Notes

- We aim to capitalize on at least 65 - 75 % of the daily range.

- We focus on the next weekly expansion, higher or lower.

- The New York Open session is easier to trade than the London Open session.

- The only time to avoid the New York Open session is when the London Open session makes 80 % of the average daily range (ADR = Average of the last 5 days).

- London Close session often provides entry opportunities for One Shot One Kill (OSOK), swing trades, and position trades.

- During the Asian Open session, a daily high or low is often formed on the JPY, AUD, and NZD currency pairs.

- It is wise to take profit before the end of the London Open session as a retracement or reversal may occur during lunchtime.

- If Monday is a large range day and trades in the premium/discount area relative to the daily chart, it will often form the high or low of the week.

- There is a 70% chance that a weekly high or low will form during Tuesday’s London Open session.

- Usually, the weekly range is capped by Thursday’s New York Open session.

- If objectives in terms of PD arrays haven’t been met by Thursday, then you could see a surprise expansion on Friday.

- If Thursday met the daily PD array for the weekly range, then chances are Friday will be a quiet day.

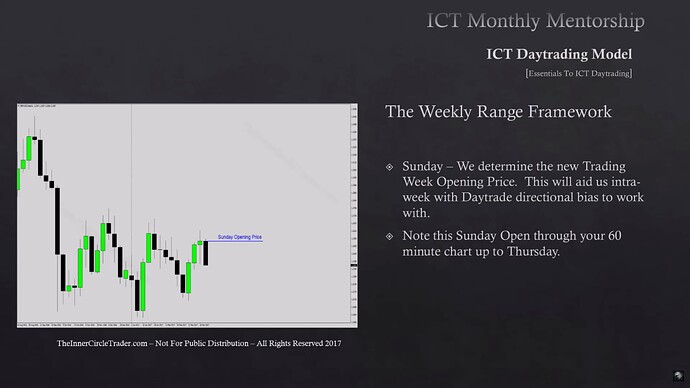

- If your broker doesn’t use Sunday’s data, just use the opening on Monday.

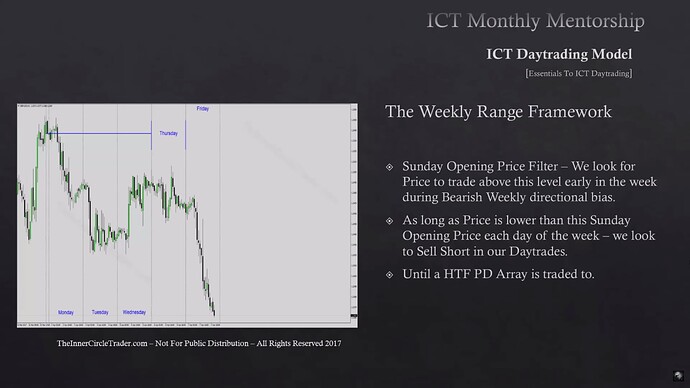

- If we are bearish and the price goes above Sunday’s opening during Thursday, it indicates a potential major intra-week reversal.

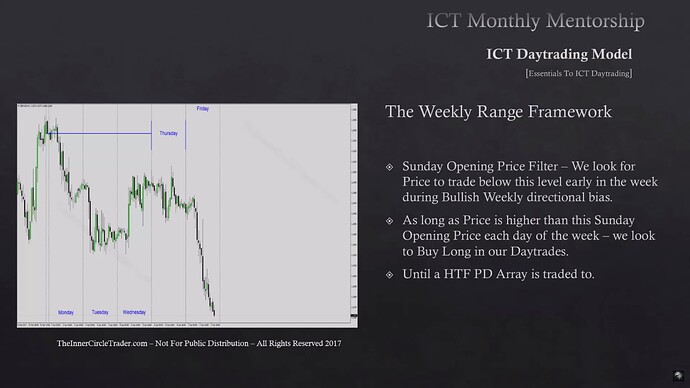

- If we are bullish and the price goes below Sunday opening during Thursday, it indicates a potential major intra-week reversal.

- We short every session if we are below the Sunday opening until we reach an opposite PD array. Then, we can expect a reversal.

- We buy every session if we are above the Sunday opening until we reach an opposite PD array. Then, we can expect a reversal.

- We generally have nine solid setups a week.

- IPDA will move from one PD array to the next, from a discount to a premium and from a premium to a discount. Knowing what they are on the daily chart will help you frame the weekly range and how it will unfold.

- The weekly range is determined by blending the Sunday opening price with the PD arrays on the daily chart.

Essentials To ICT Daytrading - The Opportunities Inside The Daily Range

Essentials To ICT Daytrading - What Frames The Daily Setups

Essentials To ICT Daytrading - Time Of Day

Essentials To ICT Daytrading - Day Of Week

Essentials To ICT Daytrading - The Weekly Range Framework

Essentials To ICT Daytrading - The Weekly Range Framework

Essentials To ICT Daytrading - The Weekly Range Framework

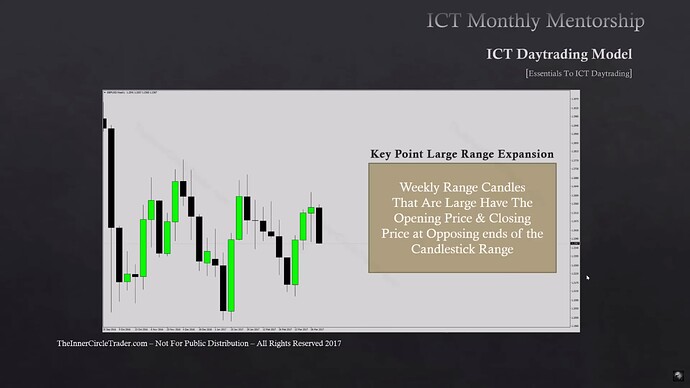

Essentials To ICT Daytrading - Key Point Large Range Expansion

Essentials To ICT Daytrading - GBPUSD Example

Essentials To ICT Daytrading - GBPUSD Example

Next lesson: ICT Mentorship Core Content - Month 8 - Defining The Daily Range

Previous lesson: ICT Mentorship Core Content - Month 7 - One Shot One Kill Model