Notes

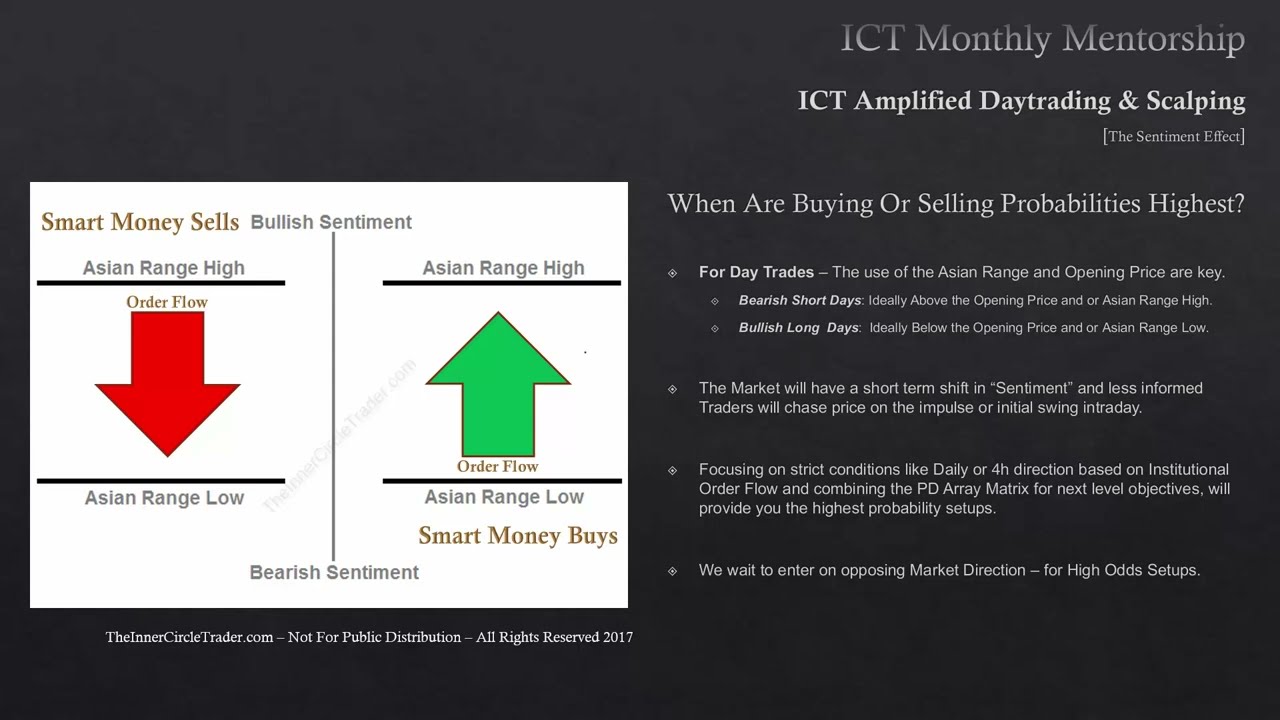

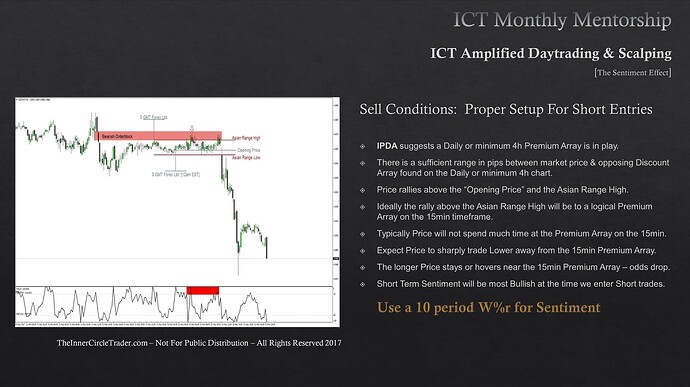

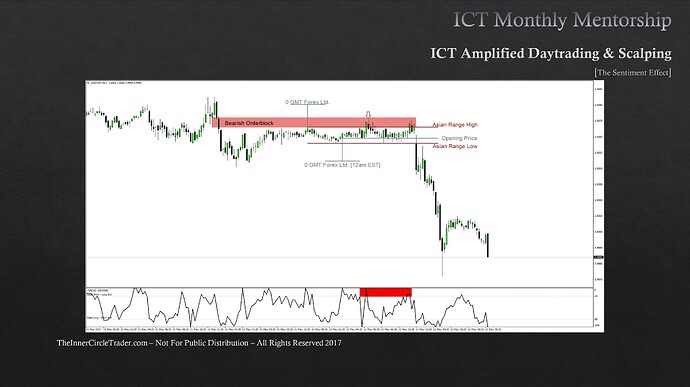

- If Smart Money is bearish, it will sell above the Asian session range. If it is bullish, it will buy below the Asian session range.

