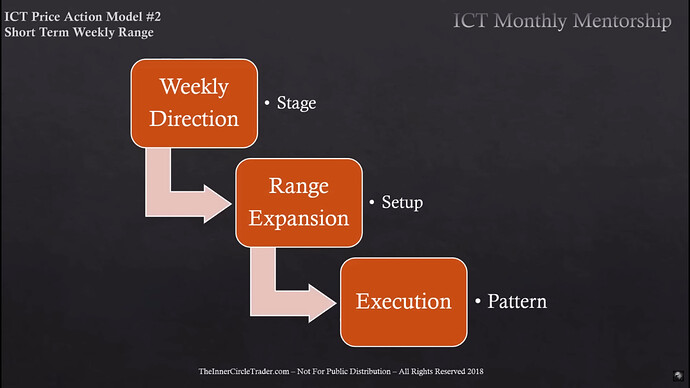

Short-Term Trading - Stage, Setup, and Pattern

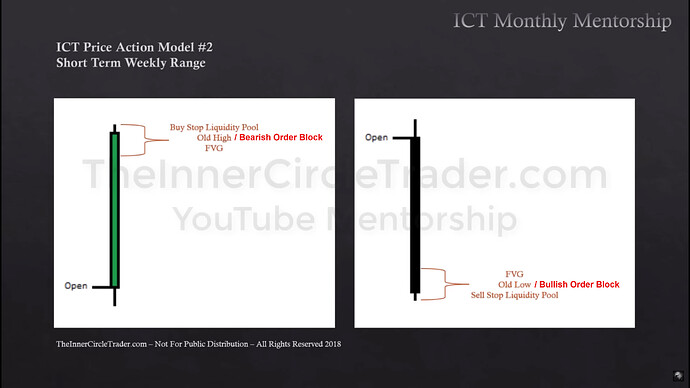

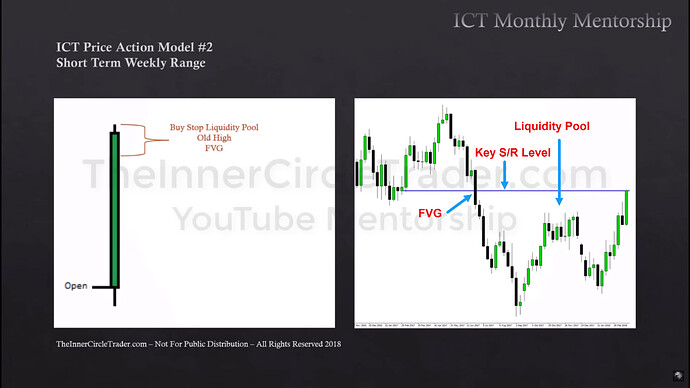

Short-Term Trading - Draw On Liquidity

Short-Term Trading - Draw On Liquidity Example

Short-Term Trading - Potential Long Trade Example

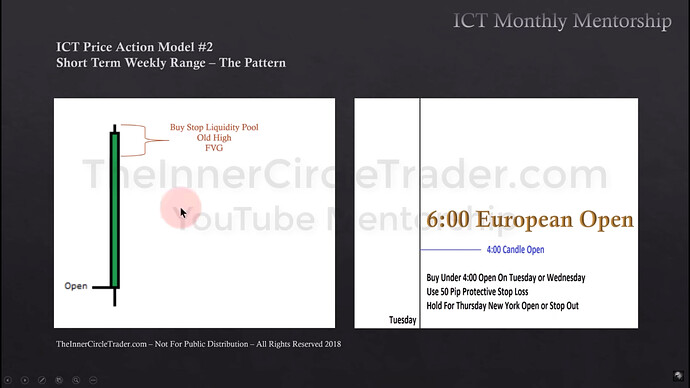

Short-Term Trading - Long Setup

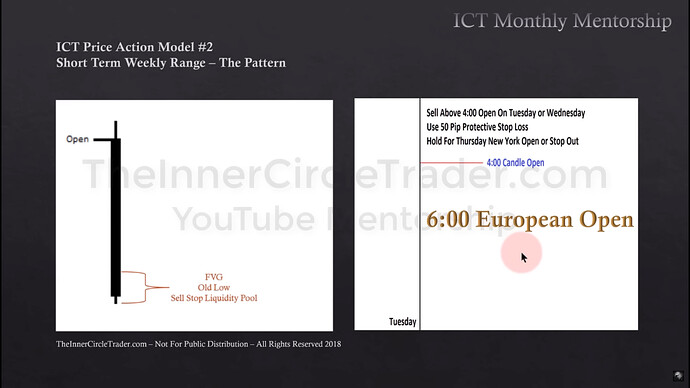

Short-Term Trading - Short Setup

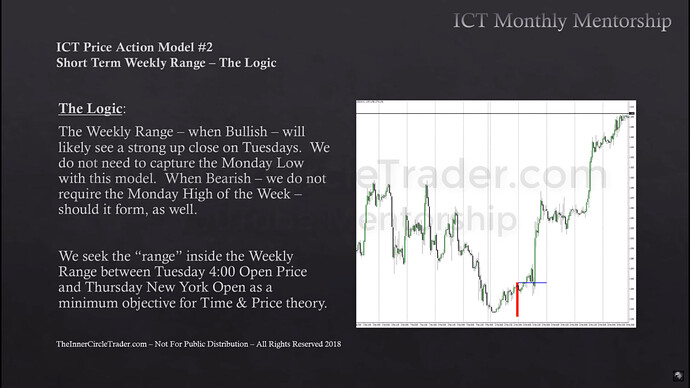

Short-Term Trading - Logic

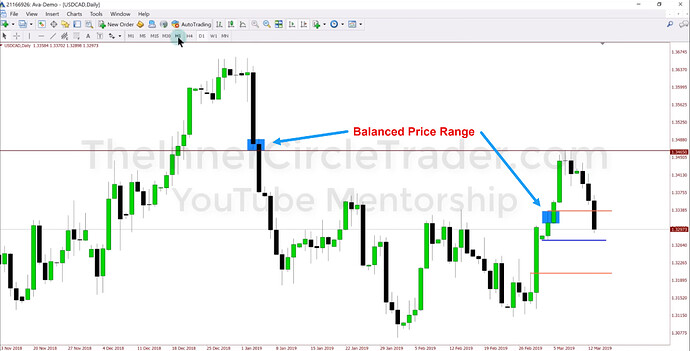

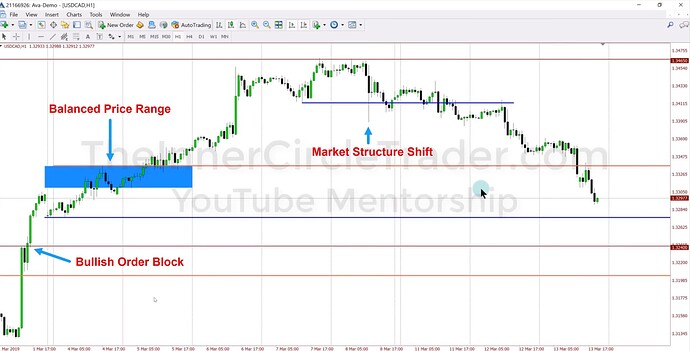

USDCAD Short-Term Trade Example - Balanced Price Range

USDCAD Short-Term Trade Example - Hourly Chart

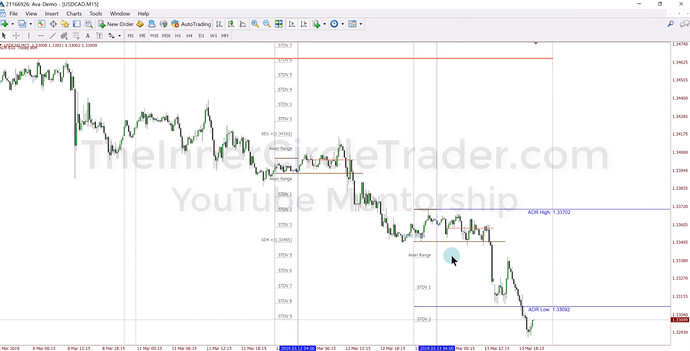

USDCAD Short-Term Trade Example - 15-Minute Chart

USDCAD Short-Term Trade Example - Consequent Encroachment

