Notes

- If we want our trades to be precise and offer high rewards with low risk, we will have to blend short-term and day trading. It is not necessary for trading the One Shot One Kill price action model, but it is generally recommended.

- We want to enter the position when the market is quiet because we expect price expansion and the creation of larger ranges.

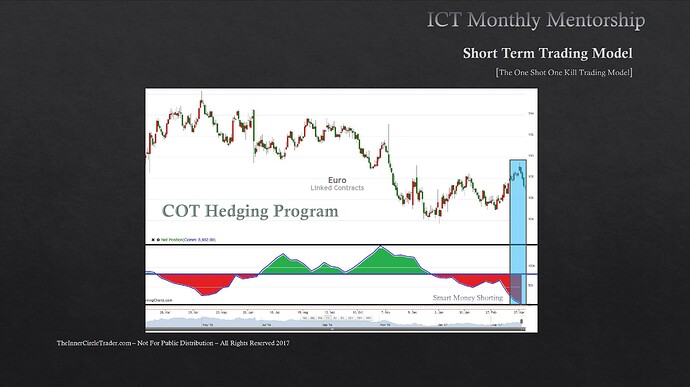

- If we expect the euro to be weak, this should be seen in both the EURUSD and EURGBP pairs.

- Michael deliberately creates gaps in the content of each lesson so that the student must complete the whole mentorship.

- After completing the mentorship, it is recommended to watch all the videos again so that the student can digest all the newly acquired knowledge.

