Notes

- Each time the market forms a new range, mark its high and low.

- Most of Michael’s trades consist of entry on internal liquidity and exit on external liquidity.

- Michael uses the HTF institutional order flow to determine the internal range liquidity and external range liquidity.

- Once you understand where the HTF wants to go, you can frame your setups to a lower time frame.

- If we are bullish and trading in sync with the higher time frame, then any run above the old high should have a low-resistance run characteristic.

- If we are bearish and trading in sync with the higher time frame, then any run below the old low should have a low-resistance run characteristic.

- When we are bullish and have established a trading range, we look for a displacement up and a retracement into a bullish order block.

- When we are bearish and have established a trading range, we look for a displacement down and a retracement into a bearish order block.

- When we are bullish and do not have an established trading range, we look for swing lows and wait for a turtle soup setup.

- When we are bearish and do not have an established trading range, we look for swing highs and wait for a turtle soup setup.

- Don’t trade too small trading ranges.

- The monthly chart is key to frame low-resistance runs.

- If you can’t frame where the monthly chart is going, then drop down to the weekly chart.

- Trading against the HTF narrative and institutional order flow is considered a high-resistance liquidity run.

- If you stay in the directional bias of the monthly, weekly, and daily charts, you have high odds of a low-resistance liquidity run.

- Low-resistance runs will give you immediate responses to your trades with low drawdown and fast actions, and that’s what you want as a trader.

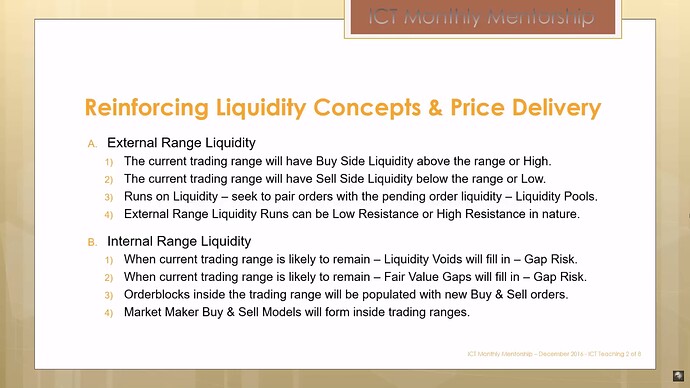

Reinforcing Liquidity Concepts & Price Delivery

Reinforcing Liquidity Concepts & Price Delivery - Low-Resistance Liquidity Run

Next lesson: ICT Mentorship Core Content - Month 4 - Orderblocks

Previous lesson: ICT Mentorship Core Content - Month 4 - Interest Rate Effects On Currency Trades