Notes

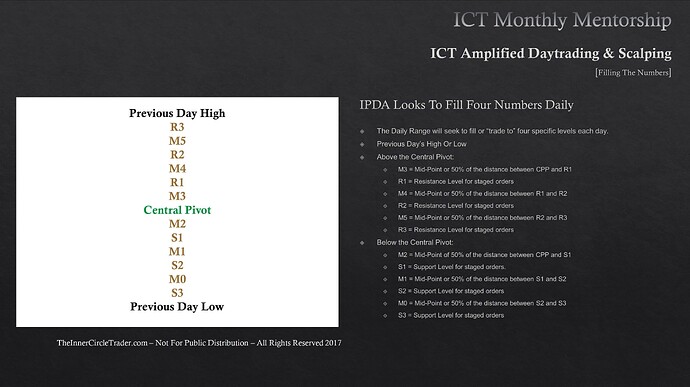

- Michael claims that large funds still use pivots for their trade decisions.

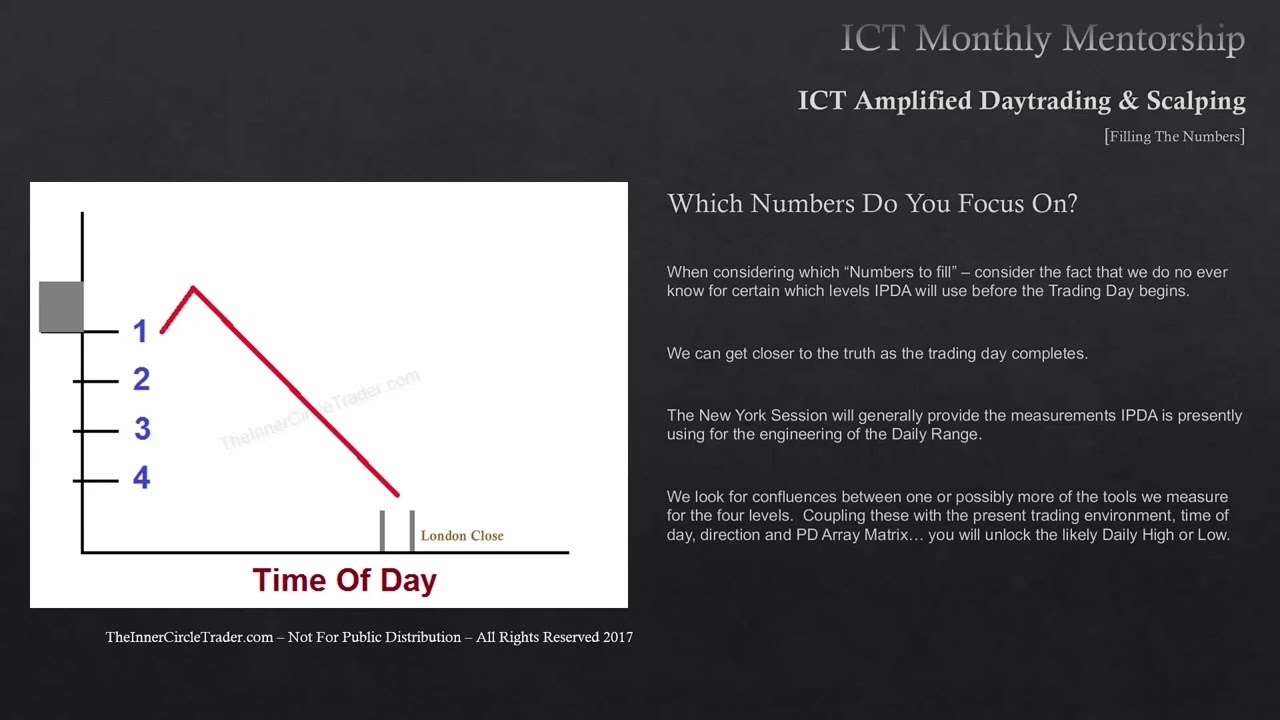

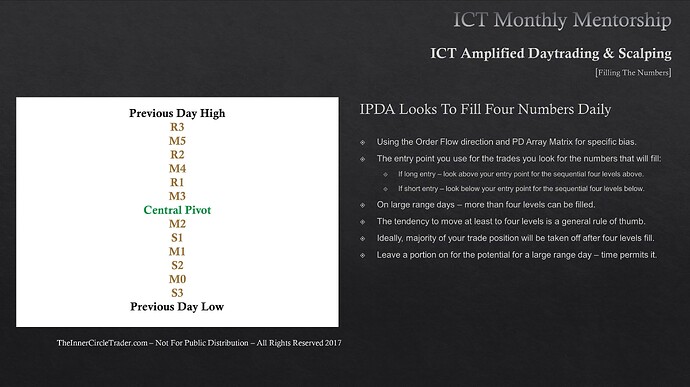

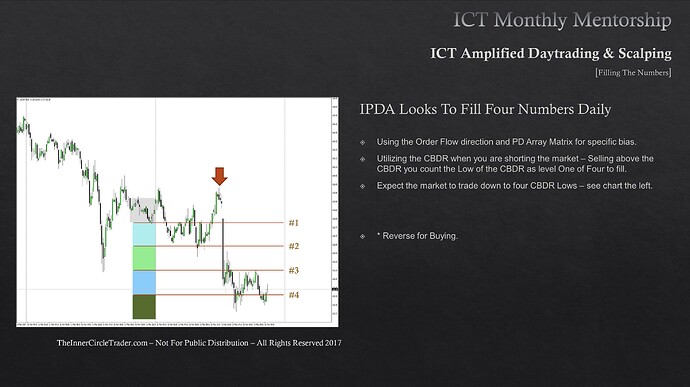

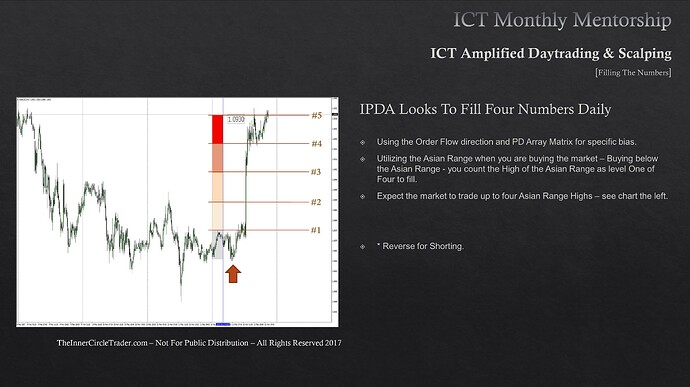

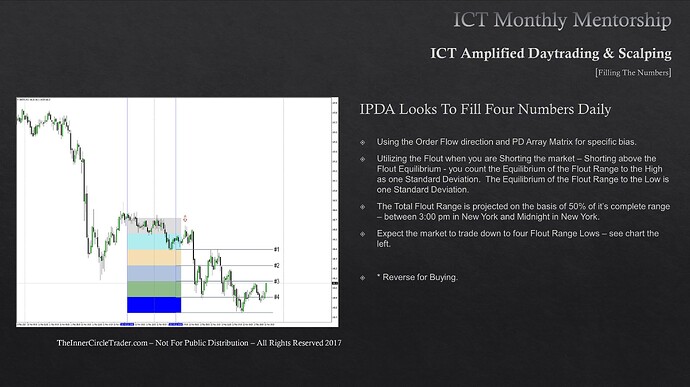

- IPDA wants to fill four pivot points or four CBDR projected levels (standard deviation) each day.

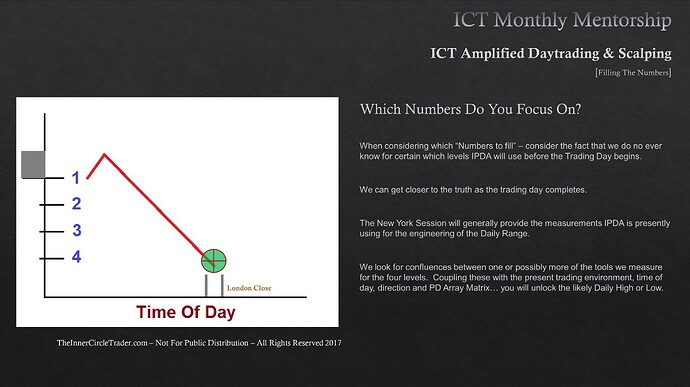

- Projections alone mean nothing. We’re always looking at how they overlap with the PD arrays.

- Michael does not use pivot points to enter trades.

- If volatility is low, then the benefits of these concepts diminish.