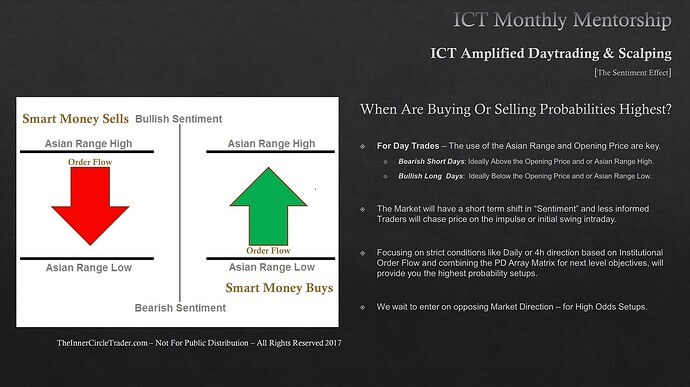

- Before entering a trade, the basic assumption is that the price respects the daily or four-hour PD array and shows a willingness to move in our expected direction, i.e., we see some kind of reaction.

- Ideally, we want to see a potential for a profit of at least 50 to 60 pips.

- To define sentiment, we use the Williams %R indicator with a period of 10 on a 15-minute chart.

- Using sentiment and a rule-based idea around the Asian session range helps us make better trades. We won’t get these conditions every trading day, but the days we do have the highest probability for day trading.

The Sentiment Effect - When Are Buying Or Selling Probabilities Highest

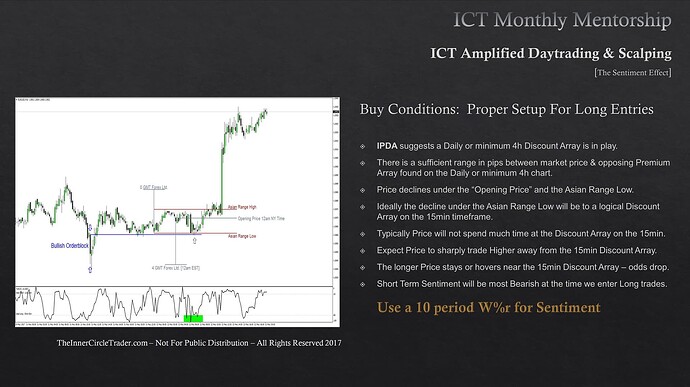

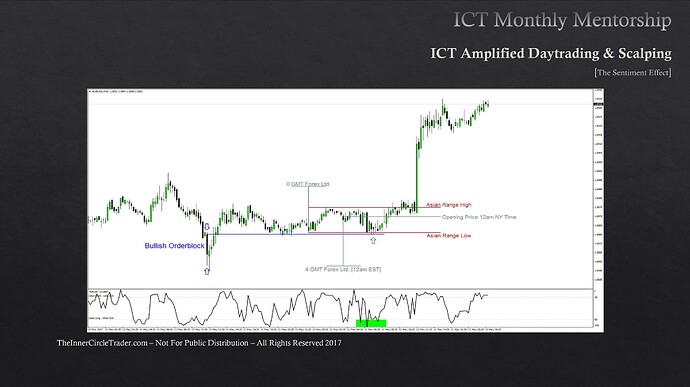

Buy Conditions - Proper Setup For Long Entries

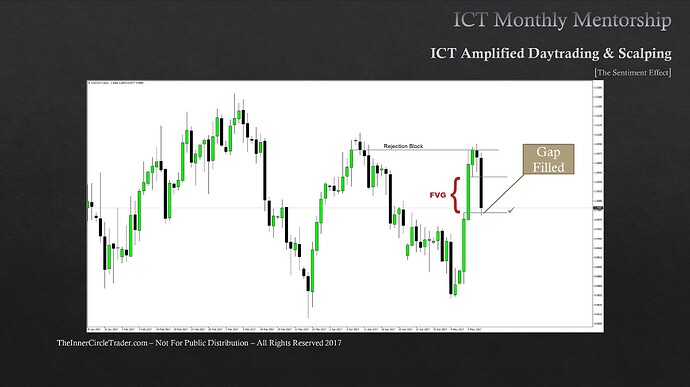

The Sentiment Effect - EURUSD Long Trade Example

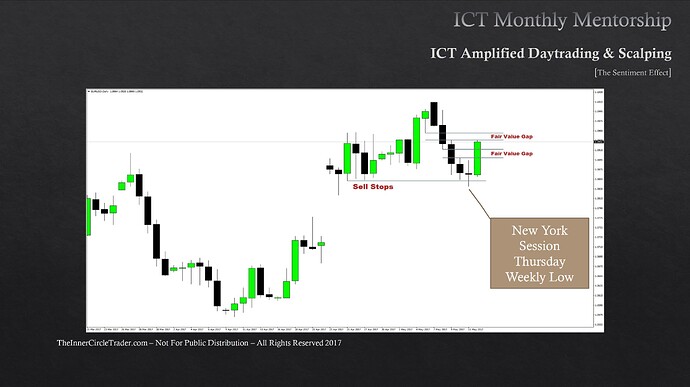

The Sentiment Effect - EURUSD Daily Chart Example

Sell Conditions - Proper Setup For Short Entries

The Sentiment Effect - USDCHF Short Trade Example

The Sentiment Effect - USDCHF Daily Chart Example

Next lesson: ICT Mentorship Core Content - Month 9 - Filling The Numbers

Previous lesson: ICT Mentorship Core Content - Month 8 - Integrating Daytrades With HTF Trade Entries