Notes

- Michael initially used oscillators but learned that price itself can provide all the necessary insights for trading, including identifying divergence.

- Indicators (like RSI or Stochastic) often fail to give accurate trading signals because they cannot distinguish market conditions, such as trending vs. range-bound markets.

- Smart money term refers to the large institutional investors or entities behind significant market movements.

- Smart money cannot hide its footprints. Their buying and selling activities leave visible traces in the price action, which can be used for trading.

- Liquidity from commercial traders (central banks) provides a counterparty for large fund traders.

- Understanding the relationship between central banks and large funds is essential because it shows that trading strategies based on institutional behavior will continue to work, even if new traders learn about them.

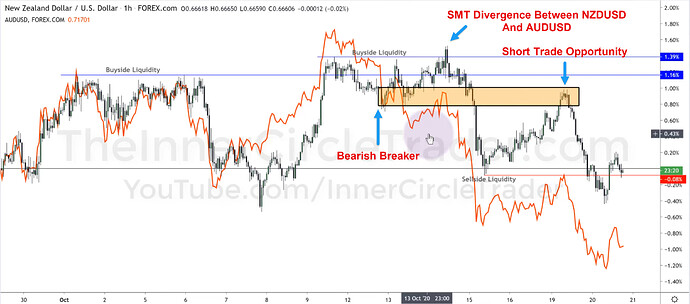

- SMT divergence occurs when two closely correlated markets show divergence in their price movements.

- The SMT divergence is an indicator of potential price reversal and liquidity accumulation or distribution. It works best in range-bound markets.

- We should look for SMT divergences, especially around relative equal highs (resistance) or relative equal lows (support).

- The SMT technique is scalable and can be applied to various time frames and asset classes.

NZDUSD - SMT Divergence And Bearish Breaker

Next lesson: ICT Forex Price Action Lesson - Friday Asian Range Concept

Previous lesson: ICT Forex Price Action Lesson - Blending Price Patterns With Time & Price Theory [Part 2]