Notes

- When we look for high-probability trades, we ask ourselves these questions:

- Where is the price likely headed?

- What level does the price want to reach?

- What level is the price heading from?

- In addition to the sessions Michael mentions, we should monitor the London open kill zone range for possible retracements in the New York open kill zone.

- We look for the same things on the lower time frames as we do on the higher time frames, i.e. PD arrays, liquidity pools, institutional market structure, etc.

- If the market has been trending upward in recent days, we should monitor the previous day’s high because the probability of a turtle soup setup is increasing.

- If the market has been trending downward in recent days, we should monitor the previous day’s low because the probability of a turtle soup setup is increasing.

- If we cannot clearly see where the price is heading, it is not a highly probable setup.

High Probability Daytrade Setups

What Makes Daytrades High Probability

What Makes Daytrades High Probability

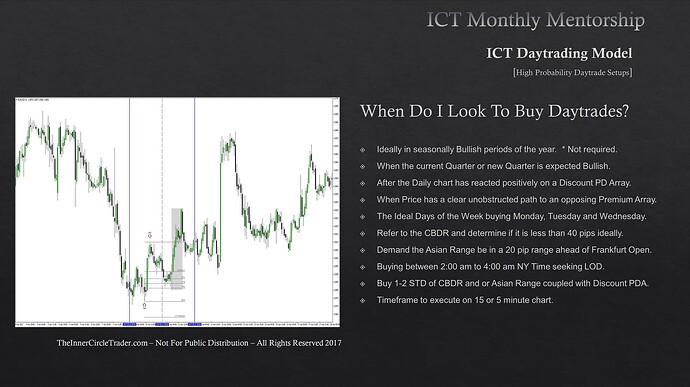

When Does ICT Look To Buy Daytrades

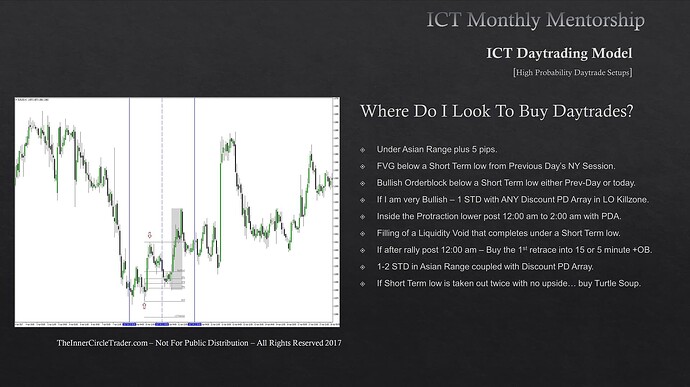

Where Does ICT Look To Buy Daytrades

Placing Stop-Losses In Buy Daytrades

Taking Profits In Buy Daytrades

When Does ICT Look To Short Daytrades

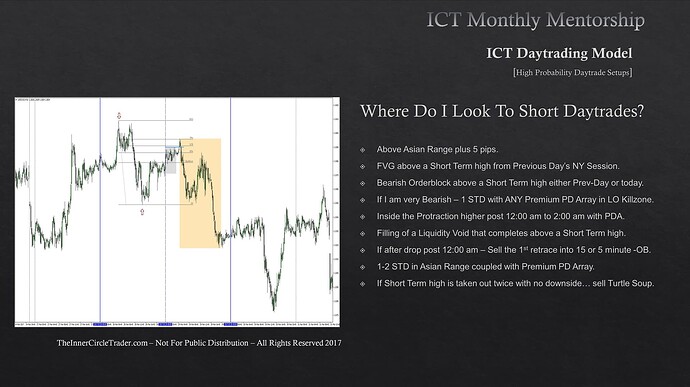

Where Does ICT Look To Short Daytrades

Placing Stop-Losses In Short Daytrades

Taking Profits In Short Daytrades

Next lesson: ICT Mentorship Core Content - Month 8 - Integrating Daytrades With HTF Trade Entries

Previous lesson: ICT Mentorship Core Content - Month 8 - When To Avoid The London Session