Notes

- Analyzing the market through the lens of short-term trading makes you a better trader overall, even if you just want to be a day trader or scalper.

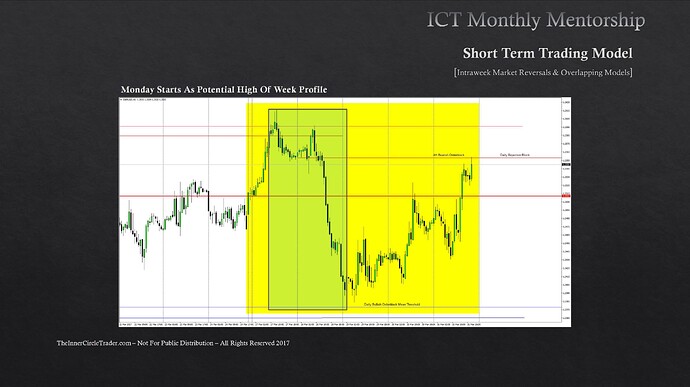

- Every time Monday and Tuesday start trading aggressively in one direction, that’s usually telling you it’s in a hurry to make the weekly range, or it’s going to go to an institutional order flow reference point that could cause it to reverse and go the opposite way.

- When the price is in a hurry to get somewhere, it’s usually repricing on a central bank level. That repricing is a response to a central bank intervention or interest rate announcement. When there’s neither of those, it’s based on speculation.

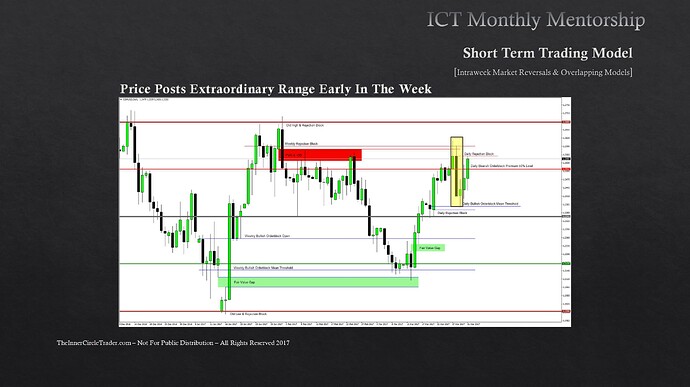

- If we see an unusual, fast, and big move at the beginning of the week, it’s a warning sign that a reversal is likely. We need to check out the higher time frames to see where the price could reverse.

- At the beginning of the week, we always anticipate the high or low of the week to be formed. That’s a general ICT concept for all weekly profiles.

- Every intraweek reversal will be overlapping of two types of price action models. For example OSOK and swing trading model.

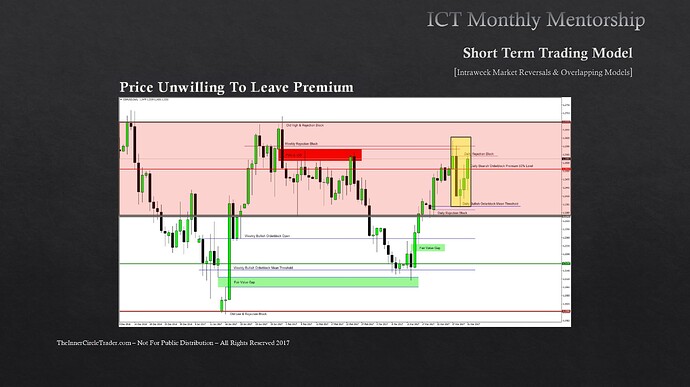

Intraweek Market Reversals & Overlapping Models - Price Unwilling To Leave Premium

Intraweek Market Reversals & Overlapping Models - Price Posts Extraordinary Range Early In The Week