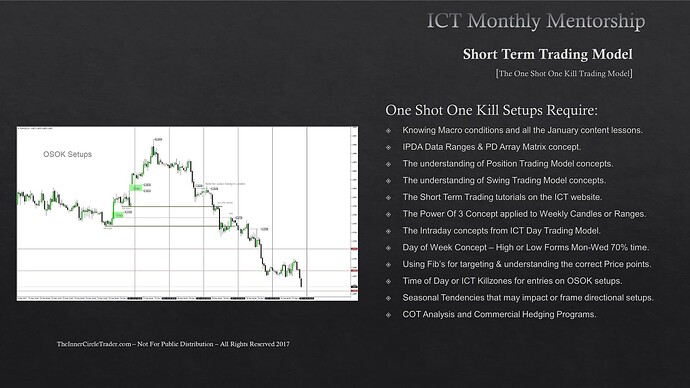

One Shot One Kill Setup Requirements

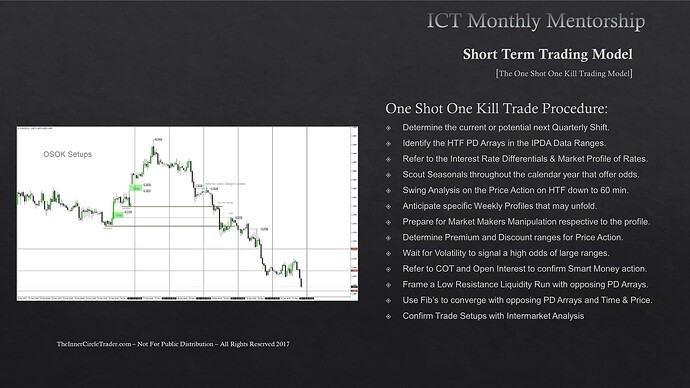

One Shot One Kill Trade Procedure

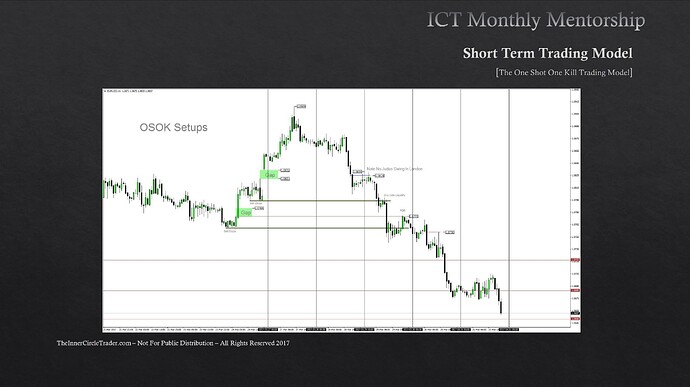

EURUSD OSOK Example - Setups

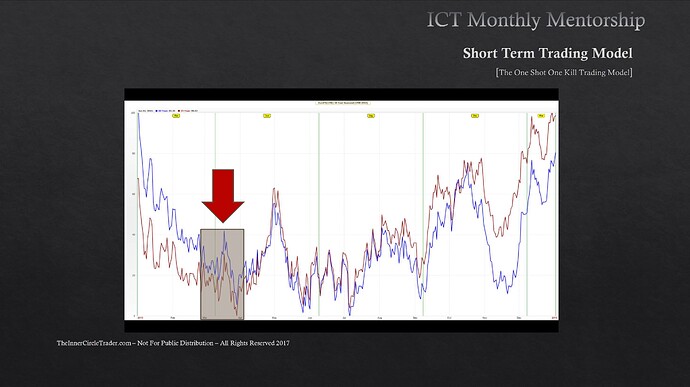

EURUSD OSOK Example - Seasonal Tendencies

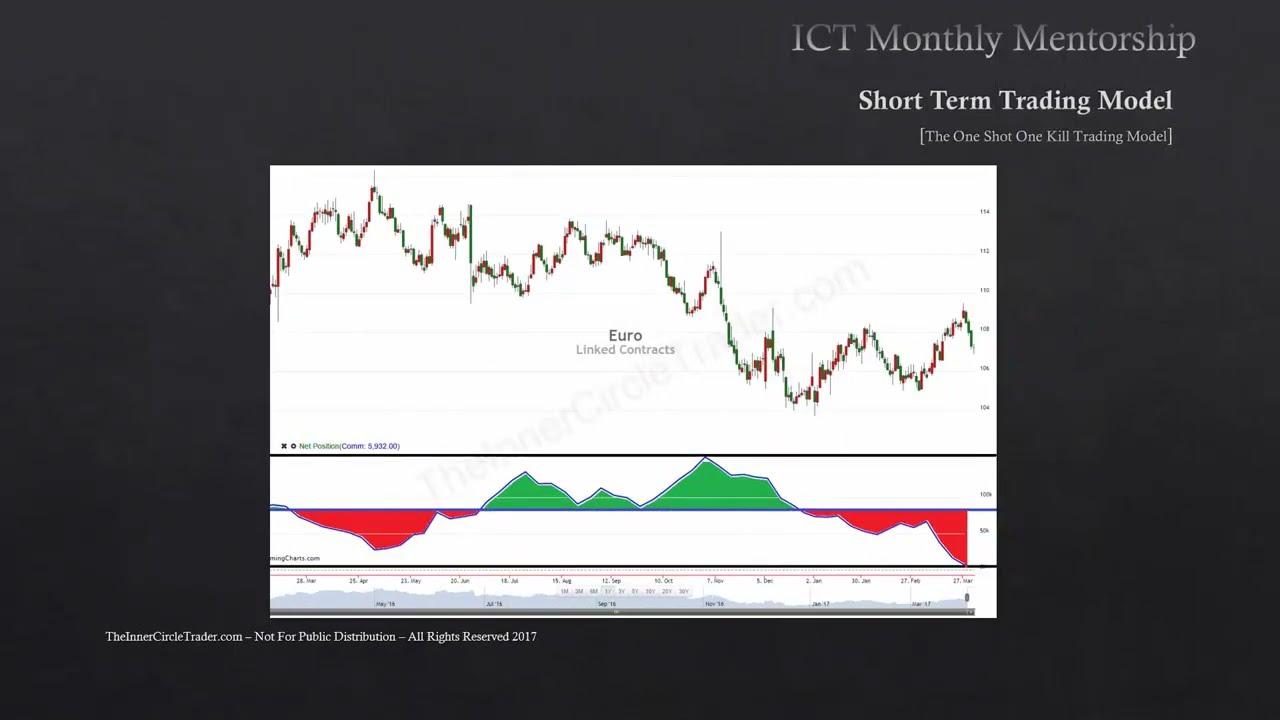

EURUSD OSOK Example - COT Hedging Program

EURUSD OSOK Example - US Dollar Index Weekly Chart

EURUSD OSOK Example - US Dollar Index Daily Chart

EURUSD OSOK Example - US Dollar Index Four-Hour Chart

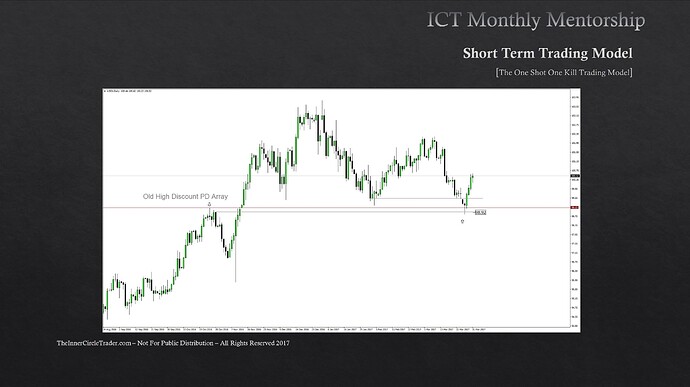

