Notes

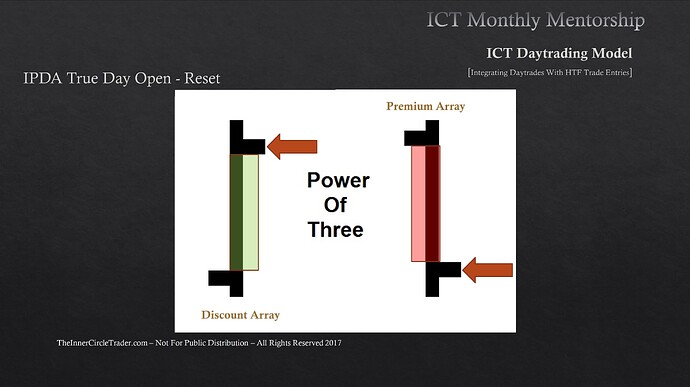

- A typical bullish day closes near the high of the day, and a typical bearish day closes near the low of the day.

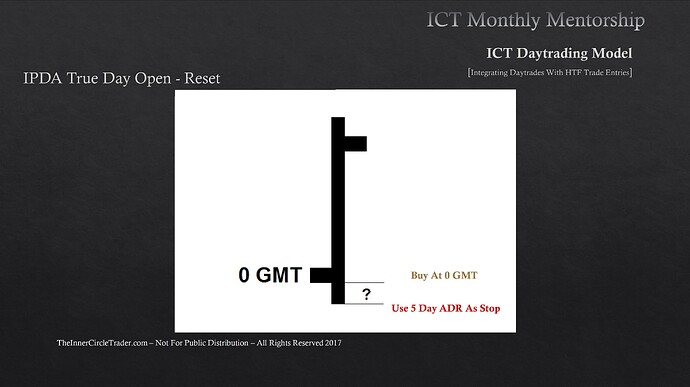

- This type of entry is for traders who, for various reasons, cannot trade the London Open Kill Zone.

- If the price respects the daily discount array and higher prices are expected, the market should not trade far below the daily opening price.

- If the price respects the daily premium array and lower prices are expected, the market should not trade far above the daily opening price.

- CBDR can help determine how far above/below the opening price the market can go.

- We don’t know how much the protraction will be. The key is that we have already seen price moving away from a premium/discount array on the daily chart the day before.

- After 0:00 GMT, we expect a protraction stage, as we do in the London open kill zone case.

- The ATR indicator with a period of 5 will help us determine the candle’s average range over the last five days.

Integrating Daytrades With HTF Trade Entries

Integrating Daytrades With HTF Trade Entries - The Open Or Openings

Integrating Daytrades With HTF Trade Entries - Power Of Three

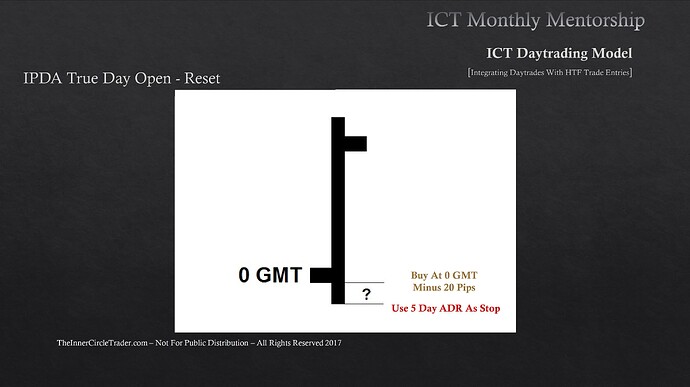

IPDA True Day Open - Reset - Buy At 0 GMT

IPDA True Day Open - Reset - Buy At 0 GMT Minus 20 Pips

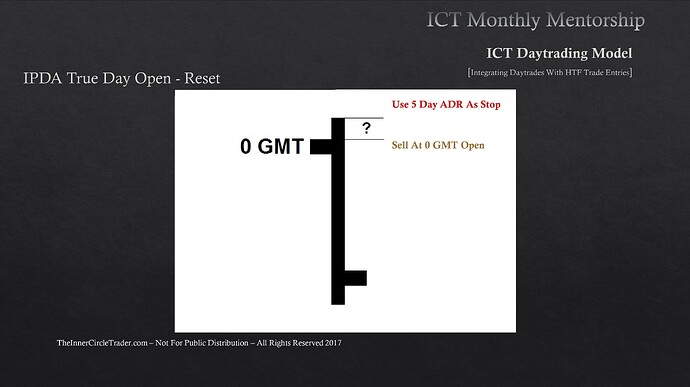

IPDA True Day Open - Reset - Sell At 0 GMT

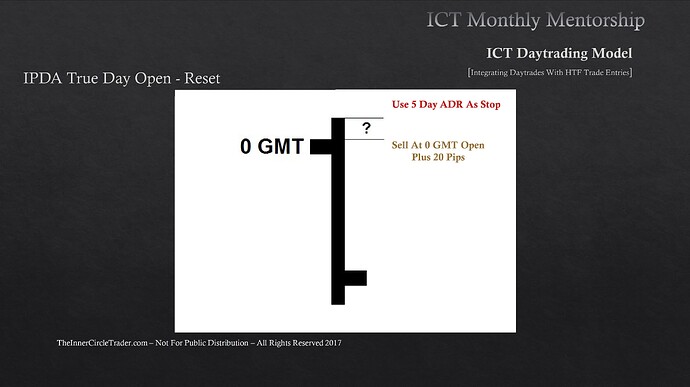

IPDA True Day Open - Reset - Sell At 0 GMT Plus 20 Pips

Next lesson: ICT Mentorship Core Content - Month 9 - The Sentiment Effect

Previous lesson: ICT Mentorship Core Content - Month 8 - High Probability Daytrade Setups