Foundation Presentation

Trading Plan & Algorithmic Theory

Notes

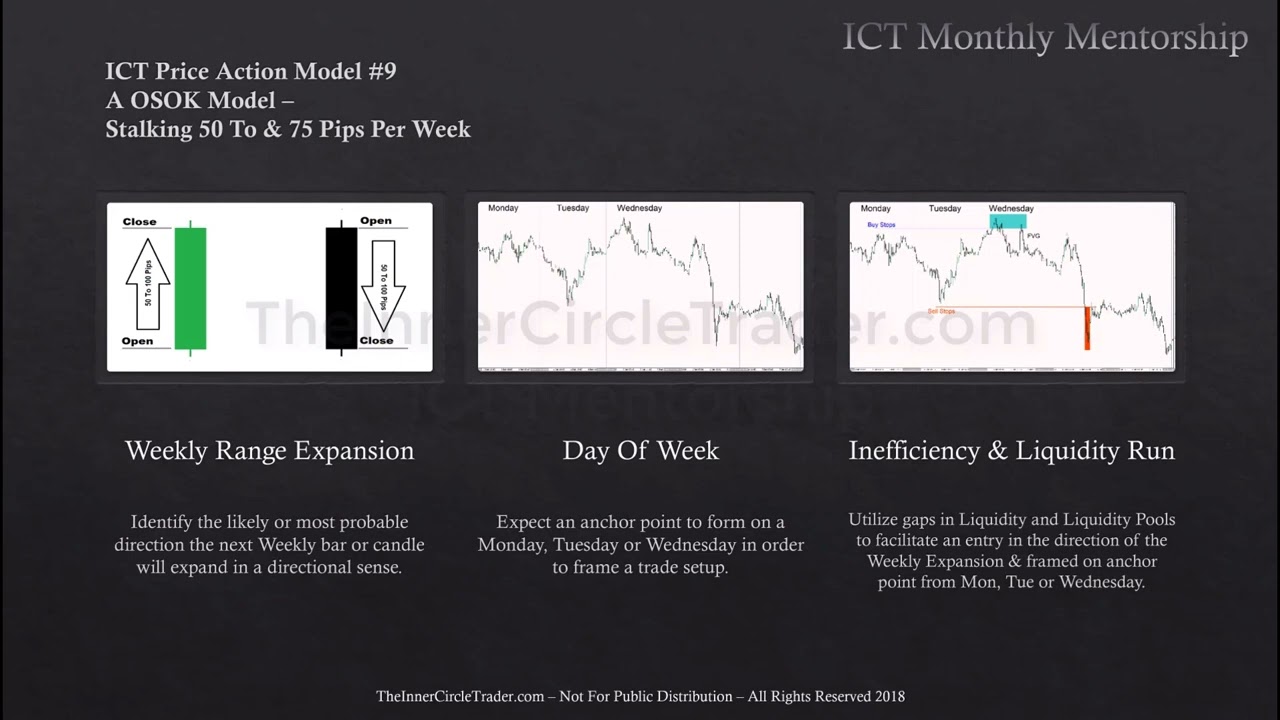

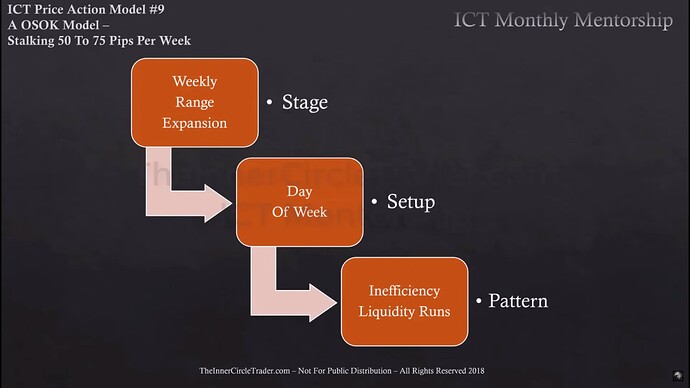

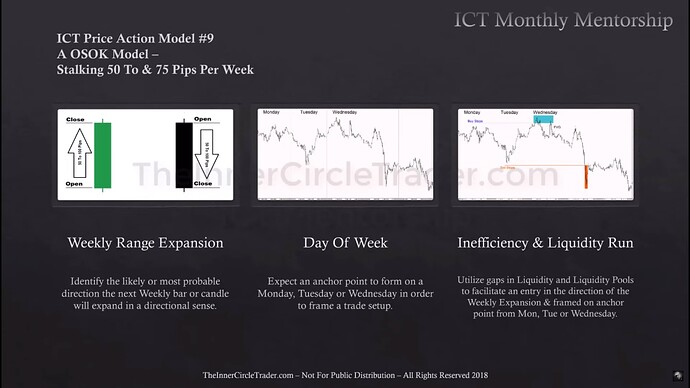

- The One Shot One Kill model (OSOK) is based on weekly range expansion, which helps build a directional bias by analyzing institutional order flow on a weekly chart.

