Notes

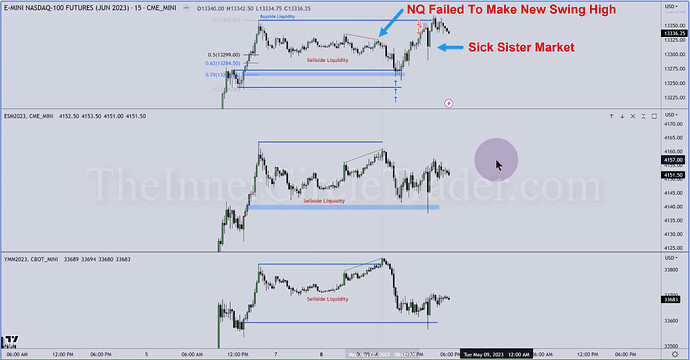

- Like SMT, we use the Sick Sister concept in trending markets during consolidation phases.

- When we lack significant economic news, consolidation in the market is expected.

- Consolidating markets does not eliminate trade opportunities but requires a nimble, market-symmetry-oriented approach.

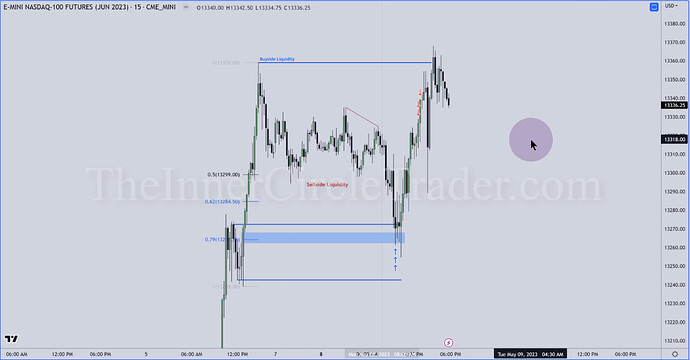

- If we are bullish, we are waiting for a situation where one of the correlated markets shows weakness (fails to form a new swing high while the other markets form a new high) and then falls into a deep discount, creating a buying opportunity. We speculate that the weakest market will later create a new swing high.

- If we are bearish, we are waiting for a situation where one of the correlated markets shows strength (fails to form a new swing low while the other markets form a new low) and then rises into a deep premium, creating a selling opportunity. We speculate that the strongest market will later create a new swing low.

- Optimal Trade Entry (OTE) levels can be used to find deep discount or premium areas.

- Whenever you have converging New Week Opening Gaps or are really close to one another, the market’s going to be likely to consolidate and go sideways.

ICT Sick Sister - YM

ICT Sick Sister - ES

ICT Sick Sister - NQ

ICT Sick Sister - Intermarket Analysis

Next lesson: 2023 ICT Mentorship - ICT Silver Bullet Time Based Trading Model

Previous lesson: 2023 ICT Mentorship - NDOG - New Day Opening Gap [Part 1]