Notes

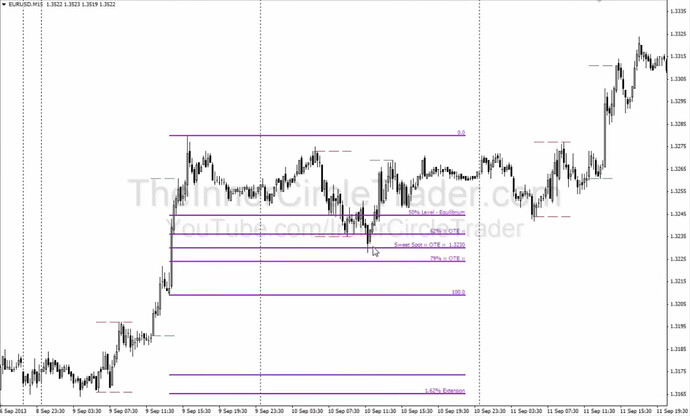

- In this lecture, Michael shows many examples of how to use his Optimal Trade Entry levels to enter a position.

- Smart Money (institutional traders) buy during downward moves and sell during upward moves.

- Determining daily bias by exponential moving averages:

- Bullish bias - If the 9-period EMA is above the 18-period EMA.

- Bearish bias - If the 9-period EMA is below the 18-period EMA.

- When a swing high is broken to the upside, it signals upward (bullish) momentum, while when a swing low is broken to the downside, it signals downward (bearish) momentum.

- Long opportunities should be looked for when our daily bias is bullish and the price has shifted upwards.

- Short opportunities should be looked for when our daily bias is bearish and the price has shifted downwards.

- Correct interpretation of the market structure is critical to understanding where the market will likely go.

- Order Blocks represent areas where institutional traders accumulate their positions.

- We use the Fibonacci tool to find areas where OTE levels overlap with Order Blocks or significant supports and resistances. We then use the identified locations to enter long and short positions.

- Success in trading comes from being methodical, patient, and waiting for the right opportunities.

- We always look for trade entries inside the Kill Zones.

Exponential Moving Averages

Optimal Trade Entry

Institutional Order Block

Optimal Trade Entry Buy Setup Example

Next lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 5

Previous lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 3