Notes

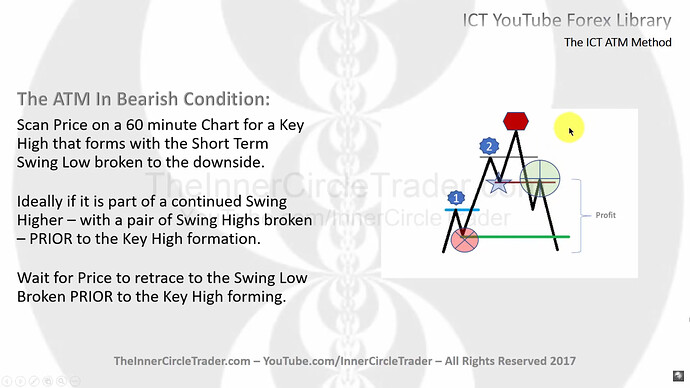

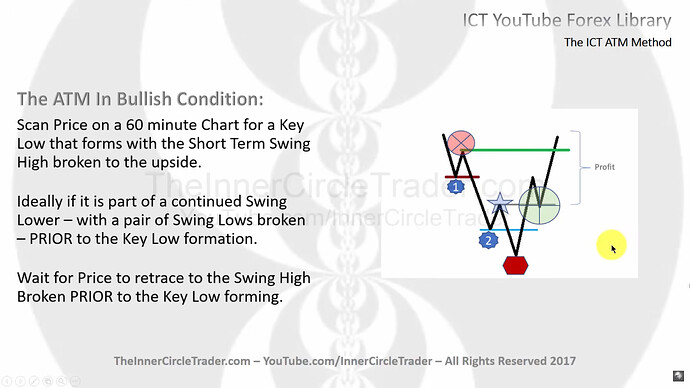

- The ICT ATM (Algorithmic Trading Model) method is based on a specific price action pattern occurring on the hourly chart.

- It capitalizes on stop runs and is relatively easy to spot and trade.

- We look for this pattern on the hourly chart.

- The goal of this model is to simplify the identification of key support and resistance levels.

- It is applicable to any asset class and any market.

- The key high is confirmed by breaking the market structure and retesting old support, which has now become resistance.

- The key low is confirmed by breaking the market structure and retesting old resistance, which has now become support.

The ATM Model In Bearish Condition

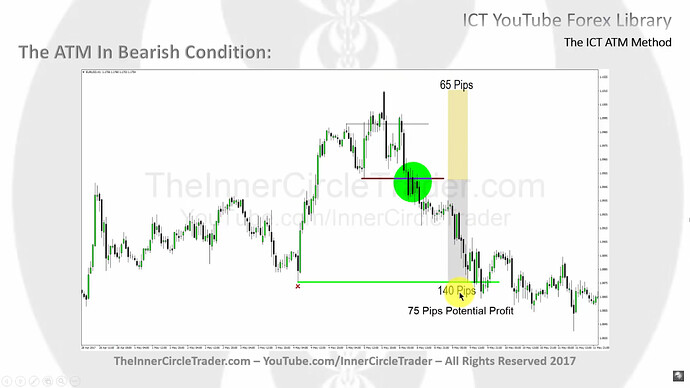

The ATM Model In Bearish Condition - Trade Example On Hourly Chart

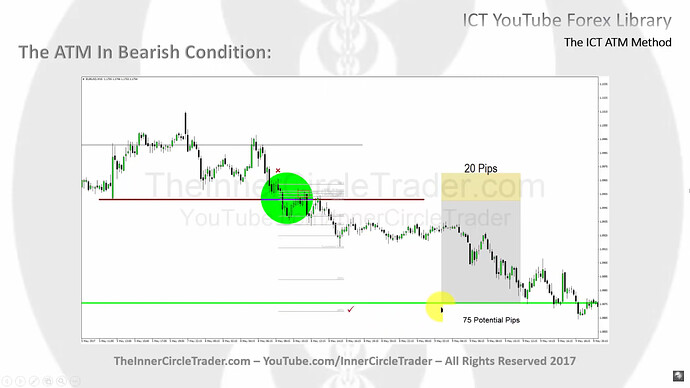

The ATM Model In Bearish Condition - Reduced Risk Eith OTE Integration

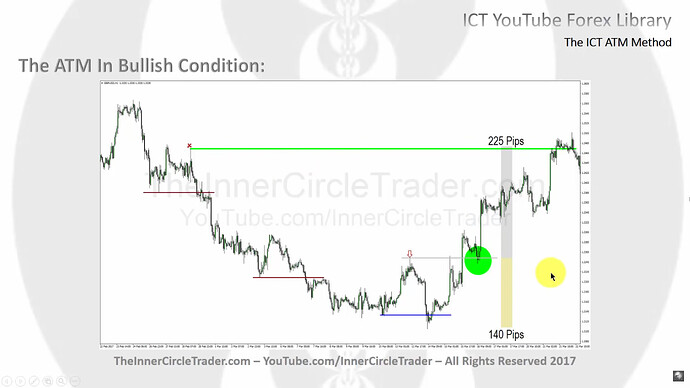

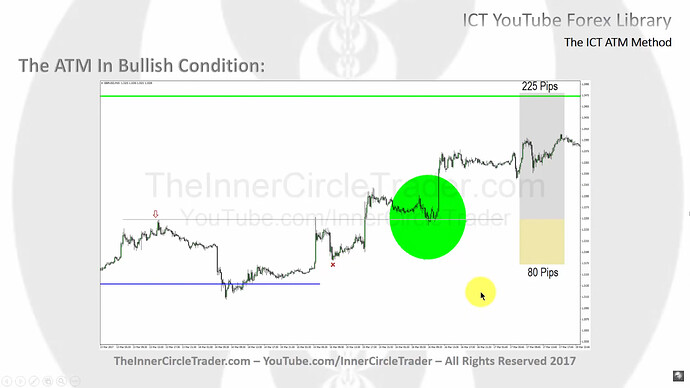

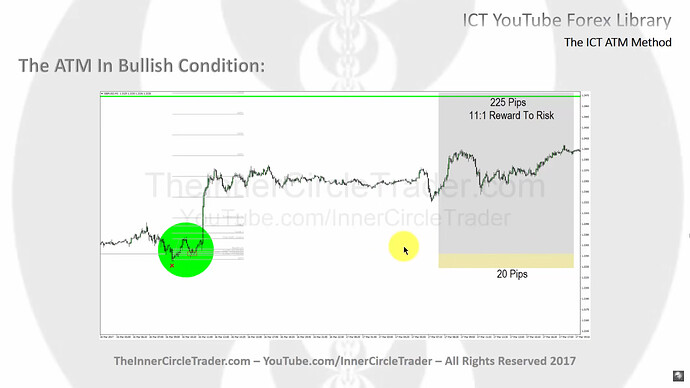

The ATM Model In Bullish Condition

The ATM Model In Bullish Condition - Trade Example On Hourly Chart|

The ATM Model In Bullish Condition - Reduced Risk With Selecting Closer Swing Low

The ATM Model In Bullish Condition - Reduced Risk With OTE Integration

Next lesson: ICT Forex - Market Maker Primer Course - Intro To ICT Optimal Trade Entry

Previous lesson: ICT Forex - Market Maker Primer Course - The ICT Smart Money Technique or SMT