Notes

- In this lesson, Michael continues to develop the concept of blending IPDA data ranges with PD Arrays.

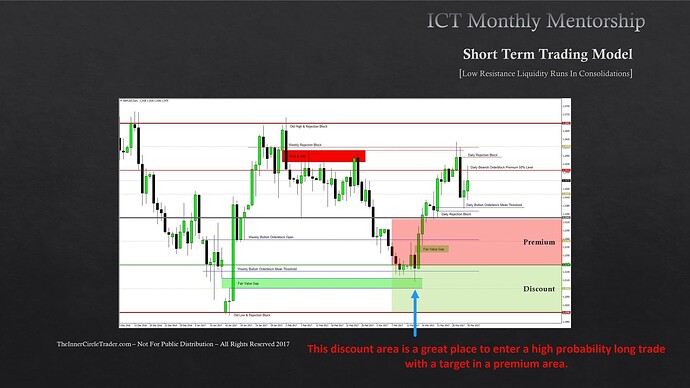

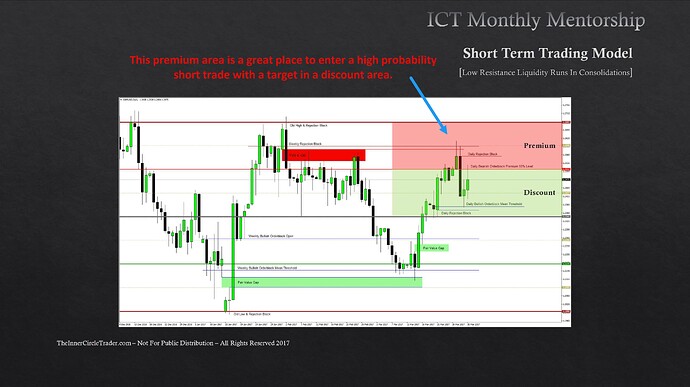

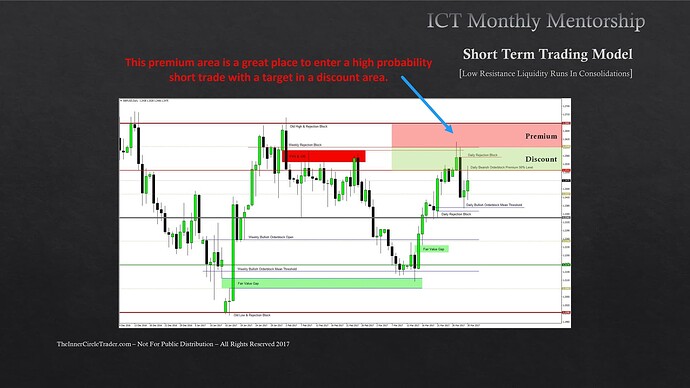

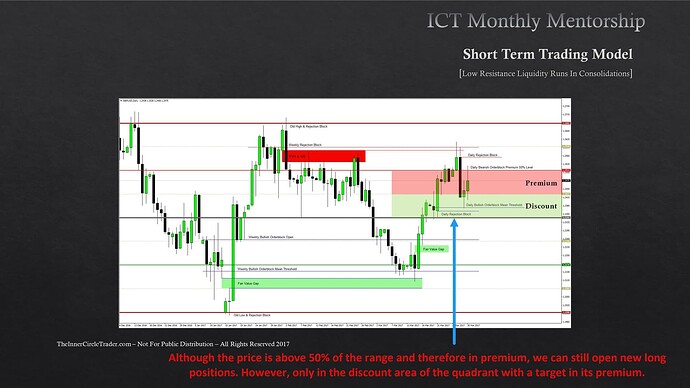

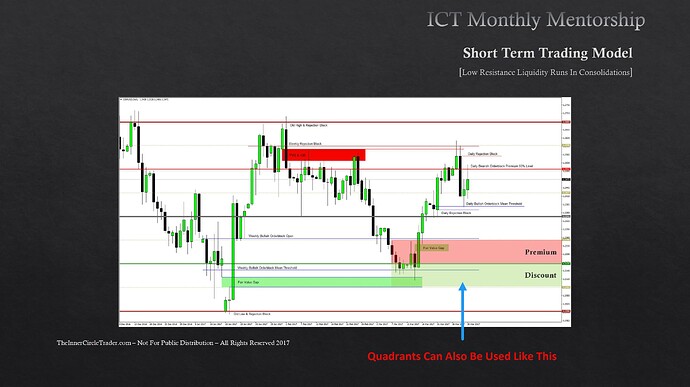

- We look for short trade opportunities in the premium area and long trade opportunities in the discount area.

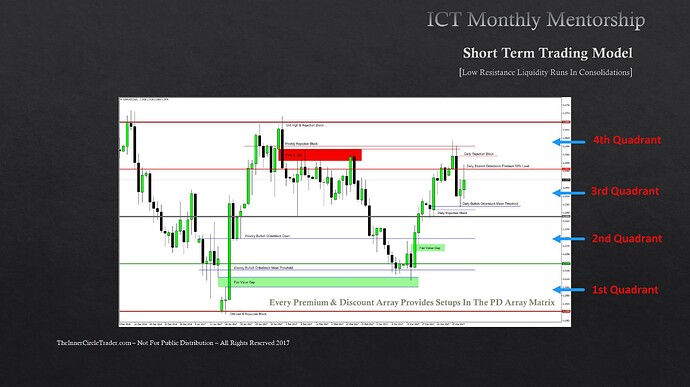

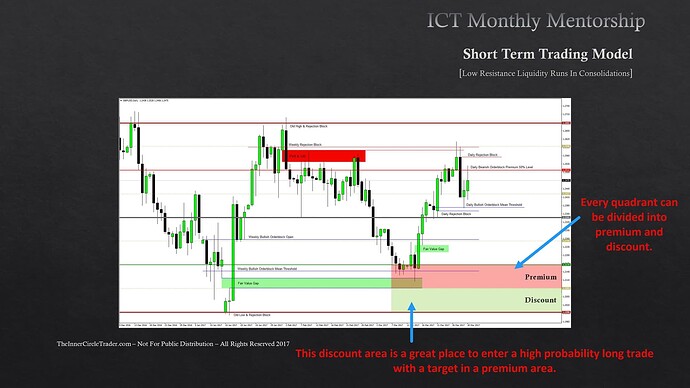

- Using the Fibonacci tool, we can divide our trading range into quadrants.

- Michael claims that dividing the trading range in this way is consistent with how the algorithm views discount and premium areas.