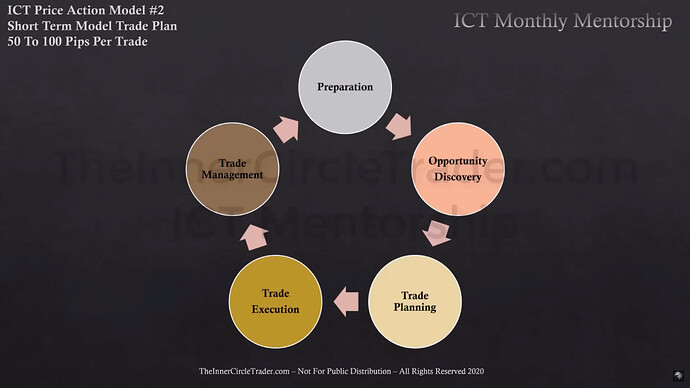

Short-Term Trading - Trade Stages

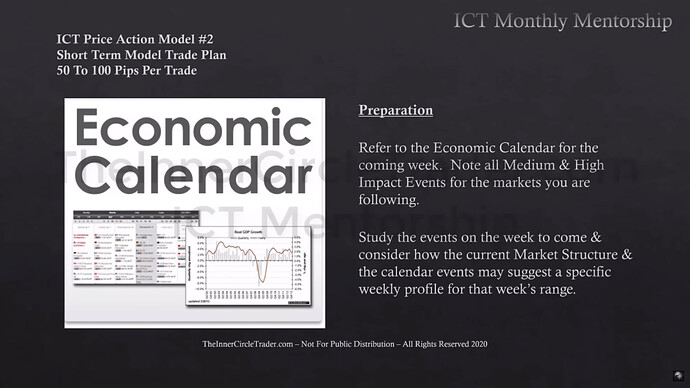

Preparation - Economic Calendar

Preparation - IPDA Data Range

Preparation - PD Arrays

Preparation - Anticipating Price Movement

Opportunity Discovery - Identification Of PD Arrays

Opportunity Discovery - Identification Of PD Arrays On Wednesday

Trade Planning - Manipulation

Trade Planning - Bearish Conditions

Trade Planning - Bullish Conditions

Trade Planning - Short Targets

Trade Planning - Long Targets

Trade Executions - Bullish Setup

Alternative Trade Executions - Bullish Setup

Trade Executions - Bearish Setup

Alternative Trade Executions - Bearish Setup

Short Trade Management - Trade Entry

Short Trade Management - Trade Exits

Short Trade Management - Stop Loss Placement

Long Trade Management - Trade Entry

Long Trade Management - Trade Exits