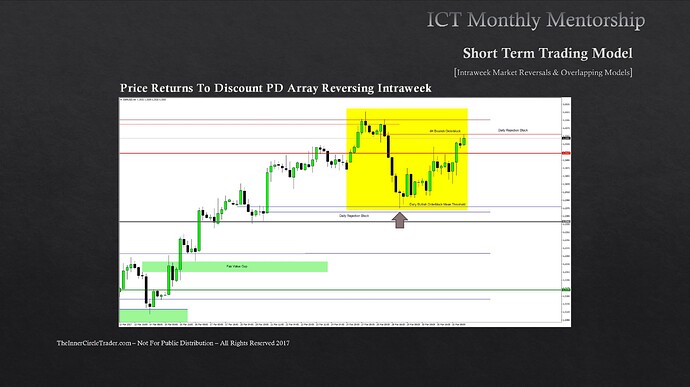

GBPUSD Intraweek Reversal Example - Price Returns To Discount PD Array Reversing Intraweek

GBPUSD Intraweek Reversal Example - Monday Starts As Potential High Of Week Profile

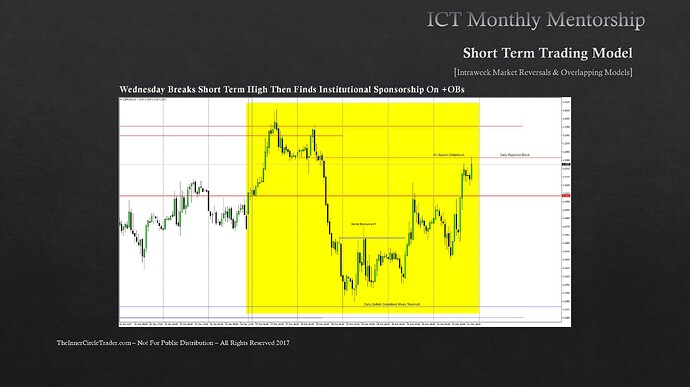

GBPUSD Intraweek Reversal Example - Wednesday Breaks Short-Term High Then Fins Institutional Sponsorship On Bullish Order Block

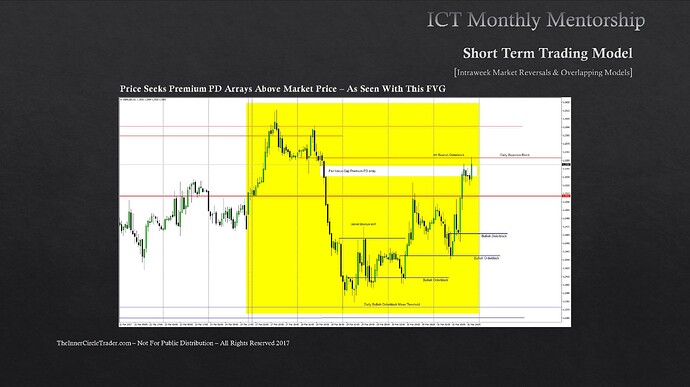

GBPUSD Intraweek Reversal Example - Price Seeks Premium PD Arrays Above Market Price

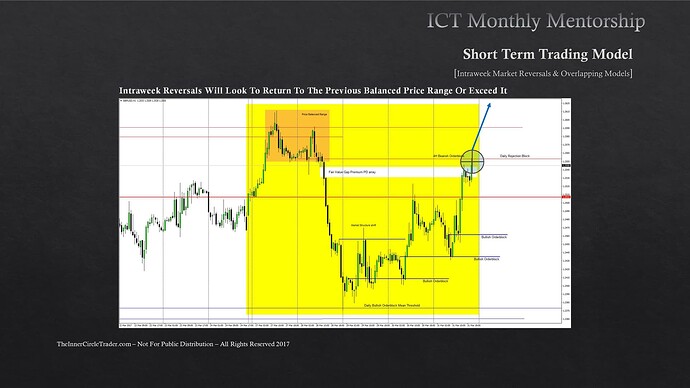

GBPUSD Intraweek Reversal Example - Balanced Price Range Target

Next lesson: ICT Mentorship Core Content - Month 7 - One Shot One Kill Model

Previous lesson: ICT Mentorship Core Content - Month 7 - Short Term Trading - Low Resistance Liquidity Runs [Part 2]