- A deep understanding of the concepts taught in the ICT Mentorship Core Content lessons is a prerequisite for understanding each Price Action Model.

- Internal Range Liquidity (IRL):

- External Range Liquidity (ERL):

- Equal Highs and Lows (Double Bottoms and Tops)

- Old Highs and Lows

- Internal range liquidity often serves as an entry point, while external range liquidity is the target for exits. Conversely, external range liquidity can be used for entries with internal range liquidity as the target.

- Michael stresses the importance of being flexible and using multiple trading models. Traders should adapt based on what the market offers, even if their primary model doesn’t present an ideal entry.

- All the ICT Price Action Models are interconnected. Mastery comes from understanding how these models complement each other, allowing traders to adapt and succeed in various market conditions.

- Michael emphasizes the importance of having a thorough understanding of market concepts before attempting advanced trading strategies. Relying on basic, simplified explanations without comprehensive background knowledge is discouraged. Effective trading requires an in-depth grasp of market mechanics and experience, which cannot be condensed into short lessons.

- True understanding comes from engaging with various market conditions and learning from a range of scenarios over time.

OSOK Foundation Presentation - Procedure

OSOK Foundation Presentation - Procedure

OSOK Foundation Presentation - USDCHF Weekly Chart Example

OSOK Foundation Presentation - Inefficiency

OSOK Foundation Presentation - USDCHF Daily Chart Example

OSOK Foundation Presentation - USDCHF 4-Hour Chart Example

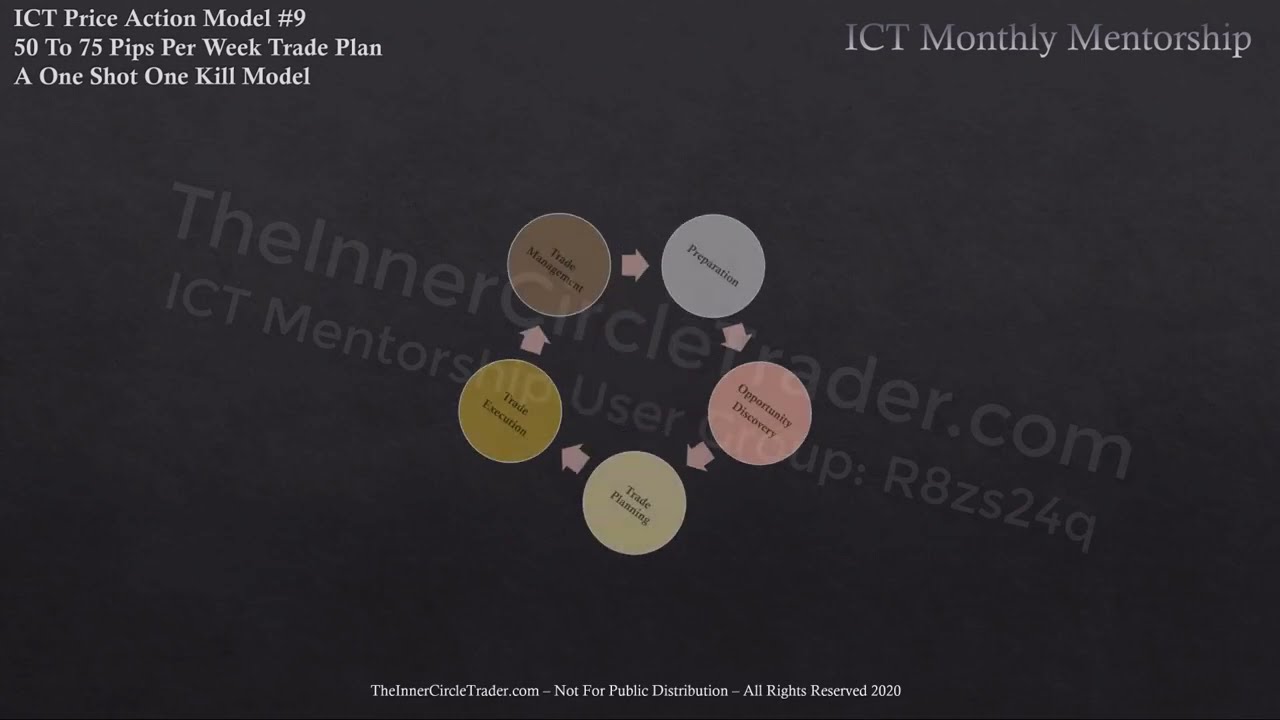

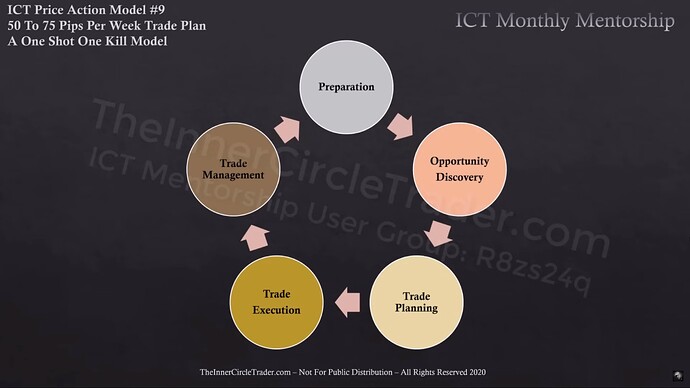

OSOK Trading Plan & Algorithmic Theory - Process

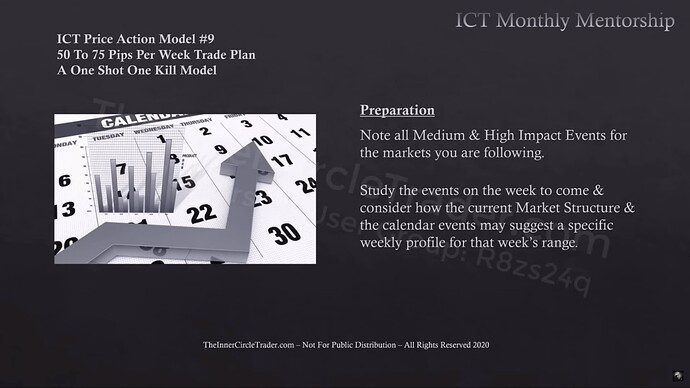

OSOK Preparation - Medium- And High-Impact News

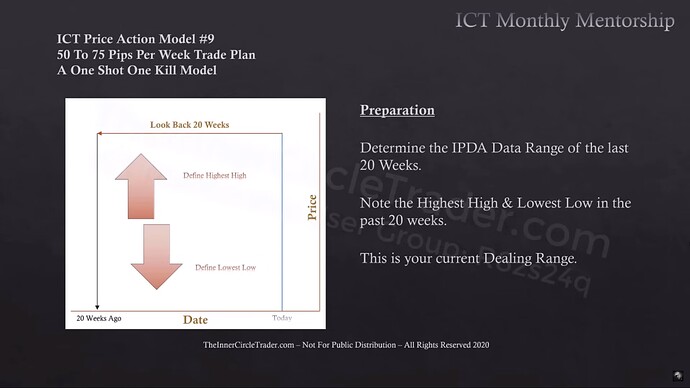

OSOK Preparation - 20-Week Look Back Period

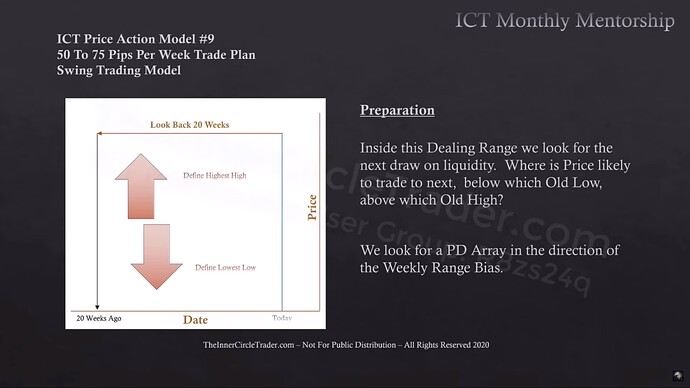

OSOK Preparation - PD Arrays Inside 20-Week Look Back Period

OSOK Preparation - Volatility Injection

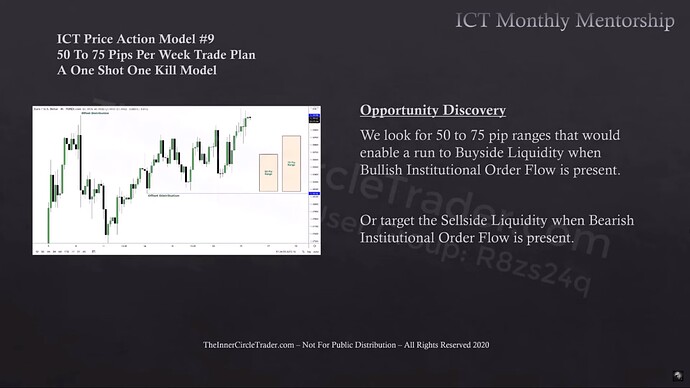

OSOK Opportunity Discovery

OSOK Trade Planning

OSOK Trade Planning - Bearish Conditions

OSOK Trade Planing - Bullish Conditions

OSOK Trade Executions - Bearish Conditions

OSOK Trade Executions - Bullish Conditions

OSOK Long Trade Management - Limit Order

OSOK Long Trade Management - Market Order

