Notes

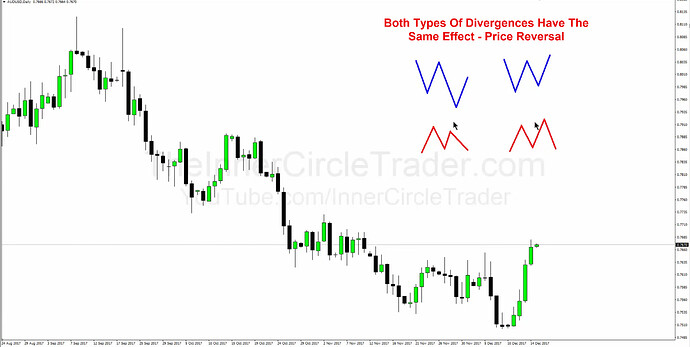

- We monitor divergences (Smart Money Technique) between correlated assets or markets.

- This technique is useful for identifying significant price movements.

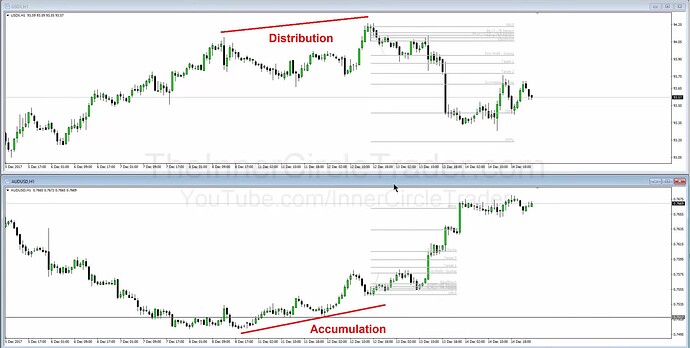

- In a symmetrical market, a lower low in the foreign currency (e.g., Aussie Dollar) should correspond with a higher high in the dollar index.

- If this correlation breaks (e.g., the dollar index fails to make a higher high while the Aussie Dollar makes a lower low), it indicates underlying distribution in the dollar index and accumulation in the foreign currency.

- Examples of bullish divergences (SMTs):

- The dollar index fails to make a higher high while the Aussie Dollar makes a lower low.

- The dollar index makes a higher high, but the Aussie Dollar fails to make a lower low.

- Examples of bearish divergences (SMTs):

- The dollar index fails to make a lower low while the Aussie Dollar makes a higher high.

- The dollar index makes a lower low, but the Aussie Dollar fails to make a higher high.

- Two basic approaches to SMT trading:

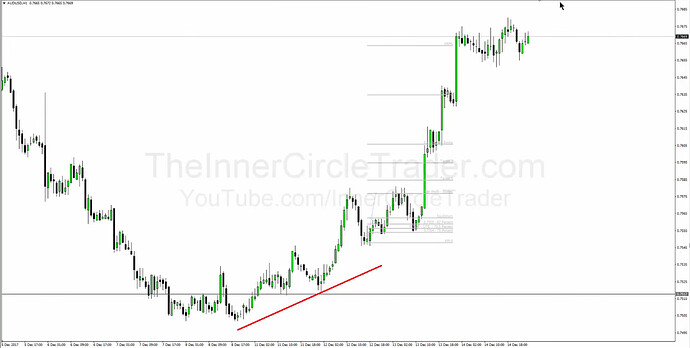

- We look for divergence after the market has removed a significant liquidity pool.

- Michael also refers to the SMT as the institutional market structure.

- Smart Money Technique is also known as Smart Money Tool.

ICT Smart Money Technique

AUDUSD SMT Example - Weekly Chart

AUDUSD SMT Example - Daily Chart

AUDUSD SMT Example - Liquidity Pool

AUDUSD SMT Example - Accumulation And Distribution

AUDUSD SMT Example - Optimal Trade Entry Opportunity

GBPUSD SMT Example - OTE And Turtle Soup Opportunity

Next lesson: ICT Forex - Market Maker Primer Course - The ICT ATM Method

Previous lesson: ICT Forex - Market Maker Primer Course - Money Management That Works