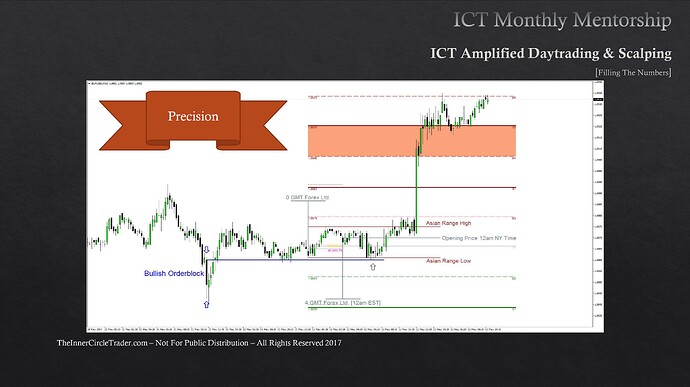

- Michael recommends using these concepts, i.e. central pivot, CBDR, Asian range, and flout altogether.

Filling The Numbers - IPDA Looks To Fill Numbers Daily

Filling The Numbers - IPDA Looks To Fill Numbers Daily

Filling The Numbers - CBDR Short Trade Example

Filling The Numbers - Asian Range Long Trade Example

Filling The Numbers - Flout Short Trade Example

Filling The Numbers - Which Numbers Does ICT Focus On

Filling The Numbers - Asian Range + Pivots Long Trade Example

Next lesson: ICT Mentorship Core Content - Month 9 - 20 Pips Per Day

Previous lesson: ICT Mentorship Core Content - Month 9 - The Sentiment Effect