Notes

- In this lecture, Michael shows many examples of how to use order blocks together with Fibonacci retracements (OTE levels) and extensions to trade various forex pairs.

- Institutional levels:

- Big-figure levels - 00 levels, such as 1800, 1.200, 96.00.

- Mid-figure levels - 50 levels, such as 1850, 1.250, 96.50.

- 80-20 levels - For example, 1820, 1880, 1.220, 1280, 96.20, 96.80.

- Small-rounded levels - Levels like 1810, 1830, 1,2230, 96.70, 96.90.

- We look for setups on the 5-minute, 15-minute, and hourly charts.

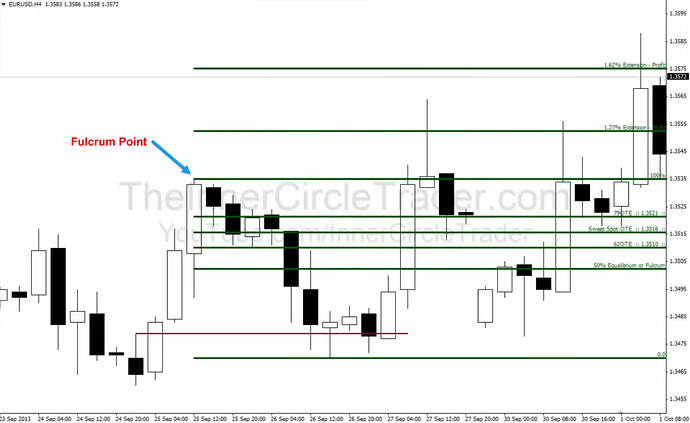

- Fibonacci extensions of 127% and 162% are the recommended profit-taking levels.

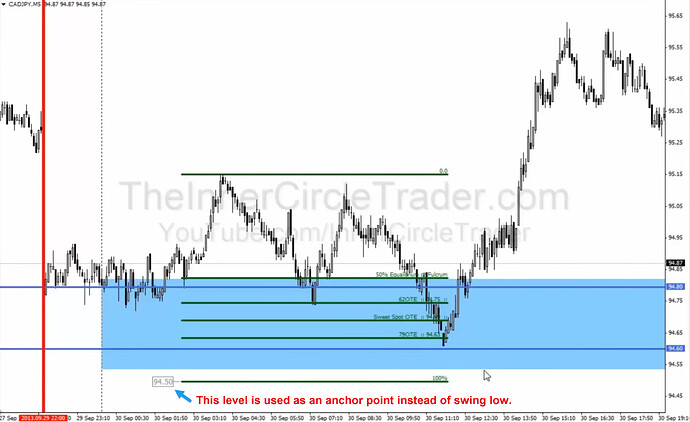

Mid-Figure Level As Anchor Point

Order Block And Optimal Trade Entry

Unfullfilled Range And Fullfilled Range

Fulcrum Point And Fibonacci Extensions

Next lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 6

Previous lesson: ICT Forex - Scout Sniper Basic Field Guide - Volume 4