Notes

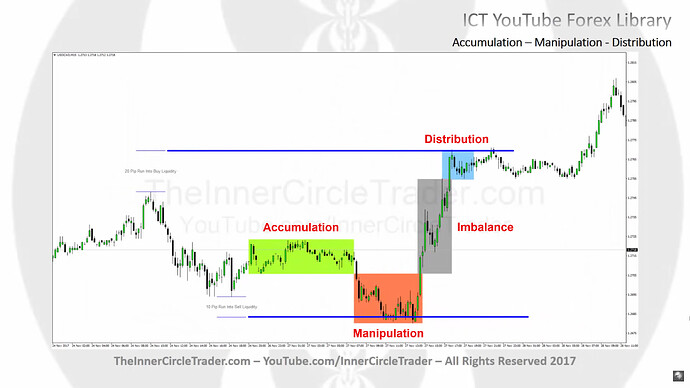

- The lesson focuses on the ICT concept of accumulation, manipulation, and distribution, also known as the Power Of Three (PO3).

- The ICT Power Of Three concept:

- Accumulation:

- Initial phase where positions are built.

- In a bullish market, long positions are accumulated around or below the opening price.

- In a bearish market, short positions are accumulated around or above the opening price.

- Manipulation:

- Following accumulation, market manipulation occurs to engineer liquidity.

- In a bullish market, manipulation often involves a temporary drop below the opening price to induce selling, creating liquidity for smart money to buy at a lower price. This also neutralizes long liquidity by hitting stop-loss orders of long traders.

- In a bearish market, manipulation often involves a temporary rise above the opening price to induce buying, creating liquidity for smart money to sell at a higher price. This also neutralizes short liquidity by hitting stop-loss orders short traders.

- Distribution:

- Final phase where positions are exited.

- In a bullish market, distribution occurs as prices rise and smart money sells to those buying above previous highs.

- In a bearish market, distribution occurs as prices drop and smart money buys from those selling below previous lows.

- Accumulation:

- The concept is applicable to all markets and time frames.

- Understanding these phases helps traders anticipate market moves.

Accumulation, Manipulation, Distribution - Power Of Three

Accumulation, Manipulation, Distribution (Power Of Three) - Bullish Conditions

Accumulation, Manipulation, Distribution (Power Of Three) - Bearish Conditions

Accumulation, Manipulation, Distribution - Power Of Three Example

Next lesson: ICT Forex - Market Maker Primer Course - Implementing The Asian Range

Previous lesson: ICT Forex - Market Maker Primer Course - Time & Price Theory