Notes

- HTF support and resistance examples:

- Since market makers have to fill a large number of orders, they are forced to scale into positions.

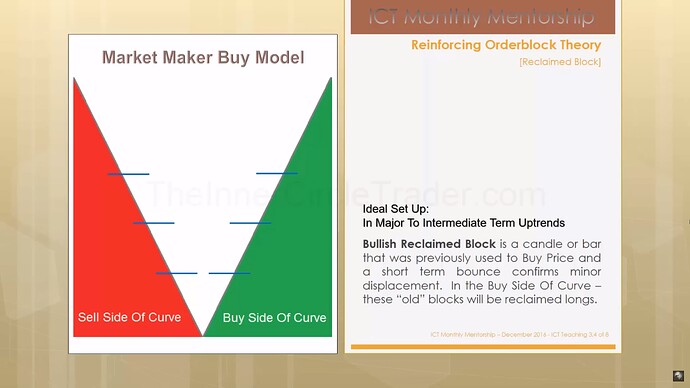

- Market maker buy model is understanding that the market is going lower to go higher.

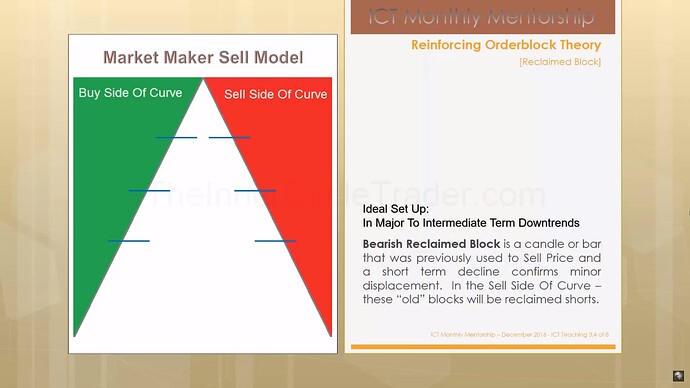

- Market maker sell model is understanding that the market is going higher to go lower.

- In the market maker buy model, smart money accumulates new long positions on the sell side of the curve. This manifests itself in small upward displacements as the price falls.

- In the market maker sell model, smart money accumulates new sell positions on the buy side of the curve. This manifests itself in small downward displacements as the price rises.

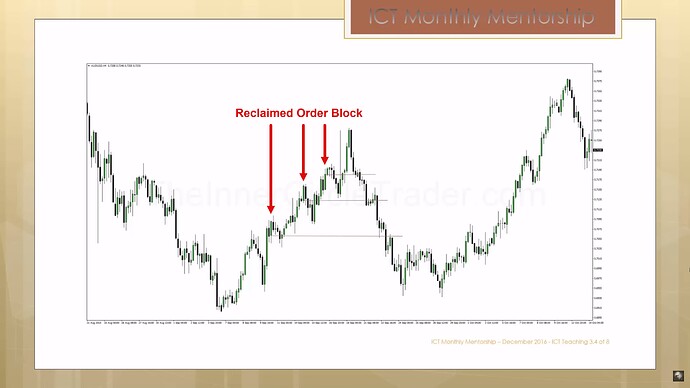

- Smart money accumulation (hedging) is the reason why premature bullish and bearish order blocks are formed.

ICT Bullish Reclaimed Order Block - Market Maker Buy Model

ICT Bullish Reclaimed Order Block - Market Maker Buy Model Example

ICT Bearish Reclaimed Order Block - Market Maker Sell Model

ICT Bearish Reclaimed Order Block - Market Maker Sell Model Example

Next lesson: ICT Mentorship Core Content - Month 4 - Propulsion Block

Previous lesson: ICT Mentorship Core Content - Month 4 - Rejection Block