Notes

- Before studying this series, the student should first watch the video ICT Forex - Market Maker Primer Course - Intro To ICT Optimal Trade Entry.

- It is always crucial to be aware of the previous day’s highs and lows.

- We also need to identify institutional levels, around the previous day’s highs and lows. Institutions use these levels to place orders.

- Institutional levels:

- Big-figure levels - 00 levels, such as 1800, 1.200, 96.00.

- Mid-figure levels - 50 levels, such as 1850, 1.250, 96.50.

- 80-20 levels - For example, 1820, 1880, 1.220, 1280, 96.20, 96.80.

- Small-rounded levels - Levels like 1810, 1830, 1,2230, 96.70, 96.90.

- Trading OTE levels is not simply trading Fibonacci levels. The key is the time we use these levels.

- This series does not teach the general use of OTE levels. It aims to teach a specific OTE model.

- Following this model, we look for entry opportunities during the New York session, specifically between 8:30 a.m. and 11:00 a.m.

- We look for movement above or below the previous day’s high (or the previous days’ highs) or below the previous day’s low (or the previous days’ lows).

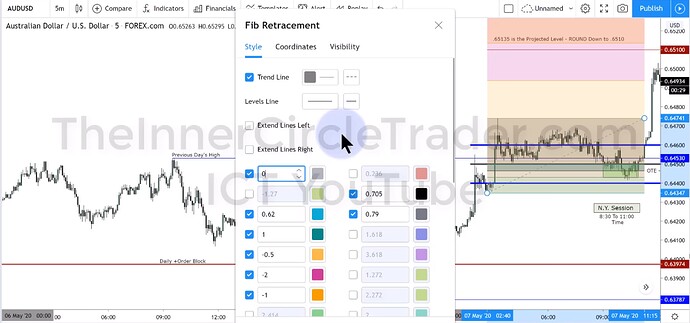

- Optimal Trade Entry levels:

- 62%

- 70,5% - Midpoint

- 79%

- Michael likes to use the 62% level for his trade entries.

- Stop loss should be placed based on the logical institutional level.

- The distance from the entry to the first target must be at least 15 pips.

- Fibonacci extensions can be used as targets.

- Michael looks for trade exits around institutional levels.

- This model does not require a daily bias determination.

- After hitting the first target, we move the stop loss to 50% (0,5) of the original range.

[Bullish Order Block On AUDUSD Daily Chart

AUDUSD OTE Trade Example

Fibonacci Tool - OTE Settings

Next lesson: ICT OTE Pattern Recognition Series - Volume 2