Notes

- Prerequisites for the transition from demo to live trading:

- Minimum of six months of consistent performance.

- Keeping risk below 3% maximum.

- Ability to handle strings of losses unemotionally.

- The best source for studying seasonal tendencies is Moore Research Center, Inc.

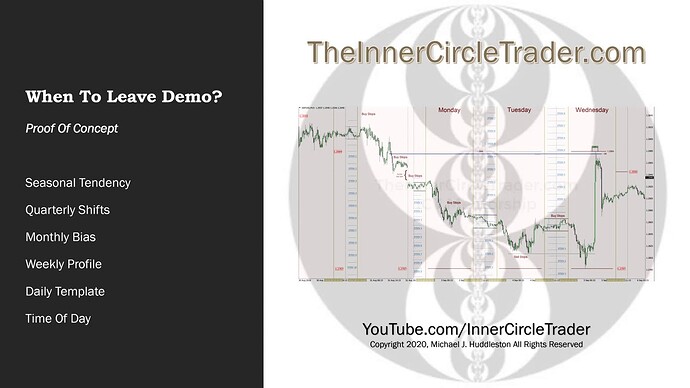

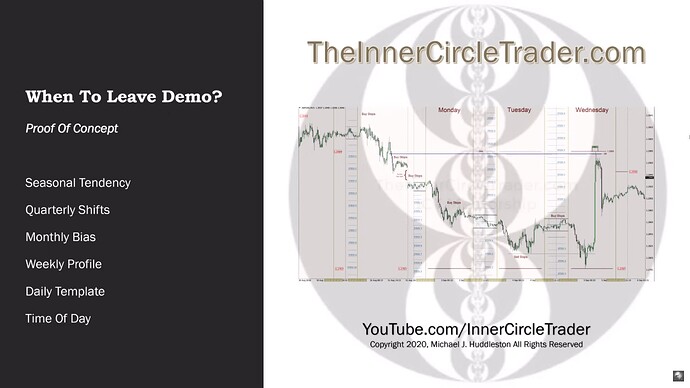

- Look for significant market movements every 3-4 months (Quarterly shifts).

- Align daily activities with the expected monthly and weekly market direction.

- Our focus should be on the open, high, low, and close of the daily bar (Power Off Three ICT Concept.

- Specifics of the sessions:

- London Open: Often sets the high or low of the day.

- New York Session: Continuation or reversal based on higher time frame levels.

- London Close: Often marks the opposite end of the daily range.

- Taking the time to understand the power of compound returns properly is essential.

- Recommendations for loss management:

- Avoid overtrading and forcing trades.

- Scale down positions after losses to manage equity drawdown.

- Be patient and avoid rushing to recover losses.

- We can do very well even if our trades offer a risk-to-reward ratio of 1:1 or 1:2.

- Velocity (turning over equity) can be more effective than aiming for large risk-to-reward ratio trades.

- Taking partial profits reduces risk and secures some gains. It also helps manage the psychological stress of holding trades.

- Advice from those who are not consistently profitable is better ignored.

- A trader should trust only his own proven methods and results.

- Michael recommends not measuring our success with other traders or authors. Instead, we should focus on our own success and development.

- Realizing that it can take years to fully develop and become a consistently profitable trader is vital.

- Consistency and patience are key to long-term success in trading.

- Sticking to a proven method despite a temporary losing streak is what separates successful traders from perpetual losing ones.

When Am I Ready For Live Funds

Proof Of Concept

Minimum Six Months Of Consistency

Manage To Keep Risk Below 3% Maximum

Weather Series Of Consecutive Losses

Previous Lesson: ICT - If I Could Go Back & Tell Myself What I Know Now - Volume 3