- Analyzing the market through 20, 40, and 60 lookback periods provides a framework for determining PD arrays for entering and exiting positions.

- One Shot One Kill trade can last one day or a whole week.

- When we analyze PD arrays, we look for ones that have not yet been used because the algorithm remembers where it has already traded.

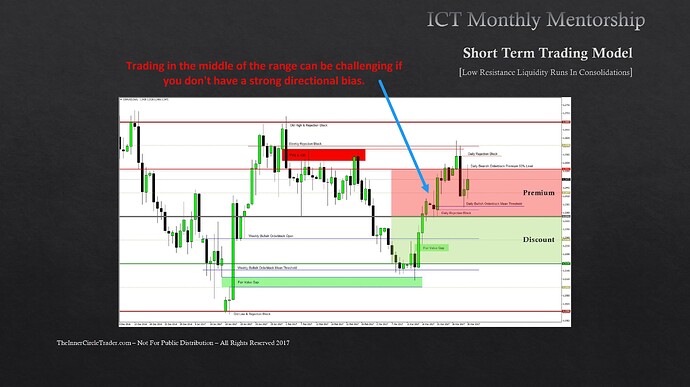

- Trading in the middle of the range can be challenging if you don’t have a strong directional bias.

- The following applies to the consolidation profile:

- The higher the price is in the premium area, the better and easier the short trade will be.

- The lower the price is in the discount area, the better and easier the long trade will be.

