Notes

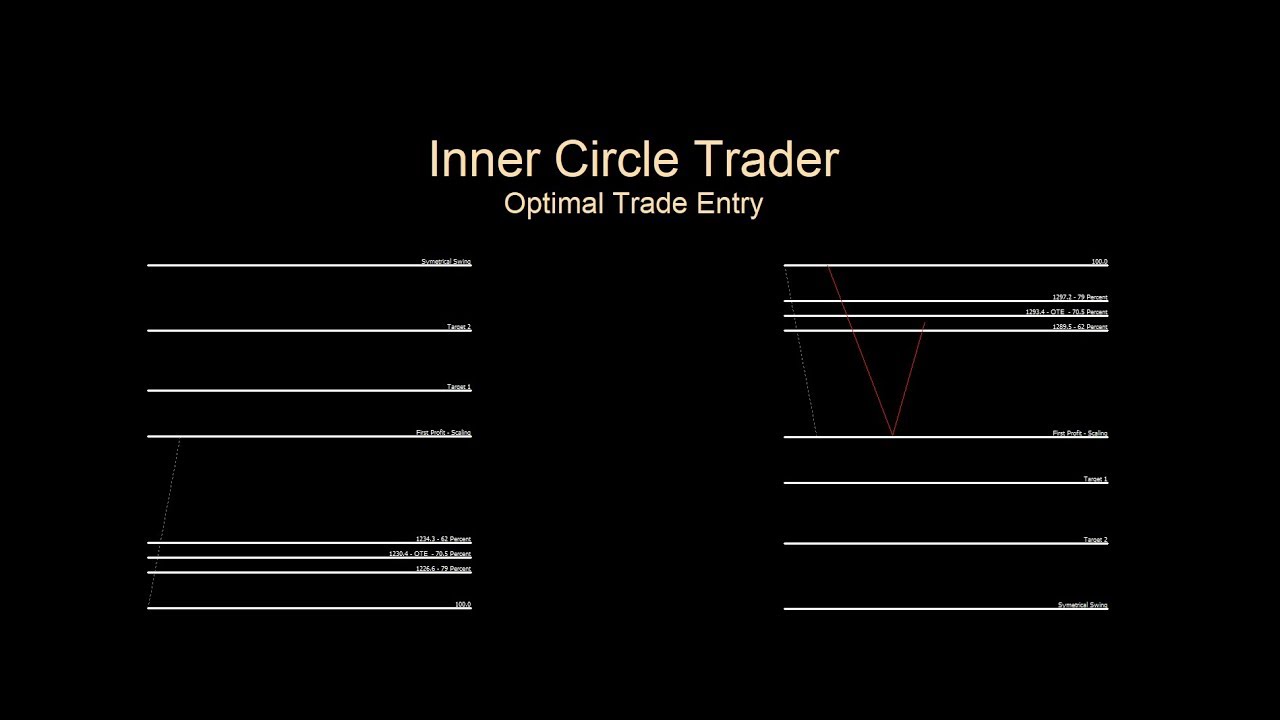

- The Optimal Trade Entry is a price action pattern where a significant impulse leg is followed by a retracement.

- The first partial profit should be taken when the trade reaches a risk-reward ratio of at least 1:2 (2R).

- Institutional levels:

- Big-figure levels - 00 levels, such as 1800, 1.200, 96.00.

- Mid-figure levels - 50 levels, such as 1850, 1.250, 96.50.

- 80-20 levels - For example, 1820, 1880, 1.220, 1280, 96.20, 96.80.

- Small-rounded levels - Levels like 1810, 1830, 1,2230, 96.70, 96.90.

- Optimal Trade Entry Levels:

- 79% retracement (0,79).

- 70,5% retracement (0,705).

- 62% retracement (0,62).

- 127% extension (-0,27) - Target 1.

- 162% extension (-0,67) - Target 2.

- 200% extension (-1,00) - Symmetrical Swing.

Intro To ICT Optimal Trade Entry - Market Maker Buy Model

Intro To ICT Optimal Trade Entry - EURUSD Optimal Trade Entry

Next lesson: ICT Forex - Market Maker Primer Course - Target Selection & Profit Objectives

Previous lesson: ICT Forex - Market Maker Primer Course - The ICT ATM Method