Notes

- This series builds on the Optimal Trade Entry Model tutorial where Michael shows how to easily use the OTE pattern.

- Broker demo platforms are trial versions offered by brokers to test strategies.

- Forex brokers often provide demo accounts that may not expire, but even if they do, new ones can be started.

- The demo account should not be treated like monopoly money. Instead, it should be used soberly to build good habits and avoid overtrading.

- Third-party apps like Forex Tester are recommended for backtesting strategies.

- TradingView offers comprehensive tools similar to MetaStock, SuperCharts, and TradeStation.

- Michael recommends focusing on open, high, low, and close prices, stripping charts of unnecessary indicators like stochastic and MACD.

- The 62% retracement level is a sweet spot for entries.

- It is important to be comfortable with non-perfect entries and exits.

- Michael uses a specifically defined New York session (8:30 - 11:00 a.m.) for optimal trade entries.

- Backtesting and keeping detailed records of trades is crucial to becoming a successful trader.

- We should record data such as entry points, drawdowns, time to target, or overall performance.

- Important insights for journaling:

- Avoid negative self-talk.

- Focus on the positive.

- Use only constructive criticism.

- Losing trades are used for study purposes, just like profitable trades.

- Michael stresses that a trader should stay consistent with the trading plan and not deviate based on short-term outcomes.

Where Do You Backtest Daily Setups

To It And Through It ICT Concept

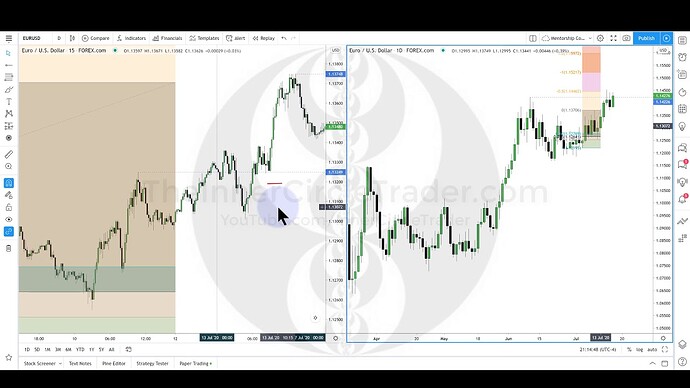

EURUSD OTE Model Trade Example #1

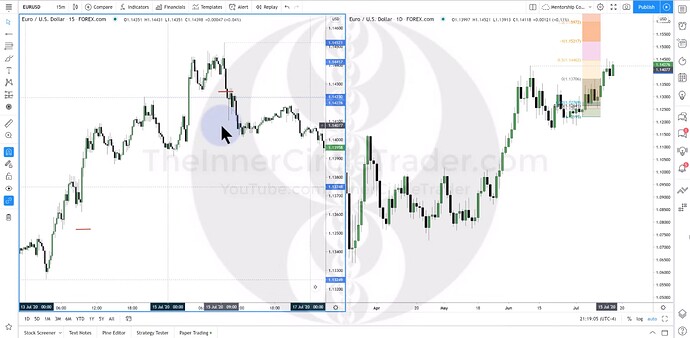

EURUSD OTE Model Trade Example #2

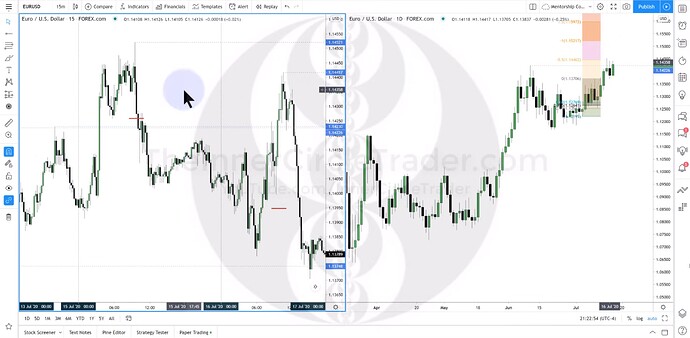

EURUSD OTE Model Trade Example #3

Next lesson: ICT - If I Could Go Back & Tell Myself What I Know Now - Volume 4

Previous Lesson: ICT - If I Could Go Back & Tell Myself What I Know Now - Volume 2