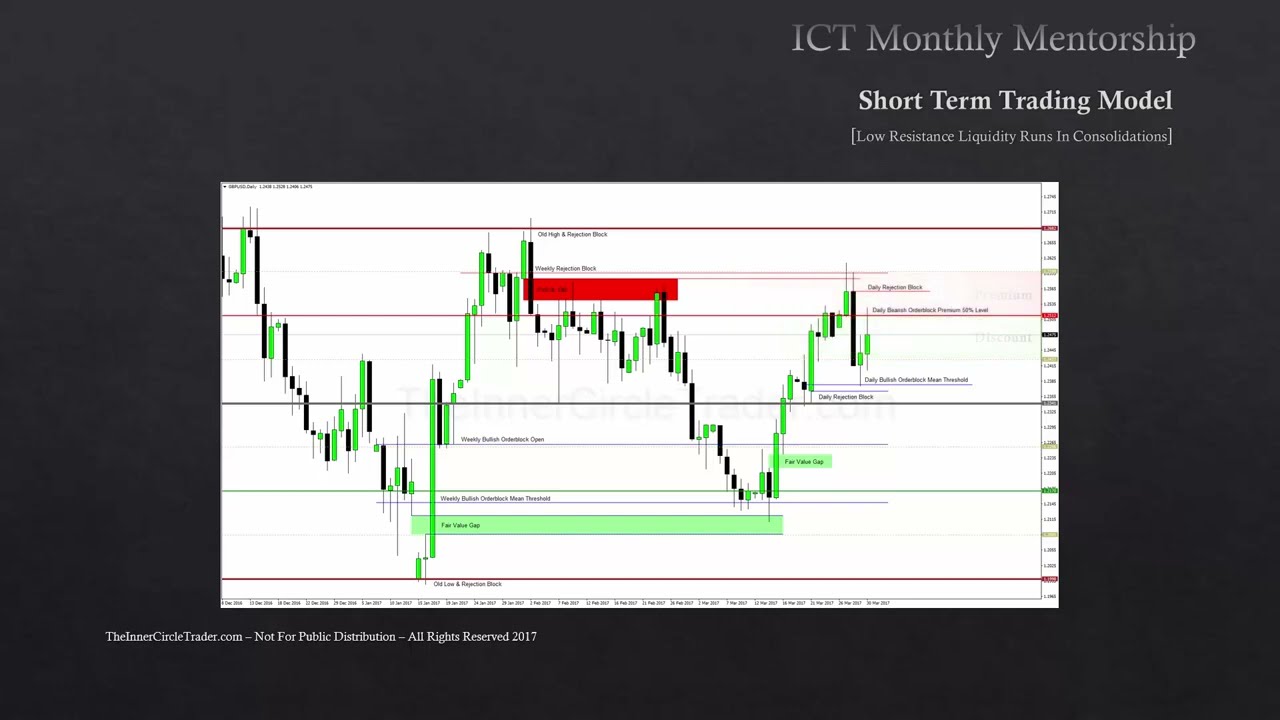

Short-Term Trading Low Resistance Liquidity Runs - PD Array Matrix And IPDA Data Ranges

Short-Term Trading Low Resistance Liquidity Runs - 60-Day Range To Determine Premium And Discount

Short-Term Trading Low Resistance Liquidity Runs - Quadrants And PD Arrays

Short-Term Trading Low Resistance Liquidity Runs - Discount In Discount Area

Short-Term Trading Low Resistance Liquidity Runs - Premium In Premium Area

Short-Term Trading Low Resistance Liquidity Runs - Middle Of The Range

Short-Term Trading Low Resistance Liquidity Runs - 1st Quadrant

Short-Term Trading Low Resistance Liquidity Runs - 4th Quadrant

Short-Term Trading Low Resistance Liquidity Runs - 3rd Quadrant

[Short-Term Trading Low Resistance Liquidity Runs - Half Quadrants

Next lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Low Resistance Liquidity Runs [Part 2]

Previous lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Blending IPDA Data Ranges & PD Arrays