EURUSD OSOK Example - US Dollar Index Premium And Discount Zones

EURUSD OSOK Example - EURGBP Four-Hour Chart

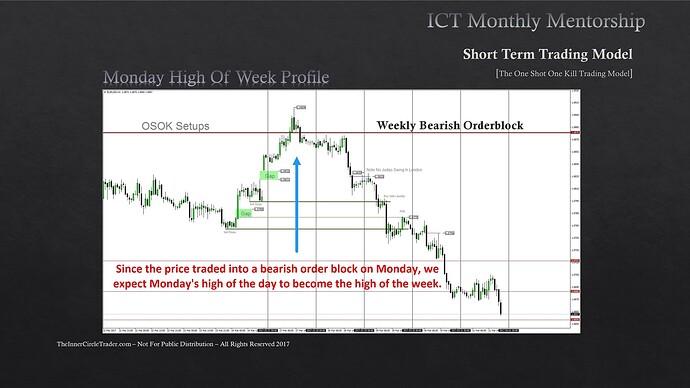

EURUSD OSOK Example - Weekly Bearish Order Block Becomes High Of The Week

EURUSD OSOK Example - 15-Minute Chart

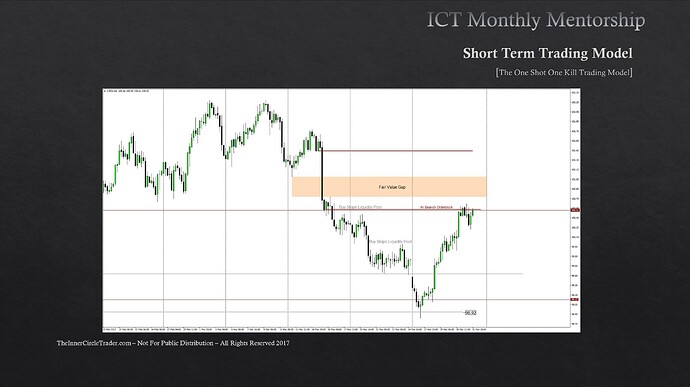

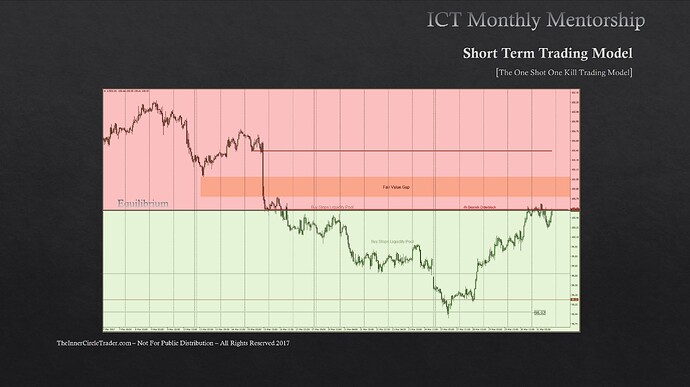

EURUSD OSOK Example - Premium And Discount

Next lesson: ICT Mentorship Core Content - Month 8 - Essentials To ICT Daytrading

Previous lesson: ICT Mentorship Core Content - Month 7 - Intraweek Market Reversals & Overlapping Models