Long Trade Management - Stop Loss Placement

Stop Loss Management

Money Management - Position Size Calculation Formula

Money Management - Position Size Calculation Example

Money Management - Reducing Risk After Loss

Money Management - Reducing Risk After Winng Streak

Backtesting

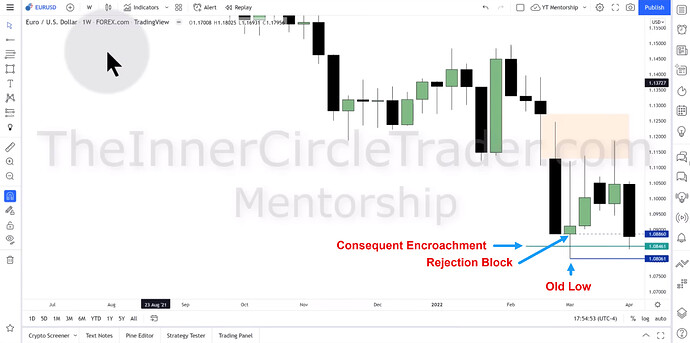

EURUSD Short-Term Short Trade Example - Weekly Chart

EURUSD Short-Term Short Trade Example - Daily Chart

EURUSD Short-Term Short Trade Example - Hourly Chart

EURUSD Short-Term Short Trade Example - 15-Minute Chart

EURUSD Short-Term Short Trade Example - 5-Minute Chart

EURUSD Short-Term Short Trade Example - Trade Entry

EURUSD Short-Term Short Trade Example - Alternative Trade Execution

EURUSD Short-Term Short Trade Example - Trade Result

Next lesson: ICT Price Action Model 3 - Swing Trading

Previous lesson: ICT Price Action Model 1 - Intraday Scalping