OSOK Short Trade Management - Limit Order

OSOK Short Trade Management - Market Order

OSOK Stop Loss Management

OSOK Money Management - Position Size Calculation Formula

OSOK Money Management - Micro Lots Example

OSOK Money Management - Standard Lots Example

OSOK Money Management - Recommendations After Loss

OSOK Money Management - Recommendations After Winning Streak

OSOK Real-Time Example

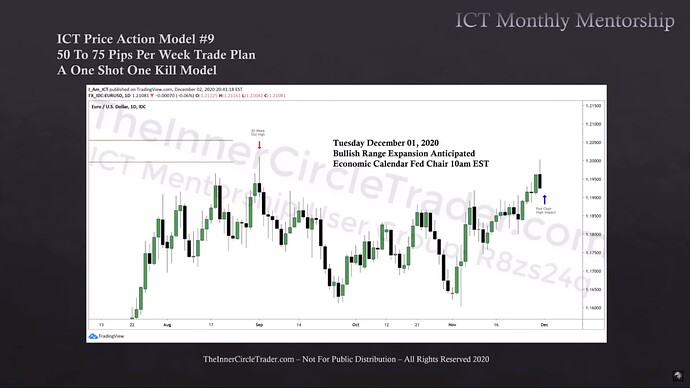

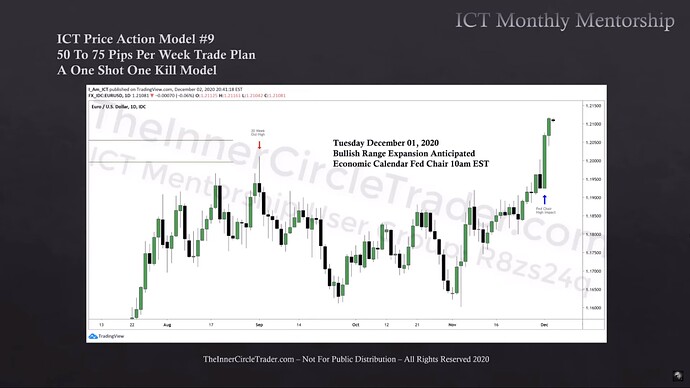

OSOK Real-Time Example - 20-Week Old High

OSOK Real-Time Example - Bullish Range Expansion Anticipated

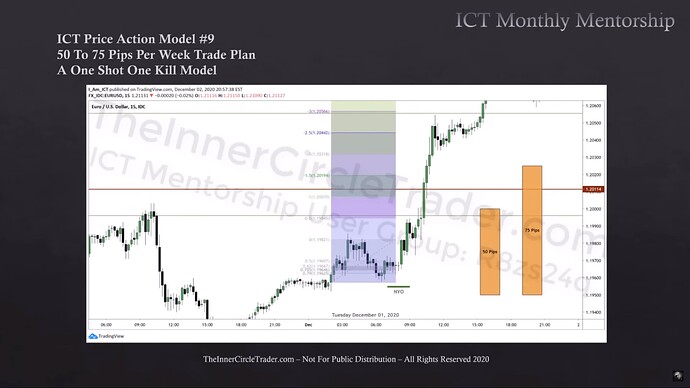

OSOK Real-Time Example - Optimal Trade Entry And Projections

OSOK Real-Time Example - Bullish Range Expansion

OSOK GBPUSD Trade Example - 15-Minute Chart

OSOK GBPUSD Trade Example - Hourly Chart

OSOK GBPUSD Trade Example - US Dollar Index SMT

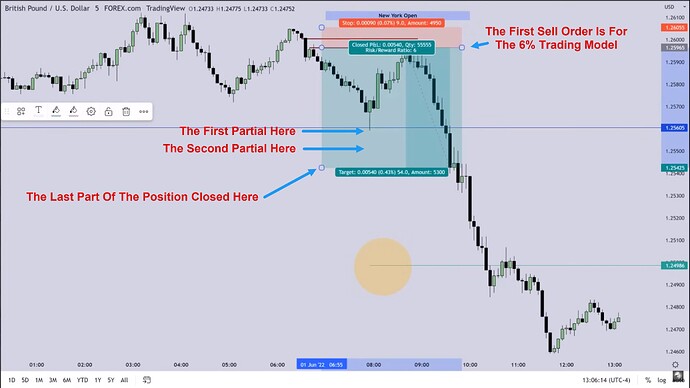

OSOK GBPUSD Trade Example - Combination With 6% Trading Model

OSOK GBPUSD Trade Example - Trading Range And Equilibrium

OSOK GBPUSD Trade Example - Trade Entries And Exits

Next lesson: ICT Price Action Model 10 - Swing Trading Model

Previous lesson: ICT Price Action Model 8 - The 6 % Trading Model